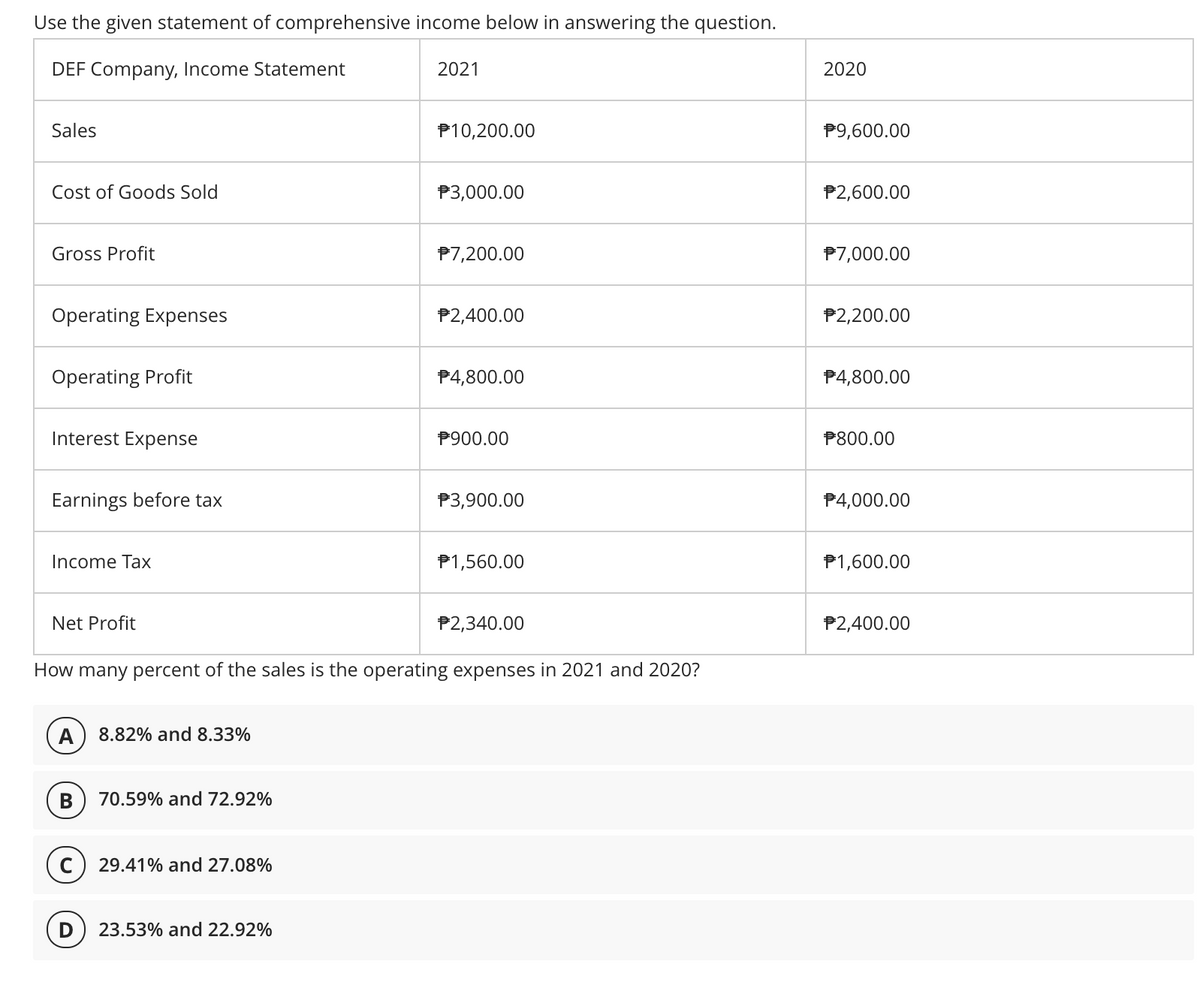

Use the given statement of comprehensive income below in answering the question. DEF Company, Income Statement 2021 2020 Sales P10,200.00 P9,600.00 Cost of Goods Sold P3,000.00 P2,600.00 Gross Profit P7,200.00 P7,000.00 Operating Expenses P2,400.00 P2,200.00 Operating Profit P4,800.00 P4,800.00 Interest Expense P900.00 P800.00 Earnings before tax P3,900.00 P4,000.00 Income Tax P1,560.00 P1,600.00 Net Profit P2,340.00 P2,400.00

Use the given statement of comprehensive income below in answering the question. DEF Company, Income Statement 2021 2020 Sales P10,200.00 P9,600.00 Cost of Goods Sold P3,000.00 P2,600.00 Gross Profit P7,200.00 P7,000.00 Operating Expenses P2,400.00 P2,200.00 Operating Profit P4,800.00 P4,800.00 Interest Expense P900.00 P800.00 Earnings before tax P3,900.00 P4,000.00 Income Tax P1,560.00 P1,600.00 Net Profit P2,340.00 P2,400.00

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 4CE

Related questions

Question

Transcribed Image Text:Use the given statement of comprehensive income below in answering the question.

DEF Company, Income Statement

2021

2020

Sales

P10,200.00

P9,600.00

Cost of Goods Sold

P3,000.00

P2,600.00

Gross Profit

P7,200.00

P7,000.00

Operating Expenses

P2,400.00

P2,200.00

Operating Profit

P4,800.00

P4,800.00

Interest Expense

P900.00

P800.00

Earnings before tax

P3,900.00

P4,000.00

Income Tax

P1,560.00

P1,600.00

Net Profit

P2,340.00

P2,400.00

How many percent of the sales is the operating expenses in 2021 and 2020?

A

8.82% and 8.33%

70.59% and 72.92%

29.41% and 27.08%

23.53% and 22.92%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning