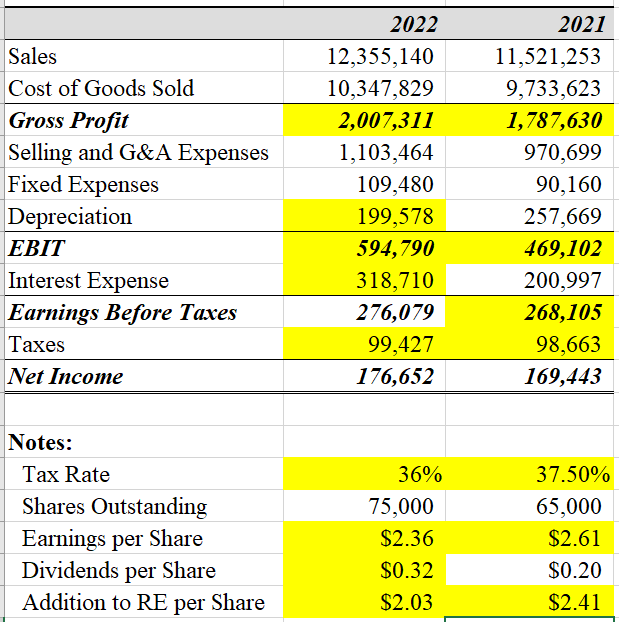

use the following information to make a Common size income statement

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Annual report; balance sheet; income statement

Common...

Related questions

Question

use the following information to make a Common size income statement

Transcribed Image Text:Sales

Cost of Goods Sold

Gross Profit

Selling and G&A Expenses

Fixed Expenses

Depreciation

EBIT

Interest Expense

Earnings Before Taxes

Taxes

Net Income

Notes:

Tax Rate

Shares Outstanding

Earnings per Share

Dividends per Share

Addition to RE per Share

2022

12,355,140

10,347,829

2,007,311

1,103,464

109,480

199,578

594,790

318,710

276,079

99,427

176,652

36%

75,000

$2.36

$0.32

$2.03

2021

11,521,253

9,733,623

1,787,630

970,699

90,160

257,669

469,102

200,997

268,105

98,663

169,443

37.50%

65,000

$2.61

$0.20

$2.41

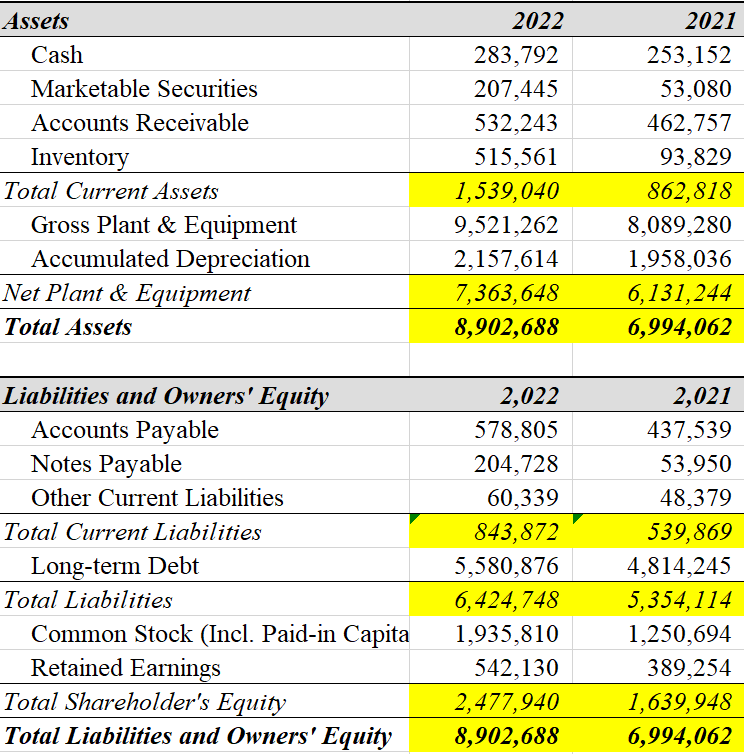

Transcribed Image Text:Assets

Cash

Marketable Securities

Accounts Receivable

Inventory

Total Current Assets

Gross Plant & Equipment

Accumulated Depreciation

Net Plant & Equipment

Total Assets

Liabilities and Owners' Equity

Accounts Payable

Notes Payable

Other Current Liabilities

Total Current Liabilities

Long-term Debt

Total Liabilities

Common Stock (Incl. Paid-in Capita

Retained Earnings

Total Shareholder's Equity

Total Liabilities and Owners' Equity

2022

283,792

207,445

532,243

515,561

1,539,040

9,521,262

2,157,614

7,363,648

8,902,688

2,022

578,805

204,728

60,339

843,872

5,580,876

6,424,748

1,935,810

542,130

2,477,940

8,902,688

2021

253,152

53,080

462,757

93,829

862,818

8,089,280

1,958,036

6,131,244

6,994,062

2,021

437,539

53,950

48,379

539,869

4,814,245

5,354,114

1,250,694

389,254

1,639,948

6,994,062

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning