Use the basic accounting equation to answer these questions. (a) The liabilities of Lantz Company are $94,900 and the stockholders' equity is $279,000. What is the amount of Lantz Company's total assets? Total assets (b) The total assets of Salley Company are $194,000 and its stockholders' equity is $90,000. What is the amount of its total liabilities? Total liabilities (c) The total assets of Brandon Co. are $81 000 and its liabilities are equal to one-fourth of its total assets. What is the amount of Brandon Co.'s stockholders' equity? Stockholders' equity $

Use the basic accounting equation to answer these questions. (a) The liabilities of Lantz Company are $94,900 and the stockholders' equity is $279,000. What is the amount of Lantz Company's total assets? Total assets (b) The total assets of Salley Company are $194,000 and its stockholders' equity is $90,000. What is the amount of its total liabilities? Total liabilities (c) The total assets of Brandon Co. are $81 000 and its liabilities are equal to one-fourth of its total assets. What is the amount of Brandon Co.'s stockholders' equity? Stockholders' equity $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 24BE: Brief Exercise 1-24 The Accounting Equation Financial information for three independent cases is as...

Related questions

Question

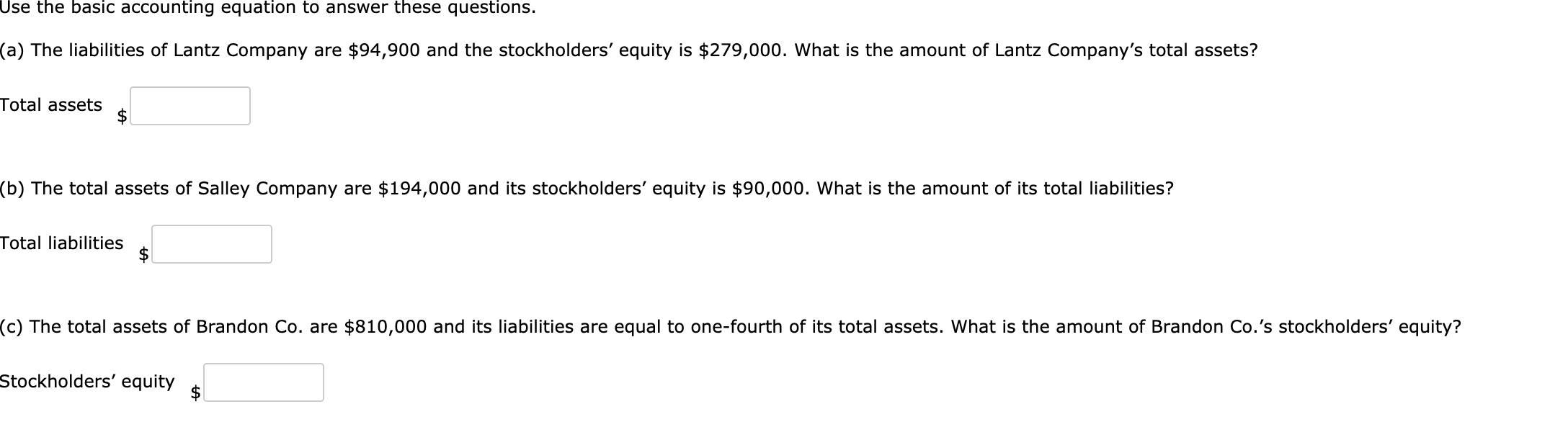

Transcribed Image Text:Use the basic accounting equation to answer these questions.

(a) The liabilities of Lantz Company are $94,900 and the stockholders' equity is $279,000. What is the amount of Lantz Company's total assets?

Total assets

(b) The total assets of Salley Company are $194,000 and its stockholders' equity is $90,000. What is the amount of its total liabilities?

Total liabilities

(c) The total assets of Brandon Co. are $81

000 and its liabilities are equal to one-fourth of its total assets. What is the amount of Brandon Co.'s stockholders' equity?

Stockholders' equity

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning