Using the financial statements mentioned above estimate the annual rate of interest paid by the corporation (cost of debt). Also, find the tax rate and capitalization ratio (proportions among equity and debt). Using these values that you have found estimate the annual weighted cost of capital (WACC) of the corporation.

Using the financial statements mentioned above estimate the annual rate of interest paid by the corporation (cost of debt). Also, find the tax rate and capitalization ratio (proportions among equity and debt). Using these values that you have found estimate the annual weighted cost of capital (WACC) of the corporation.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Using the financial statements mentioned above estimate the annual rate of interest paid by the corporation (cost of debt). Also, find the tax rate and capitalization ratio (proportions among equity and debt). Using these values that you have found estimate the annual weighted cost of capital (WACC) of the corporation.

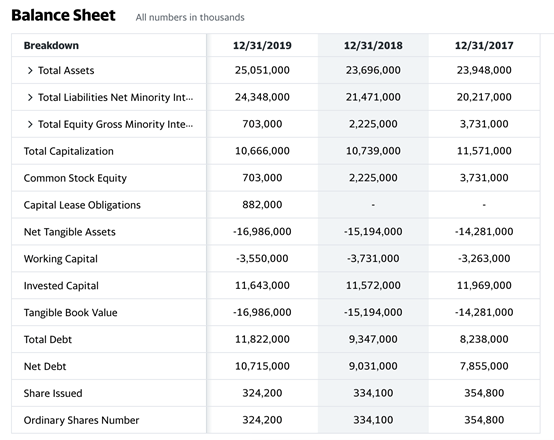

Transcribed Image Text:Balance Sheet

All numbers in thousands

Breakdown

12/31/2019

12/31/2018

12/31/2017

> Total Assets

25,051,000

23,696,000

23,948,000

> Total Liabilities Net Minority Int.

24,348,000

21,471,000

20,217,000

> Total Equity Gross Minority Inte.

703,000

2,225,000

3,731,000

Total Capitalization

10,666,000

10,739,000

11,571,000

Common Stock Equity

703,000

2,225,000

3,731,000

Capital Lease Obligations

882,000

Net Tangible Assets

-16,986,000

-15,194,000

-14,281,000

Working Capital

-3,550,000

-3,731,000

-3,263,000

Invested Capital

11,643,000

11,572,000

11,969,000

Tangible Book Value

-16,986,000

-15,194,000

-14,281,000

Total Debt

11,822,000

9,347,000

8,238,000

Net Debt

10,715,000

9,031,000

7,855,000

Share Issued

324,200

334,100

354,800

Ordinary Shares Number

324,200

334,100

354,800

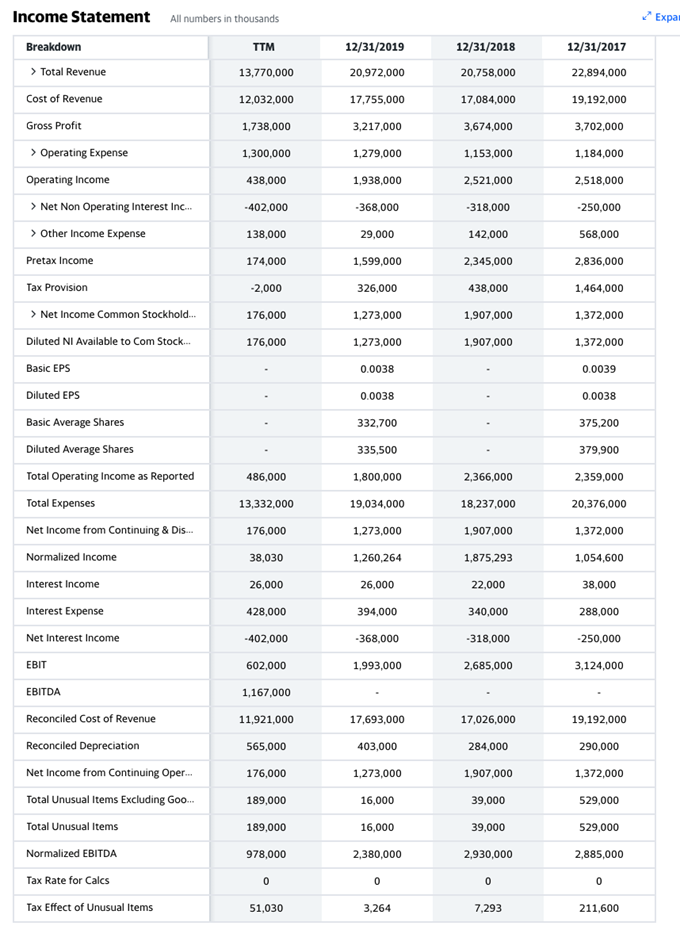

Transcribed Image Text:Income Statement

All numbers in thousands

/ Expar

Breakdown

TTM

12/31/2019

12/31/2018

12/31/2017

> Total Revenue

13,770,000

20,972,000

20,758,000

22,894,000

Cost of Revenue

12,032,000

17,755,000

17,084,000

19,192,000

Gross Profit

1,738,000

3,217,000

3,674,000

3,702,000

> Operating Expense

1,184,000

1,300,000

1,279,000

1,153,000

Operating Income

438,000

1,938,000

2,521,000

2,518,000

> Net Non Operating Interest Inc.

-402,000

-368,000

-318,000

-250,000

> Other Income Expense

138,000

29,000

142,000

568,000

Pretax Income

174,000

1,599,000

2,345,000

2,836,000

Таx Provision

-2,000

326,000

438,000

1,464,000

> Net Income Common Stockhold.

176,000

1,273,000

1,907,000

1,372,000

Diluted NI Available to Com Stock.

176,000

1,273,000

1,907,000

1,372,000

Basic EPS

0.0038

0.0039

Diluted EPS

0.0038

0.0038

Basic Average Shares

332,700

375,200

Diluted Average Shares

335,500

379,900

Total Operating Income as Reported

486,000

1,800,000

2,366,000

2,359,000

Total Expenses

13,332,000

19,034,000

18,237,000

20,376,000

Net Income from Continuing & Dis.

176,000

1,273,000

1,907,000

1,372,000

Normalized Income

38,030

1,260,264

1,875,293

1,054,600

Interest Income

26,000

26,000

22,000

38,000

Interest Expense

428,000

394,000

340,000

288,000

Net Interest Income

-402,000

-368,000

-318,000

-250,000

EBIT

602,000

1,993,000

2,685,000

3,124,000

EBITDA

1,167,000

Reconciled Cost of Revenue

11,921,000

17,693,000

17,026,000

19,192,000

Reconciled Depreciation

565,000

403,000

284,000

290,000

Net Income from Continuing Oper.

176,000

1,273,000

1,907,000

1,372,000

Total Unusual Items Excluding Goo.

189,000

16,000

39,000

529,000

Total Unusual Items

189,000

16,000

39,000

529,000

Normalized EBITDA

978,000

2,380,000

2,930,000

2,885,000

Tax Rate for Calcs

Tax Effect of Unusual Items

51,030

3,264

7,293

211,600

Expert Solution

Step 1

Weighted Average Cost of Capital (WACC) is the total cost of capital employed by an entity using equity and debt finance sources. Weights are assigned to equity and debt based on their proportion of total capital employed and the respective costs are assigned to figure out the WACC.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning