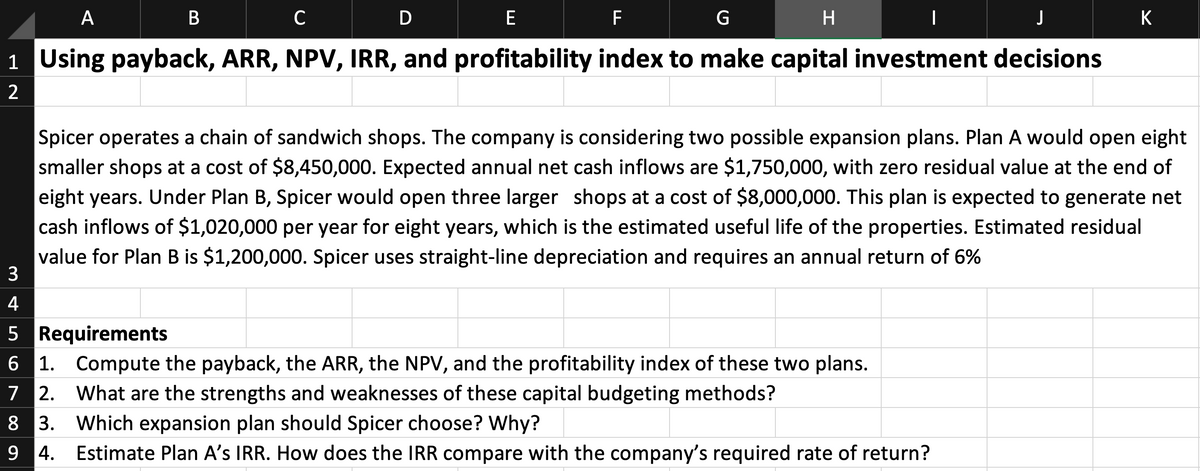

Using payback, ARR, NPV, IRR, and profitability index to make capital investment decisions Spicer operates a chain of sandwich shops. The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,450,000. Expected annual net cash inflows are $1,750,000, with zero residual value at the end of eight years. Under Plan B, Spicer would open three larger shops at a cost of $8,000,000. This plan is expected to generate net cash inflows of $1,020,000 per year for eight years, which is the estimated useful life of the properties. Estimated residual value for Plan B is $1,200,000. Spicer uses straight-line depreciation and requires an annual return of 6% Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. 2. What are the strengths and weaknesses of these capital budgeting methods? 3. Which expansion plan should Spicer choose? Why? 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return?

Using payback, ARR, NPV, IRR, and profitability index to make capital investment decisions Spicer operates a chain of sandwich shops. The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,450,000. Expected annual net cash inflows are $1,750,000, with zero residual value at the end of eight years. Under Plan B, Spicer would open three larger shops at a cost of $8,000,000. This plan is expected to generate net cash inflows of $1,020,000 per year for eight years, which is the estimated useful life of the properties. Estimated residual value for Plan B is $1,200,000. Spicer uses straight-line depreciation and requires an annual return of 6% Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans. 2. What are the strengths and weaknesses of these capital budgeting methods? 3. Which expansion plan should Spicer choose? Why? 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 6E: Cash payback method Lily Products Company is considering an investment in one of two new product...

Related questions

Question

I need 4

Transcribed Image Text:A

D

E

F

K

1 Using payback, ARR, NPV, IRR, and profitability index to make capital investment decisions

2

Spicer operates a chain of sandwich shops. The company is considering two possible expansion plans. Plan A would open eight

smaller shops at a cost of $8,450,000. Expected annual net cash inflows are $1,750,000, with zero residual value at the end of

eight years. Under Plan B, Spicer would open three larger shops at a cost of $8,000,000. This plan is expected to generate net

cash inflows of $1,020,000 per year for eight years, which is the estimated useful life of the properties. Estimated residual

value for Plan B is $1,200,000. Spicer uses straight-line depreciation and requires an annual return of 6%

3

4

5 Requirements

6 1. Compute the payback, the ARR, the NPV, and the profitability index of these two plans.

7 2. What are the strengths and weaknesses of these capital budgeting methods?

8 3. Which expansion plan should Spicer choose? Why?

9 4. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning