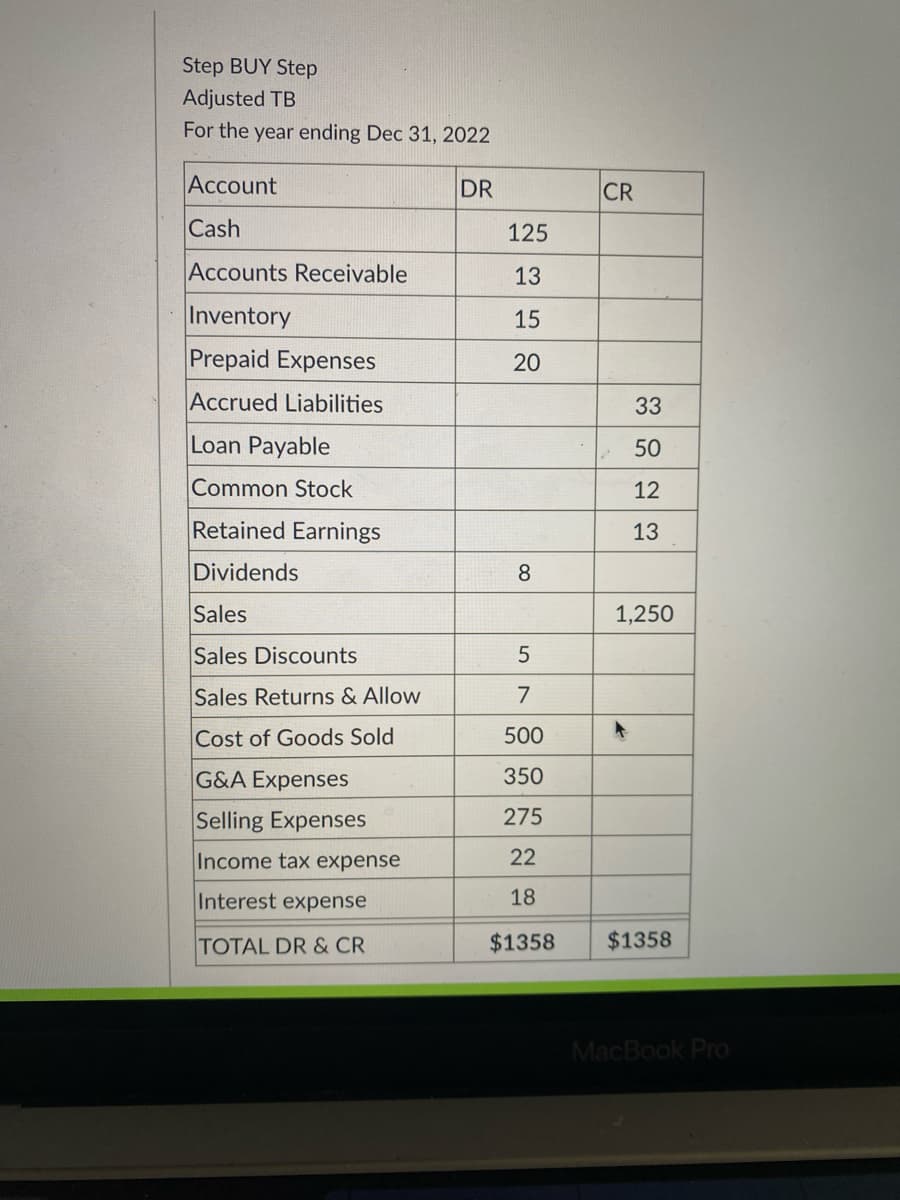

Using the adjusted trial balance below, prepare in good form a multi step income statement. Include what the net income would be and the gp%

Q: Preparation of the Statement of Comprehensive Income (Income Statement) using the multi-step format

A: Solution Working Net purchases =purchases-purchase returns and allowances – purchase discounts…

Q: A) Calculate the total Current Assets, Total Assets, Total Liabilities and Equity, Gross profit,…

A: A.

Q: indicate whether the statement describes a multiple-step income statement or asingle-step income…

A:

Q: The expense recognition principle (“matching”) controlsa. Where on the income statement expenses…

A:

Q: a. Prepare an income statement for the year using the "functional" method with supporting notes. b.…

A: Introduction: Expenses in an income statement are categorized in keeping with their nature or…

Q: Please indicate whether each entry is accounted for in profit or loss (P/L), other comprehensive…

A: Lets understand the basics. Profit or loss account is statement which shows revenue and expense…

Q: Prepare the following i. The income & expenditure account for the financial period

A: Income and expenditure is similar to P & L A/C of trading /business entities.it is used by non-…

Q: 1) On the Statement of Retained Earnings where does the Beg Balance of RE come from?2) Also…

A: Part-1.The beginning balance of Retained earnings are available in the Trial balance. As the…

Q: Expenses on the income statement may be grouped by ?

A: Income Statement: The statement that is used for reporting a corporation's financial performance, in…

Q: Prepara un "Income Statement single step

A: Since you haven’t mentioned any values to prepare Single Step Income Statement, I am explaining how…

Q: Based on the above trial balance, prepare the r Gross Profit Blank 1 Net Income from operation Blank…

A: Preparation of Income Statement

Q: Interest expense would be classified on a multiple-step income statement under the heading O…

A: Interest expense is an expenses.

Q: explain the purpose of the income statement and what information it contains. Give examples .

A: Every business operates for the purpose of results and profits. At the end of accounting period,…

Q: Statement of Comprehensive Income using a Single-step format.

A: In single-step format of Statement of Comprehensive Income, the revenues and expenses are not…

Q: The income statement is also known as the Select one: Oa. Net Income and Expense Statement Ob. Cash…

A: Financial statements: These refer to the formal or official records of the activities of the…

Q: How/where is a revenue increase shown on a pro forma income statement?

A: Pro forma income statement is the budgeted or estimated income statement which shows all estimated…

Q: Prepare a common size statement for the given income statement/statement of comprehensive income.

A: Introduction: Income statement: It tells the net profit or loss for the company. All revenues and…

Q: Required In a restated set of financial statements prepared in accordance with the current cost…

A: The first 3 subdivisions are answered for you. Please resubmit specifying the subdivisions you want…

Q: prepare an income statement for the current year using the functional presentation with supporting…

A: Income Statement (Functional View) Note Amount Amount Net Sales 1 7700000 Less: Cost of…

Q: Prepare a single-step statement of income.

A: Income Statement: It is a statement that helps in recording the expenses and income of the company…

Q: Define the following and their differences : 1. statement of comprehensive income 2. statement of…

A: Statement of comprehensive income and statement of financial position are components of financial…

Q: why adjusting of the income statement, and give three examples of items that are recasted?

A: The company prepares the Income statement to know the net income or losses that arise during the…

Q: indicate whether the statement describes a multiple-step income statement or asingle-step income…

A:

Q: Which of the following journals would correctly post an adjustment for deferred (prepaid) income?…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: The income statement form that contains several sections, subsections, and subtotals is called the…

A: The financial statement consists of mainly three statements Income statement or Profit and loss…

Q: compare the current rate method and the temporal method, evaluate how each aff ects theparent…

A: Under the current rate method, assets and liabilities are translated at the current exchange rate,…

Q: When performing vertical analysis of an income statement, the base amount is ________. A sales…

A: Vertical analysis of income statement shows each item of income statement as a percentage of sales…

Q: indicate whether the statement describes a multiple-step income statement or asingle-step income…

A: Multiple step income statement: Multiple step Income statement, as the name suggests, is an income…

Q: what is recasting of the income statement, and give three examples of items that are recasted?

A: The company prepares the income statement to know the net income or losses that arise during the…

Q: 1.The income statement can be expressed as an equation: A.Income =Income-Expenses B.Revenue-Expenses…

A: Income Statement: A financial statement which shows profitability of company over a period of time…

Q: recorded under the accrual basis of accounting A. deferred income - end B. prepaid expense - beg C.…

A: (c) Accrued income-beg , is added to income received to determine the total income for the yearthat…

Q: Required: a. Prepare a single-step income statement, b. Prepare a multiple-step income statement

A: An organization's financial outcomes for a specific time period are shown on the income statement.…

Q: alculate the following from the additional information given G Gross profit H Net profit

A: We need to compute gross and net profit of the firm.

Q: Which of the following comes first in worksheet preparation? A. Compute profit or loss as the…

A: Worksheet helpful in evaluating weather the accounting entries are posted correctly in their…

Q: What is the order of the subtotals that appear on a multi-step income statement? a. Gross Profit,…

A: The multi-step income statement is reported in the below format: Particulars Amount $ Sales…

Q: Based on the information above compute and interpret: 1.Profitability Ratio a) Gross Profit Ratio b)…

A: 1. Profitability ratios a) Gross Profit Margin = (Gross profit / Net sales ) *100 Gross profit =…

Q: Kindly prepare a statement of comprehensive income using the multi-step approach and function of…

A: Statement of comprehensive income shows all income and expenses of the business and at the end it…

Q: which comes first when preparing a income statement?

A: Income statement is a statement which provides details of all income and all expenses of the…

Q: In a multiple-step income statement, the dollar amount for income from operations is always the same…

A: A multiple step income statement refers to the income statement that shows the operating and…

Q: Prepare the Statement of Comprehensive Income using single-step approach

A: Statement of comprehensive income is a financial statement which shows all incomes and all expenses…

Q: On a multiple step income statement, the account interest expense would be located unde

A: Interest expense: Interest Expenses is the Return paid to the Debt holders of the company It is…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- PKT Ltd wanted to achieve a 25% GP for each sale completed. Inventory sales between AB and CFLtd amounted to R1875 000 for the year ended 31 December 2022. Inventory on hand in CF Ltd previouslypurchased from PKT Ltd: R620 000 (31 December 2022) R750 000 (31 December 2021)Prepare the journal entries (with narrations) for the year ended 31 December 2022. Assume a tax rate of30%.tion 8Income statement for the year ended 31 December, 2019 of KKMTN Ghana Ltd2018 2019ȼ ‘000 ȼ ‘000Turnover 420,000 523,600Cost of sales (330,000) (417,200)Gross profit 89,000 106,400Expenses:Administration 44,600 50,200Selling and distribution 15,400 (60,000) 19,600 (69,800)Profit before interest 29,000 36,600Debenture interest - (2,800)Net profit before tax 29,000 33,800Taxation (8,000) (10,000)Net Profit after tax 21,000 23,800Ordinary dividend paid 8,400 9,250Ordinary shares issued 12 million and trading at ȼ3 each as at yesterday onGSE.You are required to compute the following investment ratios:a). Earnings per shareb). Dividend per sharec). Payout ratiod). Price earnings ratioe). Earnings yieldSandhill Co. reported the following information for 2020: Sales revenue $2520000 Cost of goods sold 1748000 Operating expenses 282000 Unrealized holding gain on available-for-sale securities 85700 Cash dividends received on the securities 9200 For 2020, Sandhill would report comprehensive income of A.$85700. B.$499200. C.$575700. D.$584900.

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).Capital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio.

- Capital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio. Please help with the both questions mentionedINCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue 22450 18675Cost of sales 8475 8055Gross Profit 13975 10620Distribution costs 4245 3120Administrative expenses 1276 2134Selling expenses…tudent question Time to preview question: 00:09:07 Company is subject to an income tax rate of 30%. It has the provided the following data on December 31, 2021: Income Statement Items for 2021: Net sales P3,600,000Cost of goods sold 1,100,000Operating expenses including depreciation 840,000Depreciation expense 60,000Interest expense 100,000Income tax expense ? Other information for 2021: Payment of bank loan 300,000 Dividends paid to stockholders P250,000 Balance Sheet Items December 31, 2021 December 31, 2020Cash and cash equivalents 2,000,000 P1,750,000Accounts receivable 670,000 410,000Inventory 430,000 220,000Supplies 18,000 12,000Accounts payable 520,000 380,000Accrued liabilities 72,000 53,000Property and equipment, net 1,700,000 2,100,000Loans payable 1,000,000 1,500,000Share capital 1,000,000 1,000,000Retained earnings ? ? Based on the above, answer the following questions for 2021: (Round answers to whole numbers for monetary amounts while for percentages,…

- Hall Company’s beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: UnitsUnit PriceTotal CostJanuary 1Beginning inventory800$11.00$8,800March 51st purchase60012.007,200April 162nd purchase50012.506,250June 33rd purchase70014.009,800August 184th purchase80015.0012,000September 135th purchase90017.0015,300November 146th purchase40018.007,200December 37th purchase50020.3010,150 5,200 $76,700 There are 1,100 units of inventory on hand on December 31.Required:1.Calculate the total amount to be assigned to the ending inventory and cost of goods sold on December 31 under each of the following methods:(a)FIFO(b)LIFO(c)Weighted-average (round calculations to two decimal places)2.Assume that the market price per unit (cost to replace) of Hall’s inventory on December 31 was $16. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods:(a)FIFO lower-of-cost-or-market(b)Weighted-average…RUSH PLEASE THANK YOU The Bountiful Company was organized on January 3, 2022 with a share capital fully paid up of P 10,000,000. At December 31, 2022, the general ledger of said company showed the following accounts and balances:Your examination revealed that the cost of merchandise sold was 65% of sale.Based on the foregoing, answer the following questions: How much is the total payment of purchases during the year? A. 5,031,500 B. 3,198,500 C. 2,620,000 D. 1,680,000 How much is the total cash disbursements during the year? A. 6,299,288 B. 6,630,788 C. 5,031,500 D. 11,330,788 How much is the cash accountability at 12/31/2022? A. 7,570,712 B. 1,139,212 C. 8,838,500 D. 2,539,212THE ATHLETIC ATTICIncome StatementFor the Year Ended December 31, 2024Net sales $8,900,000Cost of goods sold 5,450,000Gross profit 3,450,000Expenses: Operating expenses $1,600,000 Depreciation expense 210,000 Interest expense 50,000 Income tax expense 360,000 Total expenses 2,220,000Net income $1,230,000 THE ATHLETIC ATTICBalance SheetsDecember 31 2024 2023Assets Current assets: Cash $164,000 Accounts receivable 790,000 Inventory 1,405,000 Supplies 110,000Long-term assets: Equipment 1,150,000 Less: Accumulated depreciation (420,000) Total assets $3,199,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $115,000 Interest payable 0 Income tax payable 40,000 Long-term liabilities: Notes payable 600,000 Stockholders' equity: Common stock 700,000…