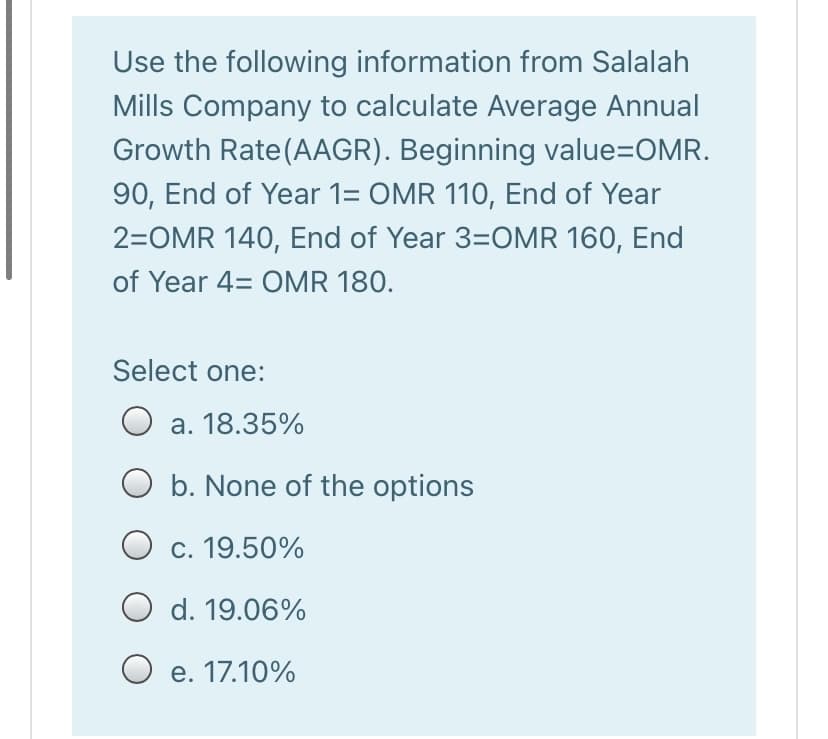

Use the following information from Salalah Mills Company to calculate Average Annual Growth Rate(AAGR). Beginning value=OMR. 90, End of Year 1= OMR 110, End of Year 2=OMR 140, End of Year 3=OMR 160, End of Year 4= OMR 180. Select one: a. 18.35% O b. None of the options c. 19.50% O d. 19.06% O e. 17.10%

Use the following information from Salalah Mills Company to calculate Average Annual Growth Rate(AAGR). Beginning value=OMR. 90, End of Year 1= OMR 110, End of Year 2=OMR 140, End of Year 3=OMR 160, End of Year 4= OMR 180. Select one: a. 18.35% O b. None of the options c. 19.50% O d. 19.06% O e. 17.10%

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter14: Valuation: Market-based Approach

Section: Chapter Questions

Problem 1FIC

Related questions

Question

Transcribed Image Text:Use the following information from Salalah

Mills Company to calculate Average Annual

Growth Rate(AAGR). Beginning value=OMR.

90, End of Year 1= OMR 110, End of Year

2=OMR 140, End of Year 3=OMR 160, End

of Year 4= OMR 180.

Select one:

O a. 18.35%

O b. None of the options

O c. 19.50%

d. 19.06%

O e. 17.10%

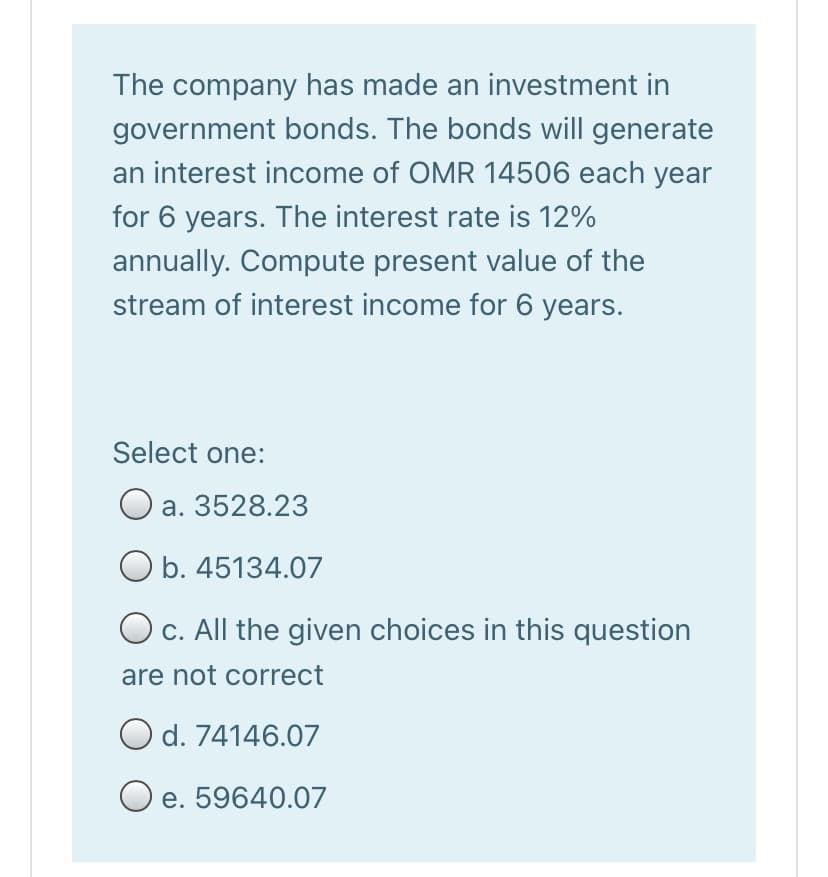

Transcribed Image Text:The company has made an investment in

government bonds. The bonds will generate

an interest income of OMR 14506 each year

for 6 years. The interest rate is 12%

annually. Compute present value of the

stream of interest income for 6 years.

Select one:

a. 3528.23

O b. 45134.07

O c. All the given choices in this question

are not correct

O d. 74146.07

O e. 59640.07

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning