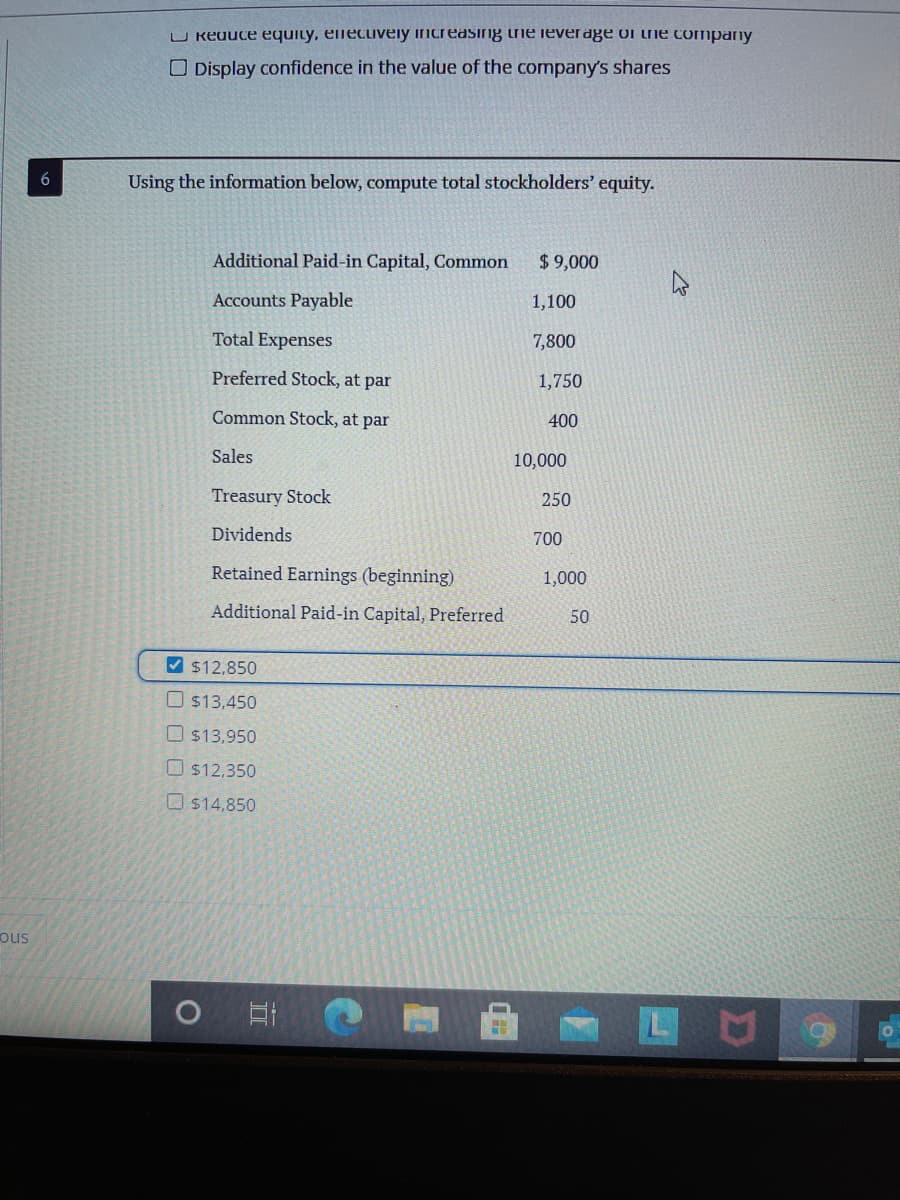

Using the information below, compute total stockholders' equity. Additional Paid-in Capital, Common $9,000 Accounts Payable 1,100 Total Expenses 7,800 Preferred Stock, at par 1,750 Common Stock, at par 400 Sales 10,000 Treasury Stock 250 Dividends 700 Retained Earnings (beginning) 1,000 Additional Paid-in Capital, Preferred 50 $12,850 O s13,450 O $13,950 O $12,350 O$14,850

Using the information below, compute total stockholders' equity. Additional Paid-in Capital, Common $9,000 Accounts Payable 1,100 Total Expenses 7,800 Preferred Stock, at par 1,750 Common Stock, at par 400 Sales 10,000 Treasury Stock 250 Dividends 700 Retained Earnings (beginning) 1,000 Additional Paid-in Capital, Preferred 50 $12,850 O s13,450 O $13,950 O $12,350 O$14,850

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 8MC: When treasury stock is purchased for cash at more than its par value, what is the effect on total...

Related questions

Question

Help with 6 and 4 please

Transcribed Image Text:U Reduce equiLy, ellectively increasing he leverage ol the company

O Display confidence in the value of the company's shares

6

Using the information below, compute total stockholders' equity.

Additional Paid-in Capital, Common

$9,000

Accounts Payable

1,100

Total Expenses

7,800

Preferred Stock, at par

1,750

Common Stock, at par

400

Sales

10,000

Treasury Stock

250

Dividends

700

Retained Earnings (beginning)

1,000

Additional Paid-in Capital, Preferred

50

V $12,850

O$13,450

O $13,950

O $12,350

O $14,850

ous

LU9

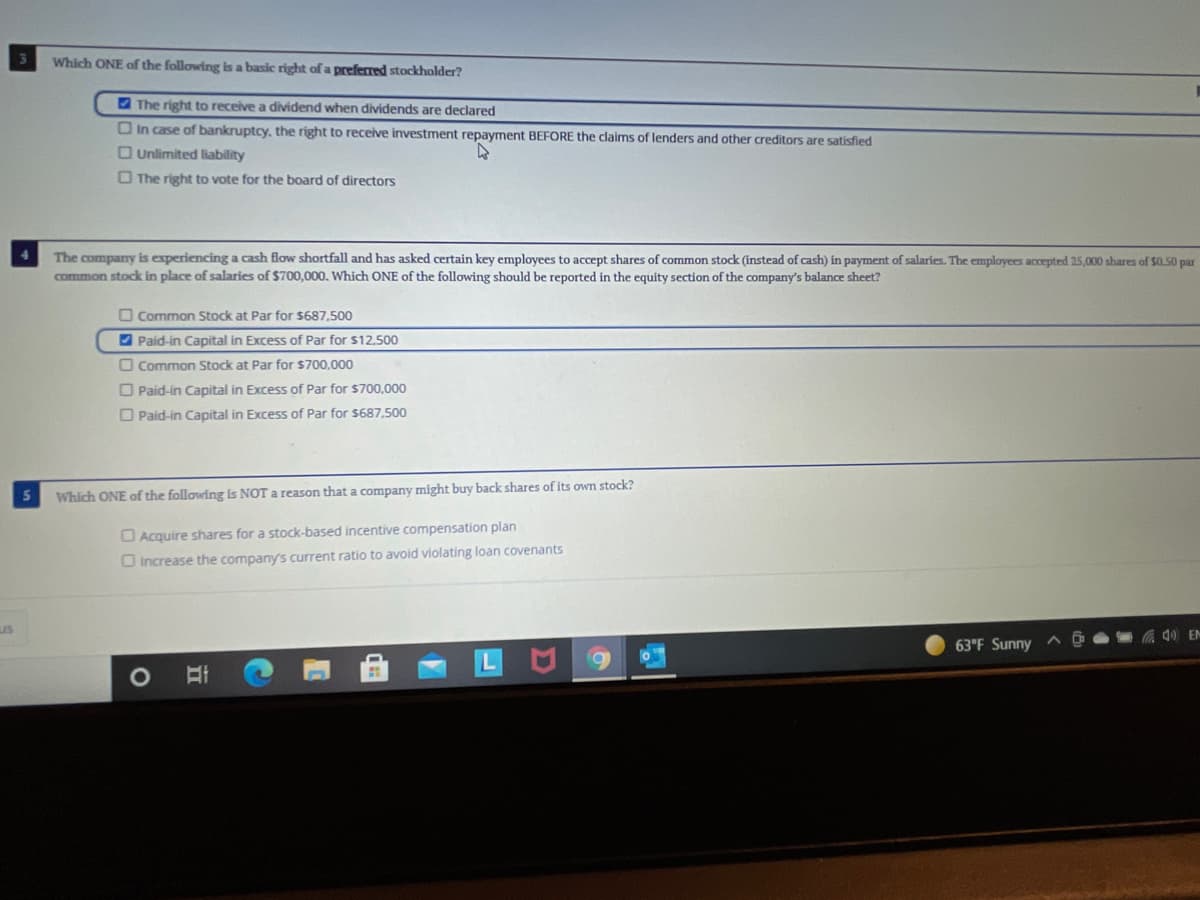

Transcribed Image Text:Which ONE of the following is a basic right of a preferred stockholder?

2 The right to receive a dividend when dividends are declared

O In case of bankruptcy, the right to receive investment repayment BEFORE the claims of lenders and other creditors are satisfied

O Unlimited liability

O The right to vote for the board of directors

The company is experiencing a cash flow shortfall and has asked certain key employees to accept shares of common stock (instead of cash) in payment of salaries. The employees accepted 25,000 shares of $0.50 par

common stock in place of salaries of $700,000. Which ONE of the following should be reported in the equity section of the company's balance sheet?

O Common Stock at Par for $687,500

O Paid-in Capital in Excess of Par for $12,500

O Common Stock at Par for $700,000

O Paid-in Capital in Excess of Par for $700.000

O Paid-in Capital in Excess of Par for $687,500

Which ONE af the following is NOT a reason that a company might buy back shares of its own stock?

O Acquire shares for a stock-based incentive compensation plan

O Increase the company's current ratio to avoid violating loan covenants

us

40 EN

63°F Sunny

立

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning