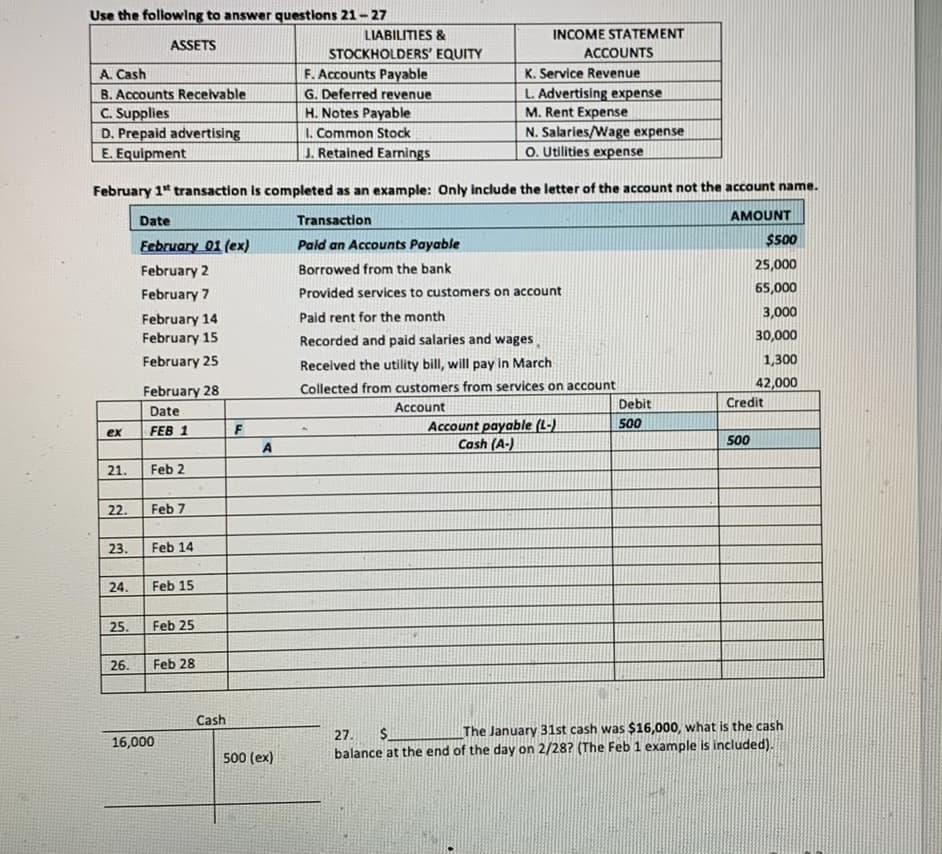

Use the following to answer questions 21-27 LIABILITIES & INCOME STATEMENT ASSETS STOCKHOLDERS' EQUITY ACCOUNTS F. Accounts Payable G. Deferred revenue H. Notes Payable I. Common Stock J. Retained Earnings K. Service Revenue L. Advertising expense M. Rent Expense N. Salaries/Wage expense O. Utilities expense A. Cash B. Accounts Recelvable C. Supplies D. Prepaid advertising E. Equipment February 1" transaction Is completed as an example: Only include the letter of the account not the account name. Date Transaction AMOUNT Eebruary 01 (ex) Paid an Accounts Payable $500 February 2 Borrowed from the bank 25,000 February 7 Provided services to customers on account 65,000 3,000 February 14 February 15 Paid rent for the month Recorded and paid salaries and wages 30,000 February 25 Received the utility bill, will pay in March 1,300 February 28 Collected from customers from services on account 42,000 Account Debit Credit Date Account payable (L-) Cash (A-) ex FEB 1 500 A 21. Feb 2 22. Feb 7 23. Feb 14 24. Feb 15 25. Feb 25 26. Feb 28 Cash $. The January 31st cash was $16,000, what is the cash 27. 16,000 500 (ex) balance at the end of the day on 2/28? (The Feb 1 example is included).

Use the following to answer questions 21-27 LIABILITIES & INCOME STATEMENT ASSETS STOCKHOLDERS' EQUITY ACCOUNTS F. Accounts Payable G. Deferred revenue H. Notes Payable I. Common Stock J. Retained Earnings K. Service Revenue L. Advertising expense M. Rent Expense N. Salaries/Wage expense O. Utilities expense A. Cash B. Accounts Recelvable C. Supplies D. Prepaid advertising E. Equipment February 1" transaction Is completed as an example: Only include the letter of the account not the account name. Date Transaction AMOUNT Eebruary 01 (ex) Paid an Accounts Payable $500 February 2 Borrowed from the bank 25,000 February 7 Provided services to customers on account 65,000 3,000 February 14 February 15 Paid rent for the month Recorded and paid salaries and wages 30,000 February 25 Received the utility bill, will pay in March 1,300 February 28 Collected from customers from services on account 42,000 Account Debit Credit Date Account payable (L-) Cash (A-) ex FEB 1 500 A 21. Feb 2 22. Feb 7 23. Feb 14 24. Feb 15 25. Feb 25 26. Feb 28 Cash $. The January 31st cash was $16,000, what is the cash 27. 16,000 500 (ex) balance at the end of the day on 2/28? (The Feb 1 example is included).

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 6PB: Single-step income Statement and balance sheet Selected accounts and related amounts for Kanpur Co....

Related questions

Question

100%

Transcribed Image Text:Use the following to answer questions 21 - 27

LIABILITIES &

INCOME STATEMENT

ASSETS

STOCKHOLDERS' EQUITY

ACCOUNTS

F. Accounts Payable

G. Deferred revenue

A. Cash

K. Service Revenue

L. Advertising expense

M. Rent Expense

N. Salaries/Wage expense

O. Utilities expense

B. Accounts Recelvable

C. Supplies

D. Prepaid advertising

E. Equipment

H. Notes Payable

I. Common Stock

J. Retained Earnings

February 1* transaction Is completed as an example: Only include the letter of the account not the account name.

Date

Transaction

AMOUNT

Eebruary 01 (ex)

Pald an Accounts Payable

$500

February 2

Borrowed from the bank

25,000

February 7

Provided services to customers on account

65,000

Paid rent for the month

3,000

February 14

February 15

Recorded and paid salaries and wages

30,000

February 25

Received the utility bill, will pay in March

1,300

February 28

Collected from customers from services on account

42,000

Account

Debit

Credit

Date

Account payable (L-)

Cash (A-)

500

ex

FEB 1

500

21.

Feb 2

22.

Feb 7

23.

Feb 14

24.

Feb 15

25.

Feb 25

26.

Feb 28

Cash

$.

The January 31st cash was $16,000, what is the cash

27.

16,000

500 (ex)

balance at the end of the day on 2/28? (The Feb 1 example is included).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning