Use the present value and future value tables to answer the following questions. Time Value of Money - Principles of Accounting, Volume 2: Managerial Accounting | OpenStax A. If you would like to accumulate $2,400 over the next 5 years when the interest rate is 15%, how much do you need to deposit in the account? $_____ B. If you place $6,200 in a savings account, how much will you have at the end of 6 years with a 12% interest rate? $_____ C. You invest $7,000 per year for 11 years at 12% interest, how much will you have at the end of 11 years?

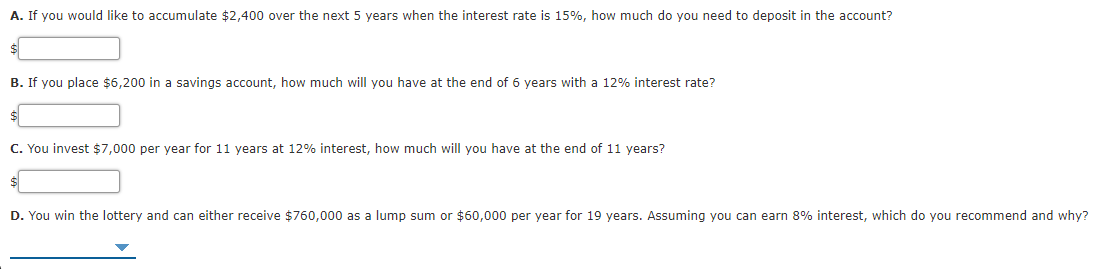

Use the present value and future value tables to answer the following questions.

A. If you would like to accumulate $2,400 over the next 5 years when the interest rate is 15%, how much do you need to deposit in the account?

$_____

B. If you place $6,200 in a savings account, how much will you have at the end of 6 years with a 12% interest rate?

$_____

C. You invest $7,000 per year for 11 years at 12% interest, how much will you have at the end of 11 years?

$_____

D. You win the lottery and can either receive $760,000 as a lump sum or $60,000 per year for 19 years. Assuming you can earn 8% interest, which do you recommend and why?

_____

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images