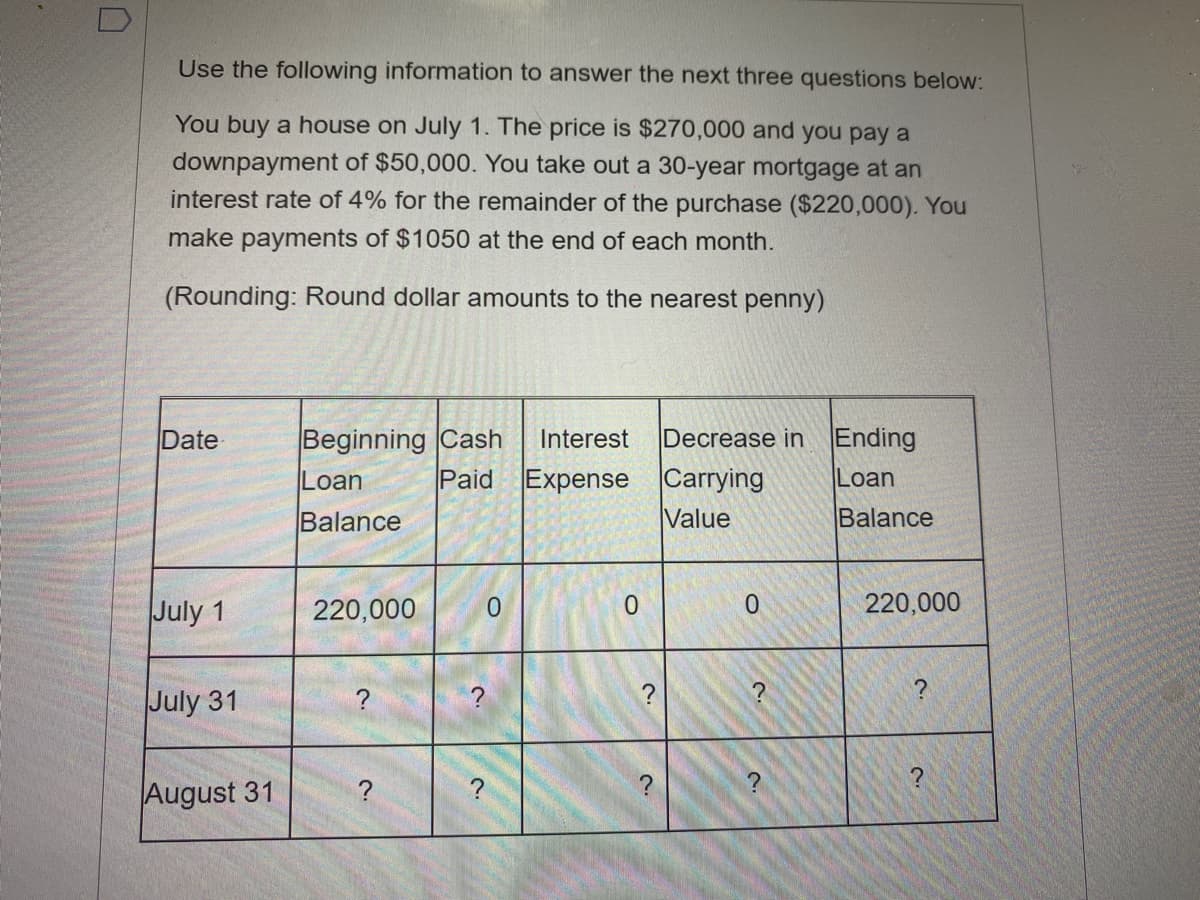

Use the following information to answer the next three questions below: You buy a house on July 1. The price is $270,000 and you pay a downpayment of $50,000. You take out a 30-year mortgage at an interest rate of 4% for the remainder of the purchase ($220,000). You make payments of $1050 at the end of each month. (Rounding: Round dollar amounts to the nearest penny) Date Beginning Cash Interest Decrease in Ending Loan Paid Expense Carrying Loan Balance Value Balance July 1 220,000 220,000 July 31 August 31

Use the following information to answer the next three questions below: You buy a house on July 1. The price is $270,000 and you pay a downpayment of $50,000. You take out a 30-year mortgage at an interest rate of 4% for the remainder of the purchase ($220,000). You make payments of $1050 at the end of each month. (Rounding: Round dollar amounts to the nearest penny) Date Beginning Cash Interest Decrease in Ending Loan Paid Expense Carrying Loan Balance Value Balance July 1 220,000 220,000 July 31 August 31

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 36P

Related questions

Question

practice

Transcribed Image Text:Use the following information to answer the next three questions below:

You buy a house on July 1. The price is $270,000 and you pay a

downpayment of $50,000. You take out a 30-year mortgage at an

interest rate of 4% for the remainder of the purchase ($220,000). You

make

payments of $1050 at the end of each month.

(Rounding: Round dollar amounts to the nearest penny)

Date

Beginning Cash

Interest

Decrease in Ending

Loan

Paid Expense Carrying

Loan

Balance

Value

Balance

July 1

220,000

220,000

July 31

August 31

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning