Using an 8% interest rate, calculate the present values for each scenario. (Round the amounts to the nearest dollar.) $ 49,137 $ Present value of Scenario 1 Present value of Scenario 2 Present value of Scenario 3 $ 48,350 53,271 Which scenario yields the highest present value? Scenario 3 appears to be the best option. Based on an 8% interest rate, its present value is the highest Using a 12% interest rate, calculate the present values for each scenario. (Round the amounts to the nearest dollar.) Present value of Scenario 1

Using an 8% interest rate, calculate the present values for each scenario. (Round the amounts to the nearest dollar.) $ 49,137 $ Present value of Scenario 1 Present value of Scenario 2 Present value of Scenario 3 $ 48,350 53,271 Which scenario yields the highest present value? Scenario 3 appears to be the best option. Based on an 8% interest rate, its present value is the highest Using a 12% interest rate, calculate the present values for each scenario. (Round the amounts to the nearest dollar.) Present value of Scenario 1

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:Your

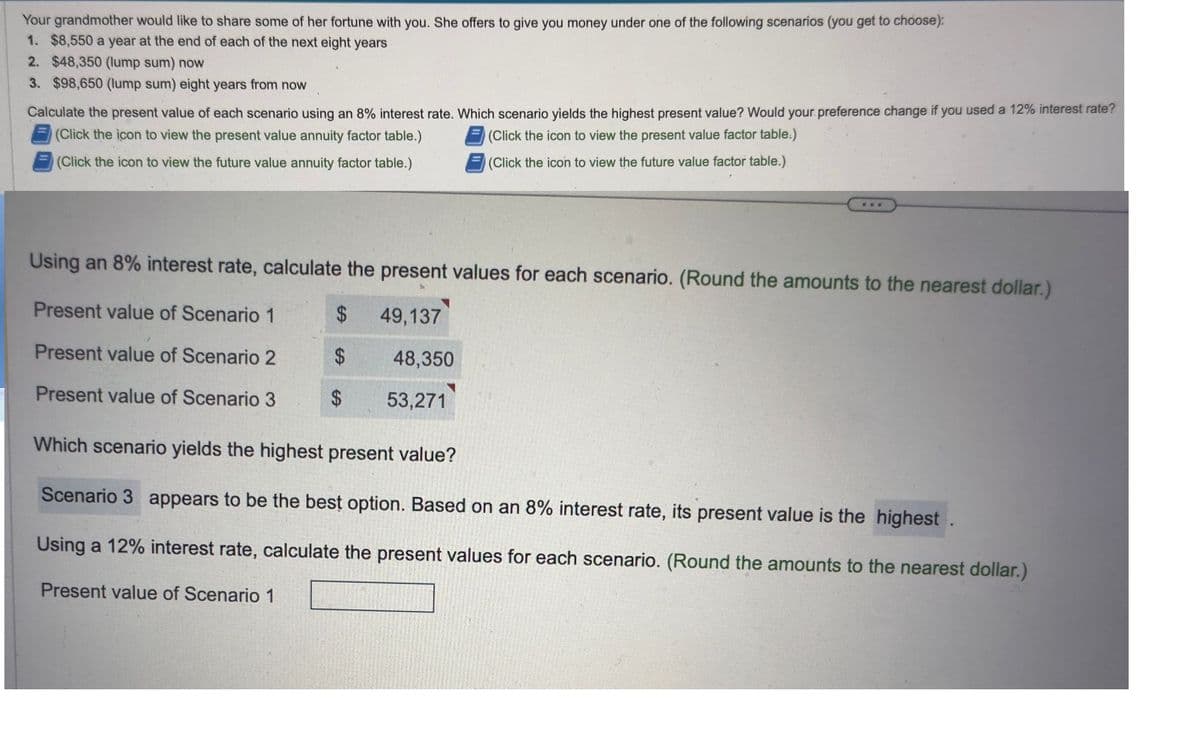

grandmother would like to share some of her fortune with you. She offers to give you money under one of the following scenarios (you get to choose):

1. $8,550 a year at the end of each of the next eight years

2. $48,350 (lump sum) now

3. $98,650 (lump sum) eight years from now

Calculate the present value of each scenario using an 8% interest rate. Which scenario yields the highest present value? Would your preference change if you used a 12% interest rate?

(Click the icon to view the present value annuity factor table.)

(Click the icon to view the present value factor table.)

(Click the icon to view the future value annuity factor table.)

(Click the icon to view the future value factor table.)

Using an 8% interest rate, calculate the present values for each scenario. (Round the amounts to the nearest dollar.)

Present value of Scenario 1

$

49,137

Present value of Scenario 2

$

Present value of Scenario 3

$

48,350

53,271

Which scenario yields the highest present value?

Scenario 3 appears to be the best option. Based on an 8% interest rate, its present value is the highest .

Using a 12% interest rate, calculate the present values for each scenario. (Round the amounts to the nearest dollar.)

Present value of Scenario 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT