Use the table for the ques Revenues -Cost of Goods Sold -Depreciation =EBIT -Taxes (30%) =Profit after tax +Depreciation -Change in NOWC -Capital Expenditures =Free Cash Flow Year 0 -300,000 Year 1 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 2 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 3 400 000 -180 000 -100 000 120 000 -36 000 8 000 100 000 -20 000 164 000 Visby Rides, a limousine hire company, is considering buving some new luxury cars. After extensive resear

Use the table for the ques Revenues -Cost of Goods Sold -Depreciation =EBIT -Taxes (30%) =Profit after tax +Depreciation -Change in NOWC -Capital Expenditures =Free Cash Flow Year 0 -300,000 Year 1 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 2 400 000 -180 000 -100 000 120 000 -36 000 84 000 100 000 -20 000 164 000 Year 3 400 000 -180 000 -100 000 120 000 -36 000 8 000 100 000 -20 000 164 000 Visby Rides, a limousine hire company, is considering buving some new luxury cars. After extensive resear

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

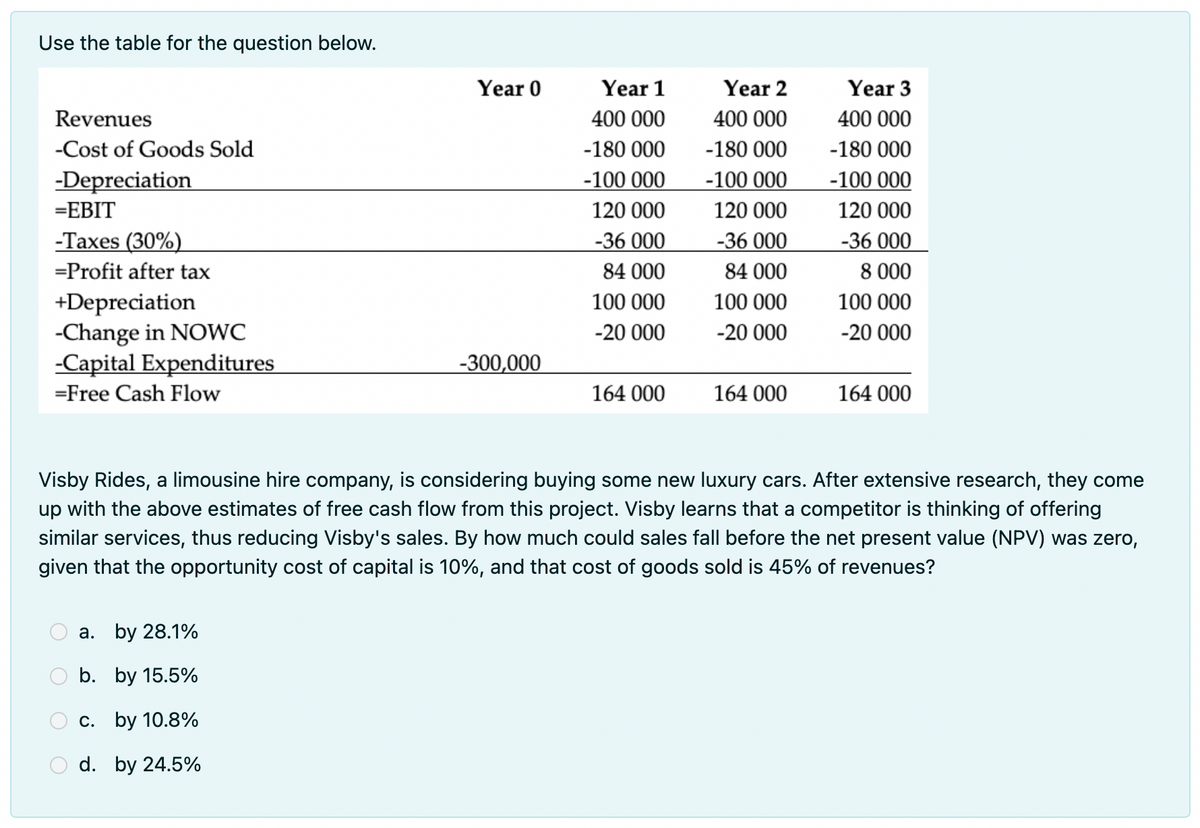

Transcribed Image Text:Use the table for the question below.

Revenues

-Cost of Goods Sold

-Depreciation

=EBIT

-Taxes (30%)

=Profit after tax

+Depreciation

-Change in NOWC

-Capital Expenditures

=Free Cash Flow

Year 0

a. by 28.1%

b. by 15.5%

c. by 10.8%

d. by 24.5%

-300,000

Year 1

400 000

-180 000

-100 000

120 000

-36 000

84 000

100 000

-20 000

164 000

Year 2

400 000

-180 000

-100 000

120 000

-36 000

84 000

100 000

-20 000

164 000

Year 3

400 000

-180 000

-100 000

120 000

-36 000

8 000

100 000

-20 000

164 000

Visby Rides, a limousine hire company, is considering buying some new luxury cars. After extensive research, they come

up with the above estimates of free cash flow from this project. Visby learns that a competitor is thinking of offering

similar services, thus reducing Visby's sales. By how much could sales fall before the net present value (NPV) was zero,

given that the opportunity cost of capital is 10%, and that cost of goods sold is 45% of revenues?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College