Use PMT= to determine the regular payment amount, rounded to the nearest dollar. Your credit care -nt has a balance of $4900 and an annual interest rate of 19%. With no further purchases charged to the card and the balance being paid off over two years, the monthly payment is $247, and the total interest paid is $1028. You can get a bank loan at 11.5% with a term of three years. Complete parts (a) and (b) below. credit-card payments. b. How much total interest will you pay? How does this compare with the total credit-card interest? Select the correct choice below and fill in the answer boxes to complete your choice. (Use the answer from part a to find this answer. Round to the nearest dollar as needed.) www A. The total interest paid over 3 years for the bank loan is approximately $ total credit-card interest. a B. The total interest paid over 3 years for the bank loan is approximately $ total credit-card interest. H This is $ This is $ less than the more than the 77°F

Use PMT= to determine the regular payment amount, rounded to the nearest dollar. Your credit care -nt has a balance of $4900 and an annual interest rate of 19%. With no further purchases charged to the card and the balance being paid off over two years, the monthly payment is $247, and the total interest paid is $1028. You can get a bank loan at 11.5% with a term of three years. Complete parts (a) and (b) below. credit-card payments. b. How much total interest will you pay? How does this compare with the total credit-card interest? Select the correct choice below and fill in the answer boxes to complete your choice. (Use the answer from part a to find this answer. Round to the nearest dollar as needed.) www A. The total interest paid over 3 years for the bank loan is approximately $ total credit-card interest. a B. The total interest paid over 3 years for the bank loan is approximately $ total credit-card interest. H This is $ This is $ less than the more than the 77°F

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

5:1 Answer B questions

Transcribed Image Text:O

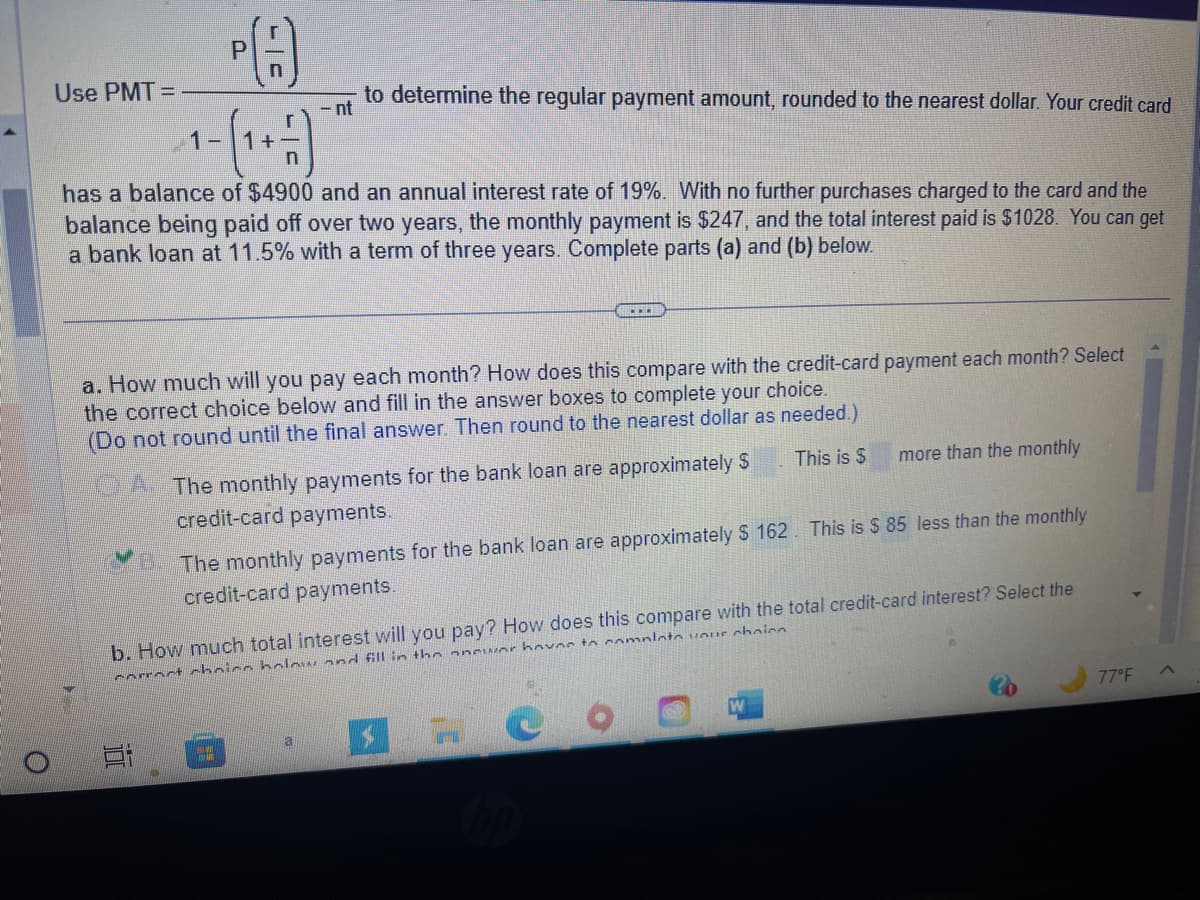

Use PMT=

1-

P

+

Ei

has a balance of $4900 and an annual interest rate of 19%. With no further purchases charged to the card and the

balance being paid off over two years, the monthly payment is $247, and the total interest paid is $1028. You can get

a bank loan at 11.5% with a term of three years. Complete parts (a) and (b) below.

to determine the regular payment amount, rounded to the nearest dollar. Your credit card

- nt

a. How much will you pay each month? How does this compare with the credit-card payment each month? Select

the correct choice below and fill in the answer boxes to complete your choice.

(Do not round until the final answer. Then round to the nearest dollar as needed.)

This is $

...

The monthly payments for the bank loan are approximately $

credit-card payments.

a

The monthly payments for the bank loan are approximately $ 162. This is $ 85 less than the monthly

credit-card payments.

b. How much total interest will you pay? How does this compare with the total credit-card interest? Select the

correct choice below and fill in the answer have to complete your choic

more than the monthly

H

77°F

Transcribed Image Text:O

Use PMT=

PA

to determine the regular payment amount, rounded to the nearest dollar. Your credit card

- nt

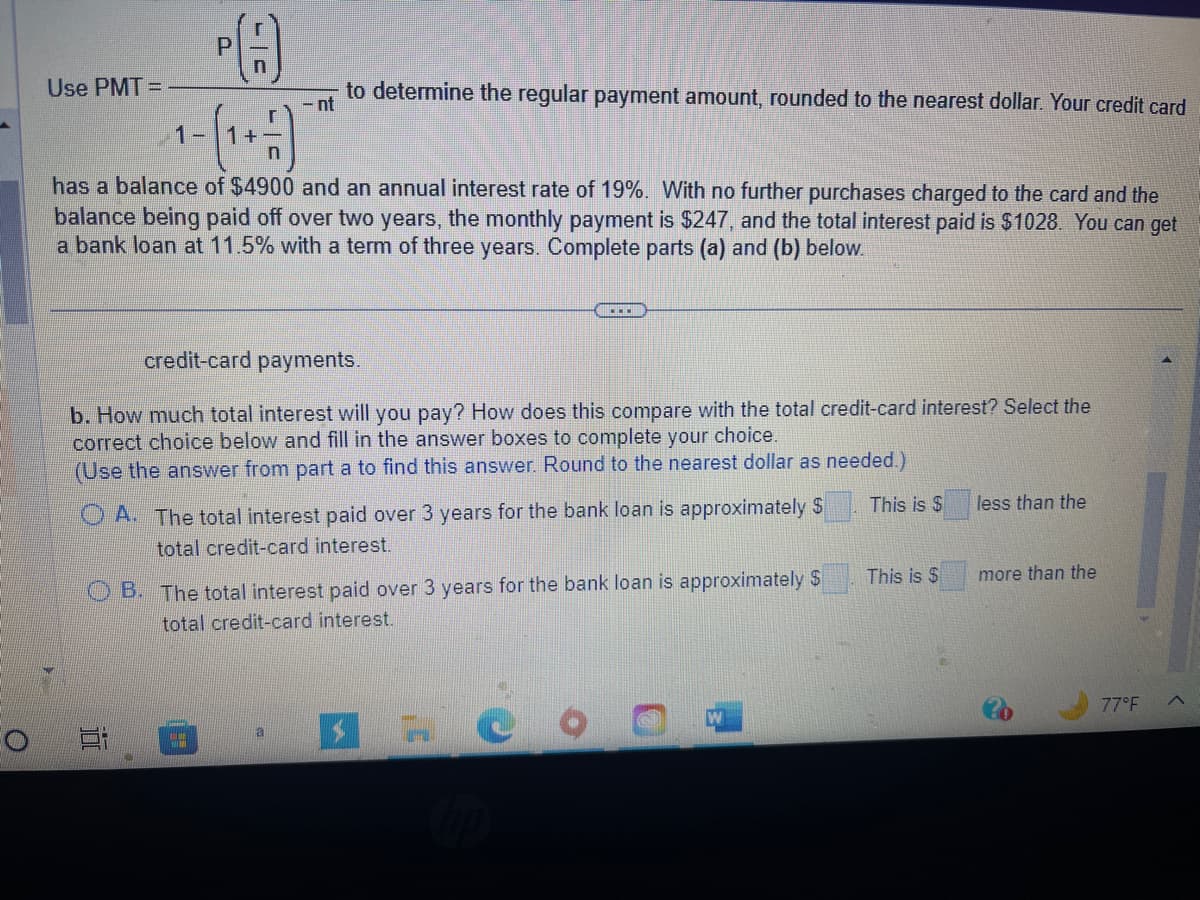

has a balance of $4900 and an annual interest rate of 19%. With no further purchases charged to the card and the

balance being paid off over two years, the monthly payment is $247, and the total interest paid is $1028. You can get

a bank loan at 11.5% with a term of three years. Complete parts (a) and (b) below.

credit-card payments.

b. How much total interest will you pay? How does this compare with the total credit-card interest? Select the

correct choice below and fill in the answer boxes to complete your choice.

(Use the answer from part a to find this answer. Round

the nearest dollar as needed.)

OA. The total interest paid over 3 years for the bank loan is approximately $

total credit-card interest.

OB. The total interest paid over 3 years for the bank loan is approximately $

total credit-card interest.

a

This is $

This is $

less than the

more than the

77°F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning