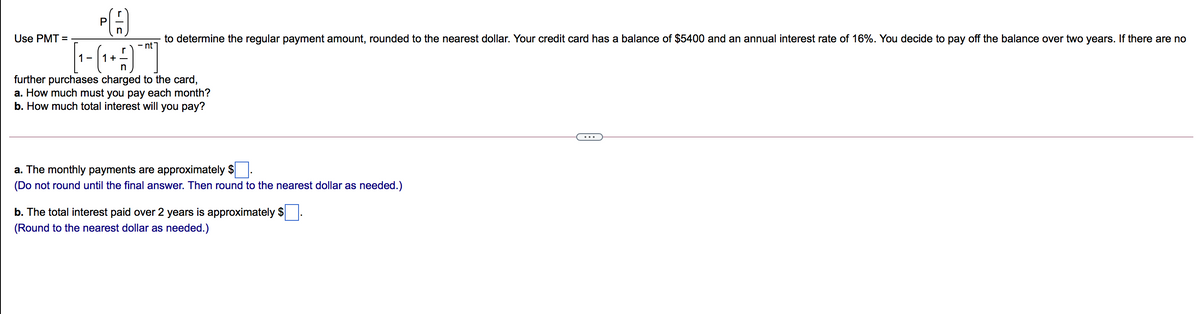

Use PMT = determine the regular payment amount, rounded to the nearest dollar. Your credit card has a balance of $5400 and an annual interest rate of 16%. You decide to pay off the balance over two years. further purchases charged to the card, a. How much must you pay each month? b. How much total interest will you pay? a. The monthly payments are approximately $. (Do not round until the final answer. Then round to the nearest dollar as needed.) b. The total interest paid over 2 years is approximately $ (Round to the nearest dollar as needed.)

Use PMT = determine the regular payment amount, rounded to the nearest dollar. Your credit card has a balance of $5400 and an annual interest rate of 16%. You decide to pay off the balance over two years. further purchases charged to the card, a. How much must you pay each month? b. How much total interest will you pay? a. The monthly payments are approximately $. (Do not round until the final answer. Then round to the nearest dollar as needed.) b. The total interest paid over 2 years is approximately $ (Round to the nearest dollar as needed.)

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter8: Sequences And Series

Section8.4: Mathematics Of Finance

Problem 20E: Mortgage A couple can afford to make a monthly mortgage payment of $650. If the mortgage rate is 9%...

Related questions

Question

bothn please

Transcribed Image Text:P

Use PMT =

to determine the regular payment amount, rounded to the nearest dollar. Your credit card has a balance of $5400 and an annual interest rate of 16%. You decide to pay off the balance over two years. If there are no

nt

1 -

1 +

further purchases charged to the card,

a. How much must you pay each month?

b. How much total interest will you pay?

a. The monthly payments are approximately $

(Do not round until the final answer. Then round to the nearest dollar as needed.)

b. The total interest paid over 2 years is approximately $

(Round to the nearest dollar as needed.)

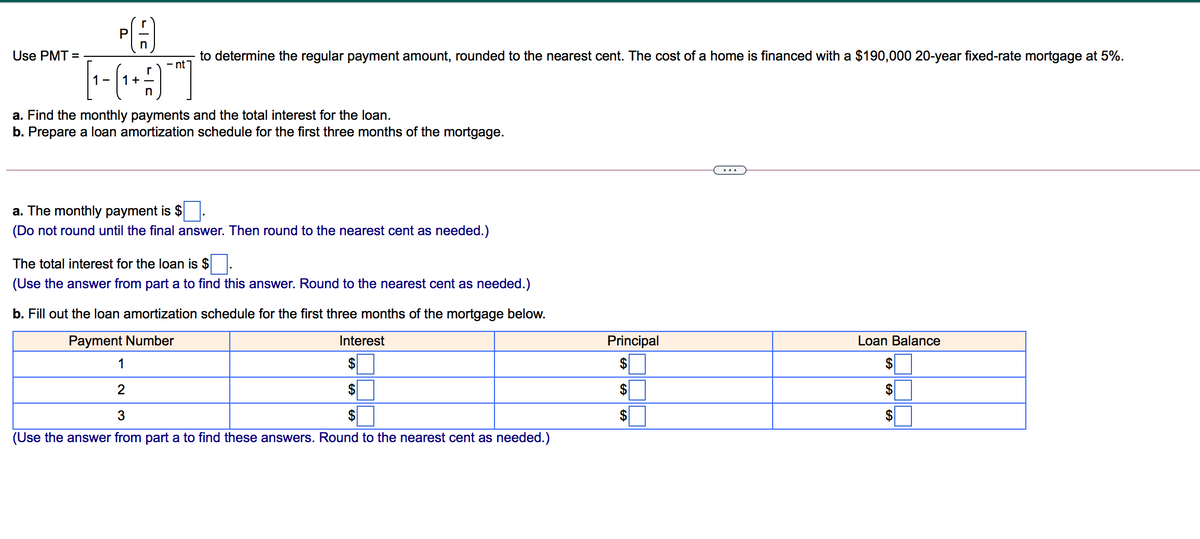

Transcribed Image Text:n

Use PMT =

to determine the regular payment amount, rounded to the nearest cent. The cost of a home is financed with a $190,000 20-year fixed-rate mortgage at 5%.

- nt

1+

-

a. Find the monthly payments and the total interest for the loan.

b. Prepare a loan amortization schedule for the first three months of the mortgage.

a. The monthly payment is $

(Do not round until the final answer. Then round to the nearest cent as needed.)

The total interest for the loan is $

(Use the answer from part a to find this answer. Round to the nearest cent as needed.)

b. Fill out the loan amortization schedule for the first three months of the mortgage below.

Payment Number

Interest

Principal

Loan Balance

1

$

$

2

$

3

$

$

$

(Use the answer from part a to find these answers. Round to the nearest cent as needed.)

%24

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning