Using the provided information answer the following questions. The following results relate to Life Healthcare Ltd, a private hospital group 0 companies, for the year ended 30 September 2012: 2012 2011 Sales R10 937m R9 812 Net Profit R1 743m R1 492 Total assets R9 256m R8 468 Equity R3 941m R3 518 5.1 What does it mean if a business is solvent? 5.2 Describe the 3 key drivers of return on equity for a company. In other words, describe the three areas that a company focus on in order to maximise shareholders' wealth? 5.3 Calculate the asset efficiency (return on assets) for Life Healthcare Ltd for 2012. Provided that in (2011: 1.16 times). 5.4 Comment on the movement in asset efficiency between the two years, and briefly indicate the reasons for the change.

Using the provided information answer the following questions. The following results relate to Life Healthcare Ltd, a private hospital group 0 companies, for the year ended 30 September 2012: 2012 2011 Sales R10 937m R9 812 Net Profit R1 743m R1 492 Total assets R9 256m R8 468 Equity R3 941m R3 518 5.1 What does it mean if a business is solvent? 5.2 Describe the 3 key drivers of return on equity for a company. In other words, describe the three areas that a company focus on in order to maximise shareholders' wealth? 5.3 Calculate the asset efficiency (return on assets) for Life Healthcare Ltd for 2012. Provided that in (2011: 1.16 times). 5.4 Comment on the movement in asset efficiency between the two years, and briefly indicate the reasons for the change.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter9: Operating Activities

Section: Chapter Questions

Problem 13QE

Related questions

Question

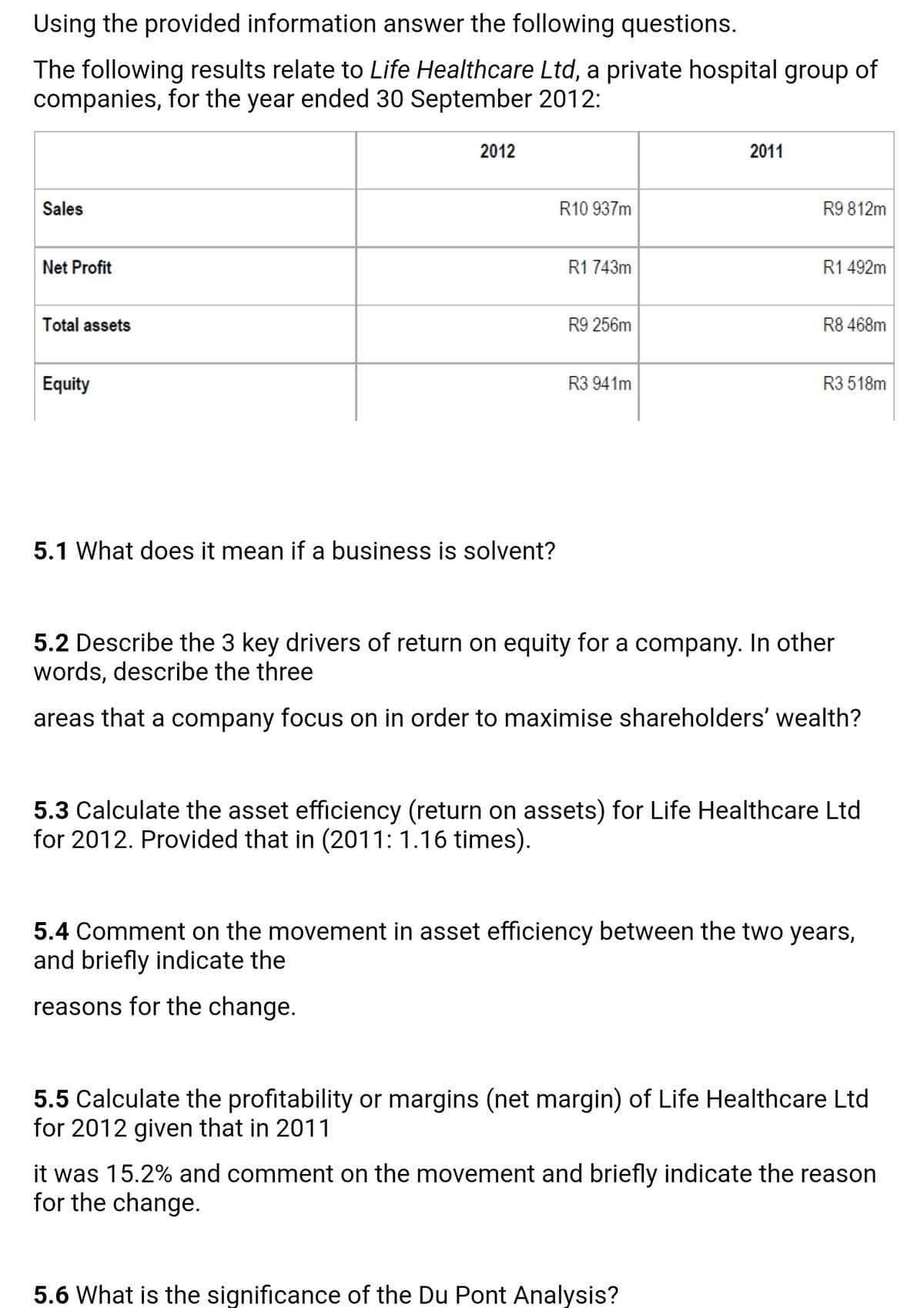

Transcribed Image Text:Using the provided information answer the following questions.

The following results relate to Life Healthcare Ltd, a private hospital group of

companies, for the year ended 30 September 2012:

2012

2011

Sales

R10 937m

R9 812m

Net Profit

R1 743m

R1 492m

Total assets

R9 256m

R8 468m

Equity

R3 941m

R3 518m

5.1 What does it mean if a business is solvent?

5.2 Describe the 3 key drivers of return on equity for a company. In other

words, describe the three

areas that a company focus on in order to maximise shareholders' wealth?

5.3 Calculate the asset efficiency (return on assets) for Life Healthcare Ltd

for 2012. Provided that in (2011: 1.16 times).

5.4 Comment on the movement in asset efficiency between the two years,

and briefly indicate the

reasons for the change.

5.5 Calculate the profitability or margins (net margin) of Life Healthcare Ltd

for 2012 given that in 2011

it was 15.2% and comment on the movement and briefly indicate the reason

for the change.

5.6 What is the significance of the Du Pont Analysis?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning