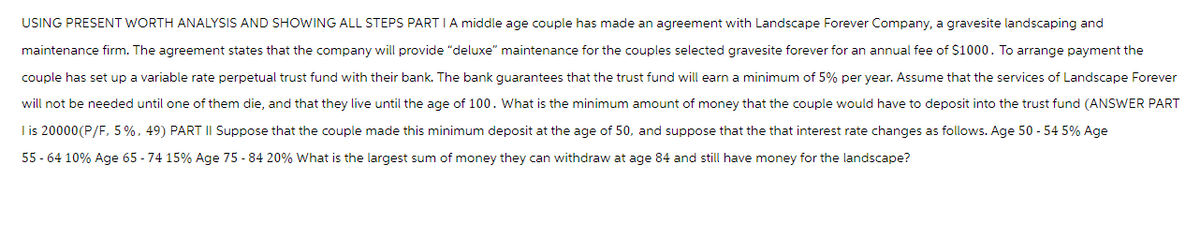

USING PRESENT WORTH ANALYSIS AND SHOWING ALL STEPS PARTI A middle age couple has made an agreement with Landscape Forever Company, a gravesite landscaping and maintenance firm. The agreement states that the company will provide "deluxe" maintenance for the couples selected gravesite forever for an annual fee of $1000. To arrange payment the couple has set up a variable rate perpetual trust fund with their bank. The bank guarantees that the trust fund will earn a minimum of 5% per year. Assume that the services of Landscape Forever will not be needed until one of them die, and that they live until the age of 100. What is the minimum amount of money that the couple would have to deposit into the trust fund (ANSWER PART I is 20000 (P/F, 5%, 49) PART II Suppose that the couple made this minimum deposit at the age of 50, and suppose that the that interest rate changes as follows. Age 50 - 54 5% Age 55-64 10% Age 65-74 15% Age 75 - 84 20% What is the largest sum of money they can withdraw at age 84 and still have money for the landscape?

USING PRESENT WORTH ANALYSIS AND SHOWING ALL STEPS PARTI A middle age couple has made an agreement with Landscape Forever Company, a gravesite landscaping and maintenance firm. The agreement states that the company will provide "deluxe" maintenance for the couples selected gravesite forever for an annual fee of $1000. To arrange payment the couple has set up a variable rate perpetual trust fund with their bank. The bank guarantees that the trust fund will earn a minimum of 5% per year. Assume that the services of Landscape Forever will not be needed until one of them die, and that they live until the age of 100. What is the minimum amount of money that the couple would have to deposit into the trust fund (ANSWER PART I is 20000 (P/F, 5%, 49) PART II Suppose that the couple made this minimum deposit at the age of 50, and suppose that the that interest rate changes as follows. Age 50 - 54 5% Age 55-64 10% Age 65-74 15% Age 75 - 84 20% What is the largest sum of money they can withdraw at age 84 and still have money for the landscape?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.12AMCP

Related questions

Question

Transcribed Image Text:USING PRESENT WORTH ANALYSIS AND SHOWING ALL STEPS PARTI A middle age couple has made an agreement with Landscape Forever Company, a gravesite landscaping and

maintenance firm. The agreement states that the company will provide "deluxe" maintenance for the couples selected gravesite forever for an annual fee of $1000. To arrange payment the

couple has set up a variable rate perpetual trust fund with their bank. The bank guarantees that the trust fund will earn a minimum of 5% per year. Assume that the services of Landscape Forever

will not be needed until one of them die, and that they live until the age of 100. What is the minimum amount of money that the couple would have to deposit into the trust fund (ANSWER PART

I is 20000 (P/F, 5%, 49) PART II Suppose that the couple made this minimum deposit at the age of 50, and suppose that the that interest rate changes as follows. Age 50 - 54 5% Age

55-64 10% Age 65-74 15% Age 75 - 84 20% What is the largest sum of money they can withdraw at age 84 and still have money for the landscape?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning