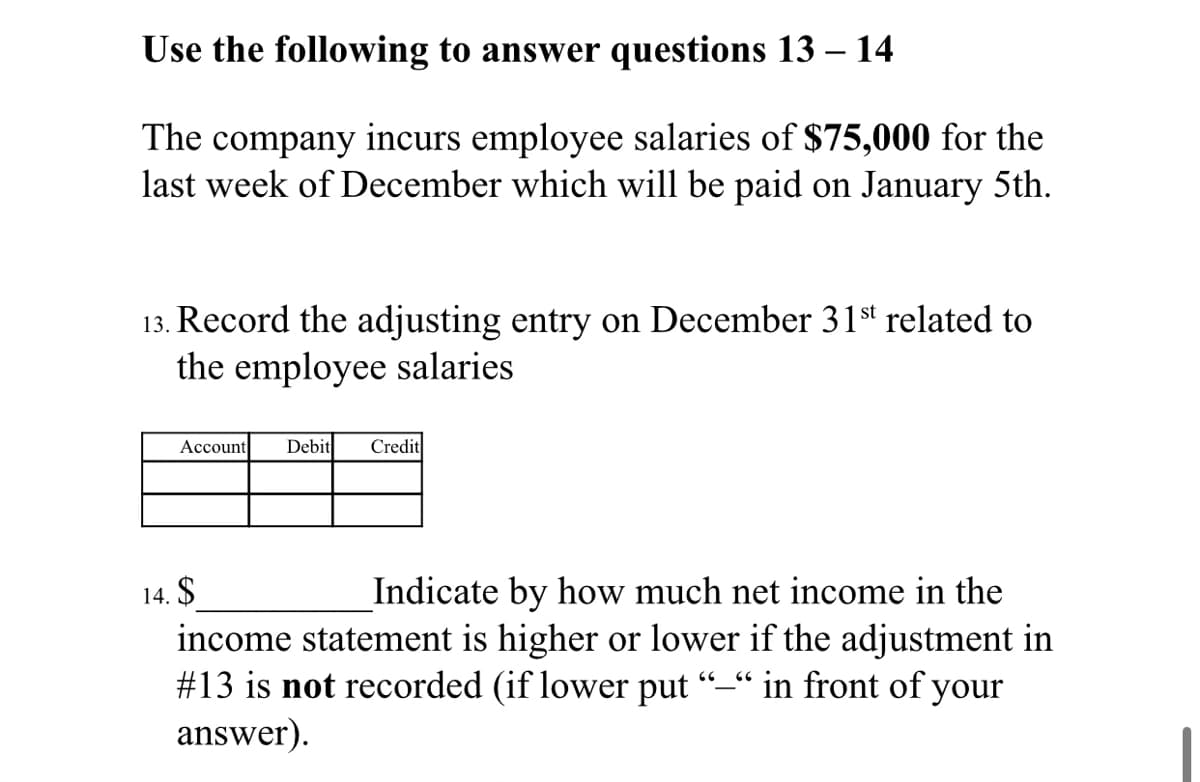

Use the following to answer questions 13 – 14 The company incurs employee salaries of $75,000 for the last week of December which will be paid on January 5th. 13. Record the adjusting entry on December 31st related to the employee salaries Account Debit Credit Indicate by how much net income in the income statement is higher or lower if the adjustment in #13 is not recorded (if lower put ““ in front of your 14. $ answer).

Use the following to answer questions 13 – 14 The company incurs employee salaries of $75,000 for the last week of December which will be paid on January 5th. 13. Record the adjusting entry on December 31st related to the employee salaries Account Debit Credit Indicate by how much net income in the income statement is higher or lower if the adjustment in #13 is not recorded (if lower put ““ in front of your 14. $ answer).

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 7EA: Reviewing payroll records indicates that employee salaries that are due to be paid on January 3...

Related questions

Question

Transcribed Image Text:Use the following to answer questions 13 – 14

The company incurs employee salaries of $75,000 for the

last week of December which will be paid on January 5th.

13. Record the adjusting entry on December 31st related to

the employee salaries

Account

Debit

Credit

14. $

Indicate by how much net income in the

income statement is higher or lower if the adjustment in

#13 is not recorded (if lower put

answer).

“in front of your

Expert Solution

Step 1

Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized income or expenses for the period is adjusted in accounts by adjusting entry at the end of the accounting period to correctly measure the net income.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub