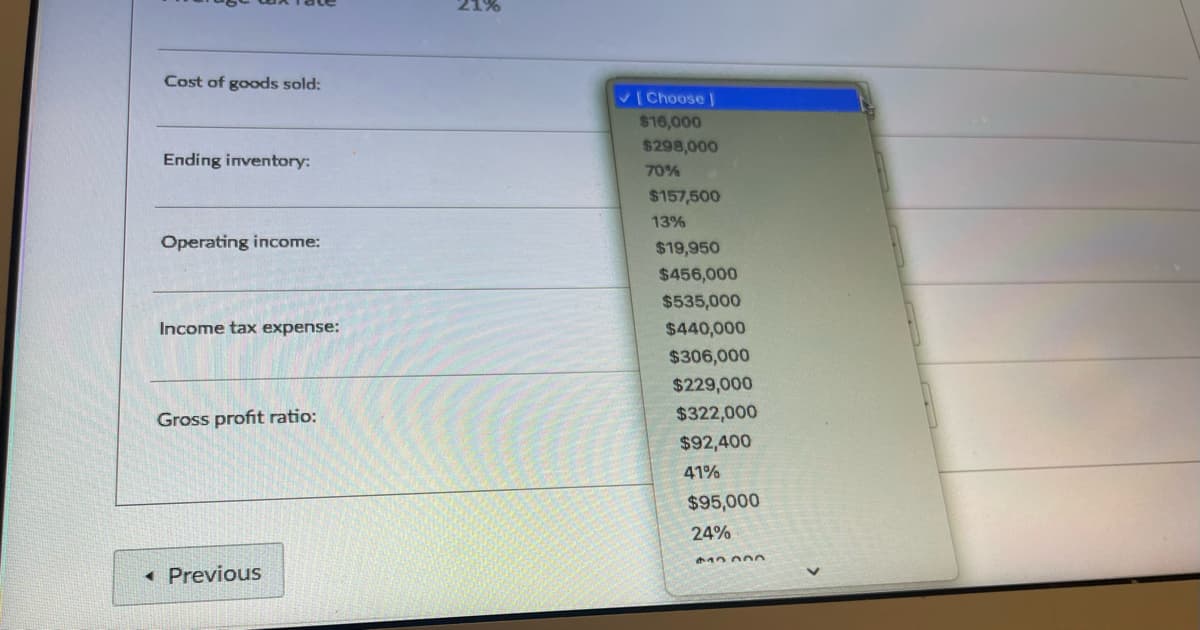

Use the following to answer the questions Net Sales $750,000 Gross profit $310,000 Beginning inventory $12,000 Purchases $444,000 Operating expense $215,000 Average tax rate 21% Cost of goods sold: V[Choose] $16,000 $298,000 Ending inventory: 70% $157,500 13% Operating income: $19,950 $456,000 $535,000 Income tax expense:

Use the following to answer the questions Net Sales $750,000 Gross profit $310,000 Beginning inventory $12,000 Purchases $444,000 Operating expense $215,000 Average tax rate 21% Cost of goods sold: V[Choose] $16,000 $298,000 Ending inventory: 70% $157,500 13% Operating income: $19,950 $456,000 $535,000 Income tax expense:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 11RE: Johnson Corporation had beginning inventory of 20,000 at cost and 35,000 at retail. During the year,...

Related questions

Question

Transcribed Image Text:21%

Cost of goods sold:

vChoose |

$16,000

$298,000

Ending inventory:

70%

$157,500

13%

Operating income:

$19,950

$456,000

$535,000

Income tax expense:

$440,000

$306,000

$229,000

Gross profit ratio:

$322,000

$92,400

41%

$95,000

24%

« Previous

![Use the following to answer the questions

Net Sales

$750,000

Gross profit

$310,000

Beginning inventory

$12,000

Purchases

$444,000

Operating expense

$215,000

Average tax rate

21%

Cost of goods sold:

V[Choose]

$16,000

$298,000

Ending inventory:

70%

$157,500

13%

Operating income:

$19,950

$456,000

$535,000

Income tax expense:](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F55641691-1667-47ee-9651-1b83a1cab4bd%2Fe93616bd-c6a8-451a-be97-2cc7c52cb7c0%2Fhfp6na_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Use the following to answer the questions

Net Sales

$750,000

Gross profit

$310,000

Beginning inventory

$12,000

Purchases

$444,000

Operating expense

$215,000

Average tax rate

21%

Cost of goods sold:

V[Choose]

$16,000

$298,000

Ending inventory:

70%

$157,500

13%

Operating income:

$19,950

$456,000

$535,000

Income tax expense:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning