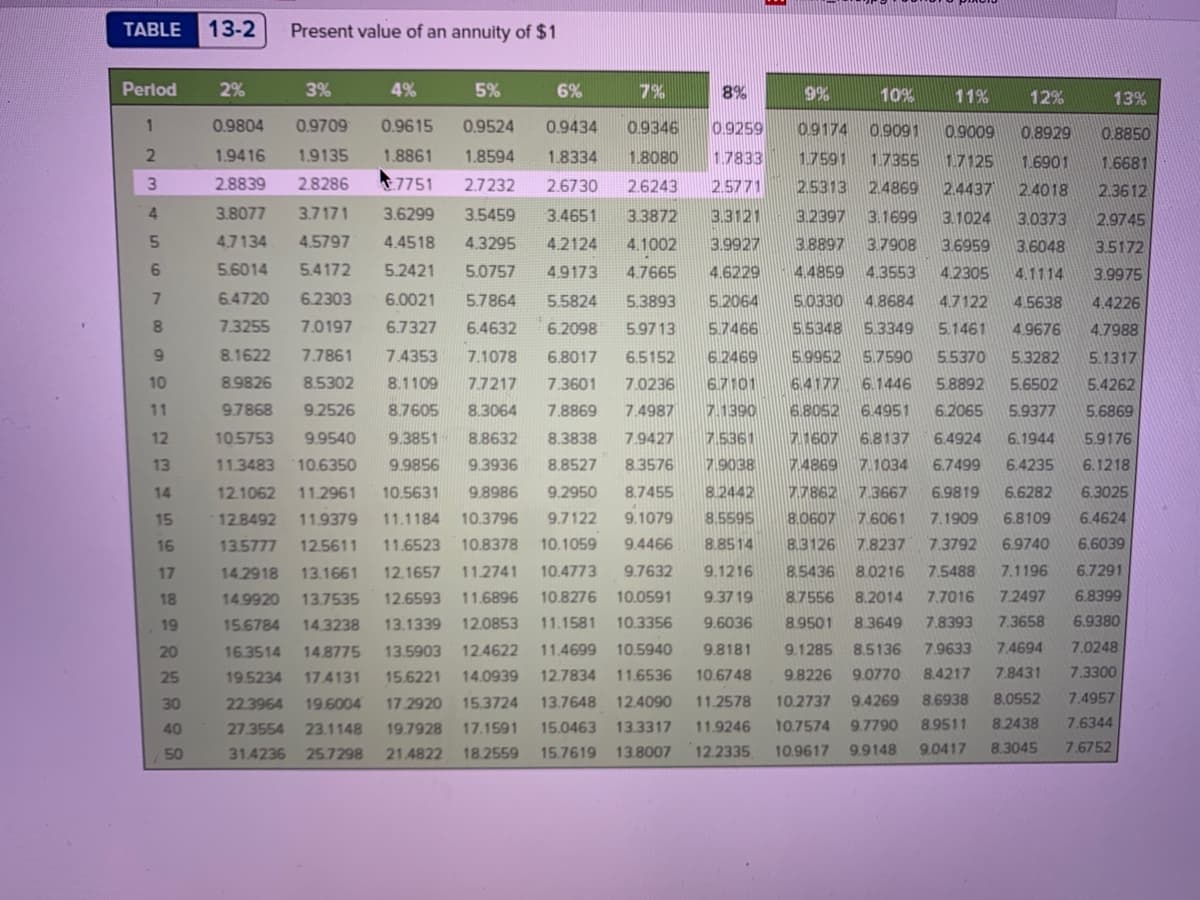

Using the annuity table, complete the following. (Use Table 13.2.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Payment amount end of each period 1,450 Frequency of payment - Annually Length of time 7 years Interest rate 9 % PV of Annuity

Using the annuity table, complete the following. (Use Table 13.2.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Payment amount end of each period 1,450 Frequency of payment - Annually Length of time 7 years Interest rate 9 % PV of Annuity

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Using the annuity table, complete the following. (Use Table 13.2.) (Do not round intermediate calculations. Round your answer to the nearest cent.)

Payment amount end of each period 1,450

Frequency of payment - Annually

Length of time 7 years

Interest rate 9 %

PV of Annuity

Transcribed Image Text:TABLE

13-2

Present value of an annuity of $1

Perlod

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

1

0.9804

0.9709

0.9615

0.9524

0.9434

0.9346

0.9259

0.9174

0.9091

0.9009

0.8929

0.8850

1.9416

1.9135

1.8861

1.8594

1.8334

1.8080

1.7833

1.7591

1.7355

1.7125

1.6901

1.6681

3

2.8839

2.8286

7751

2.7232

2.6730

2.6243

2.5771

2.5313

2.4869

2.4437

2.4018

2.3612

4.

3.8077

3.7171

3.6299

3.5459

3.4651

3.3872

3.3121

3.2397

3.1699

3.1024

3.0373

2.9745

5.

4.7134

4.5797

4.4518

4.3295

4.2124

4.1002

3.9927

3.8897

3.7908

3.6959

3.6048

3.5172

6.

5.6014

5.4172

5.2421

5.0757

4.9173

4.7665

4.6229

4.4859

4.3553

4.2305

4.1114

3.9975

7.

6.4720

6.2303

6.0021

5.7864

5.5824

5.3893

5.2064

5.0330

4.8684

4.7122

4.5638

4.4226

8.

7.3255

7.0197

6.7327

6.4632

6.2098

5.9713

5.7466

5.5348

5.3349

5.1461

4 9676

4.7988

9.

8.1622

7.7861

7.4353

7.1078

6.8017

6.5152

6.2469

5.9952

5.7590

55370

5.3282

5.1317

10

8.9826

8.5302

8.1109

7.7217

7.3601

7.0236

6.7101

6.4177

6.1446

5.8892

5.6502

5.4262

11

9.7868

9.2526

8.7605

8.3064

7.8869

7.4987

7.1390

6.8052

6.4951

6.2065

5.9377

5.6869

12

10.5753

9.9540

9.3851

8.8632

8.3838

7.9427

7.5361

71607

6.8137

6.4924

6.1944

5.9176

13

11.3483

10.6350

9.9856

9.3936

8.8527

8.3576

7.9038

74869

7.1034

6.7499

6.4235

6.1218

14

12.1062

11.2961

10.5631

9.8986

9.2950

8.7455

8.2442

77862 7.3667

6.9819

6.6282

6.3025

15

12.8492

11.9379

11.1184

10.3796

9.7122

9.1079

8.5595

8.0607

7.6061

7.1909

6.8109

6.4624

16

13.5777

125611

11.6523

10.8378

10.1059

9.4466

8.8514

8.3126

7.8237

7.3792

6.9740

6.6039

17

142918

13.1661

12.1657

11.2741

10.4773

9.7632

9.1216

8.5436 8.0216

7.5488

7.1196

6.7291

18

149920

13.7535

12.6593 11.6896

10.8276

10.0591

9.37 19

8.7556

8.2014

7.7016

7.2497

6.8399

19

15.6784

14.3238

13.1339

12.0853

11.1581

10.3356

9.6036

8.9501

8.3649

7.8393

7.3658

6.9380

20

16.3514

14.8775

13.5903

12.4622

11.4699

10.5940

9.8181

9.1285

8.5136

7.9633

7.4694

7.0248

25

19.5234

17.4131

15.6221

14.0939

12.7834

11.6536

10.6748

9.8226

9.0770

8.4217

7.8431

7.3300

30

22.3964

19.6004

17.2920

15.3724

13.7648

12.4090

11.2578

10.2737

9.4269

8.6938

8.0552

7.4957

40

27.3554

23.1148

19.7928

17.1591

15.0463

133317

11.9246

10.7574

9.7790

8.9511

8.2438

7,6344

50

31.4236 25.7298

21.4822

18.2559

15.7619 13.8007

12.2335

10.9617

9.9148

9.0417

8.3045

7.6752

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education