using the data below make a statement of cash flow using an indirect method

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter1: The Role Of Accounting In Business

Section: Chapter Questions

Problem 1.4.2MBA: Return on assets The following data (in millions) were adapted from recent financial statements of...

Related questions

Question

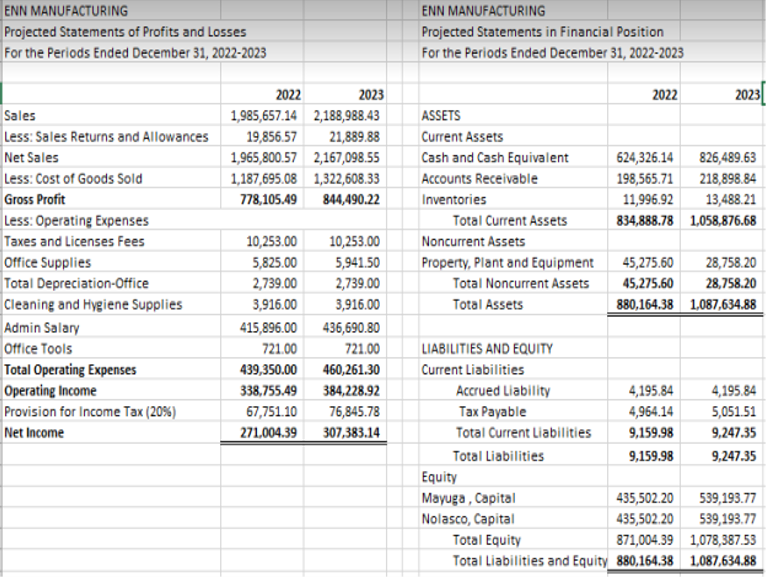

using the data below make a statement of cash flow using an indirect method

Transcribed Image Text:ENN MANUFACTURING

ENN MANUFACTURING

Projected Statements of Profits and Losses

Projected Statements in Financial Position

For the Periods Ended December 31, 2022-2023

For the Periods Ended December 31, 2022-2023

2022

2023

2022

2023

Sales

Less: Sales Returns and Allowances

Net Sales

1,985,657.14 2,188,988.43

ASSETS

19,856.57

21,889.88

|Current Assets

1,965,800.57 2,167,098.55

Cash and Cash Equivalent

624,326.14

826,489.63

Less: Cost of Goods Sold

1,187,695.08 1,322,608.33

Accounts Receivable

198,565.71

218,898.84

Gross Profit

778,105.49

844,490.22

Inventories

11,996.92

13,488.21

Less: Operating Expenses

Taxes and Licenses Fees

Office Supplies

Total Depreciation-Office

Cleaning and Hygiene Supplies

Admin Salary

Office Tools

Total Operating Expenses

Operating Income

Provision for Income Tax (20%)

Total Current Assets

834,888.78 1,058,876.68

10,253.00

10,253.00

Noncurrent Assets

5,825.00

5,941.50

Property, Plant and Equipment

45,275.60

28,758.20

2,739.00

2,739.00

Total Noncurrent Assets

45,275.60

28,758.20

3,916.00

3,916.00

Total Assets

880,164.38 1.087,634.88

415,896.00

436,690.80

721.00

721.00

LIABILITIES AND EQUITY

439,350.00

460,261.30

Current Liabilities

338,755.49

384,228.92

Accrued Liability

4,195.84

4,195.84

751.10,ף

76,845.78

Таx Payable

4,964.14

5,051.51

Net Income

271,004.39

307,383.14

Total Current Liabilities

9,159.98

9,247.35

Total Liabilities

9,159.98

9,247.35

Equity

Mayuga, Capital

435,502.20

539,193.77

Nolasco, Capital

435,502.20

539,193.77

Total Equity

871,004.39 1,078,387.53

Total Liabilities and Equity 880,164.38 1,087,634.88

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning