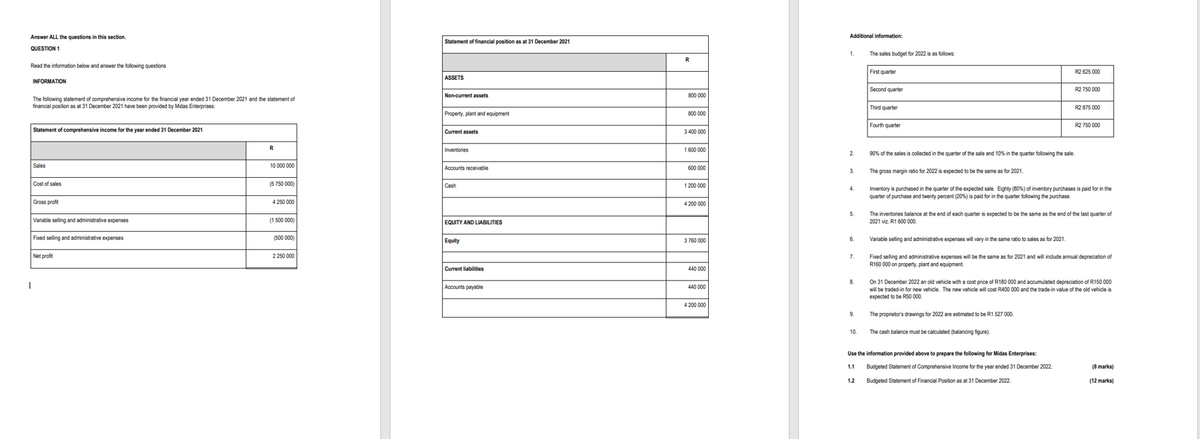

Use the information provided above to prepare the following for Midas Enterprises Budgeted Statement of Comprehensive income for the year ended 31 December 2022 12 Budgeted Statement of Financial Position as at 31 December 2012 1.1

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps