Using the same purchase information at the beginning of the question, prepare the table assuming that the ompany used double-declining-balance depreciation. Year 2017 2018 2019 2020 Year 2017 2018 2019 Net Book Value at the Beginning of the Year $70000 $35000 $17500 2020 11000 Cost of Long-Term Asset $70,000 1) Using the same purchase information and residual value at the beginning of the question, assume that the ompany uses the units-of-production method. The asset can produce one million units. Prepare the depreciation able. $70,000 $70,000 $70,000 Depreciation Expense $35000 $17500 $6500 $0 Units Produced 210,000 $12390 140,000 $ 120,000 $ 360,000 $ Accumulated Depreciation $ 35000 $52500 $59000 Depreciation Expense 59000 $12390 $ LA LA $ LA Net Book Value at the End of the Year $ Accumulated Depreciation $ 35000 $17500 $11000 11000 Net Book Value $ LA $ 57610

Using the same purchase information at the beginning of the question, prepare the table assuming that the ompany used double-declining-balance depreciation. Year 2017 2018 2019 2020 Year 2017 2018 2019 Net Book Value at the Beginning of the Year $70000 $35000 $17500 2020 11000 Cost of Long-Term Asset $70,000 1) Using the same purchase information and residual value at the beginning of the question, assume that the ompany uses the units-of-production method. The asset can produce one million units. Prepare the depreciation able. $70,000 $70,000 $70,000 Depreciation Expense $35000 $17500 $6500 $0 Units Produced 210,000 $12390 140,000 $ 120,000 $ 360,000 $ Accumulated Depreciation $ 35000 $52500 $59000 Depreciation Expense 59000 $12390 $ LA LA $ LA Net Book Value at the End of the Year $ Accumulated Depreciation $ 35000 $17500 $11000 11000 Net Book Value $ LA $ 57610

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8P: Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of...

Related questions

Question

Could you explain me how to do the option d. Thanks.

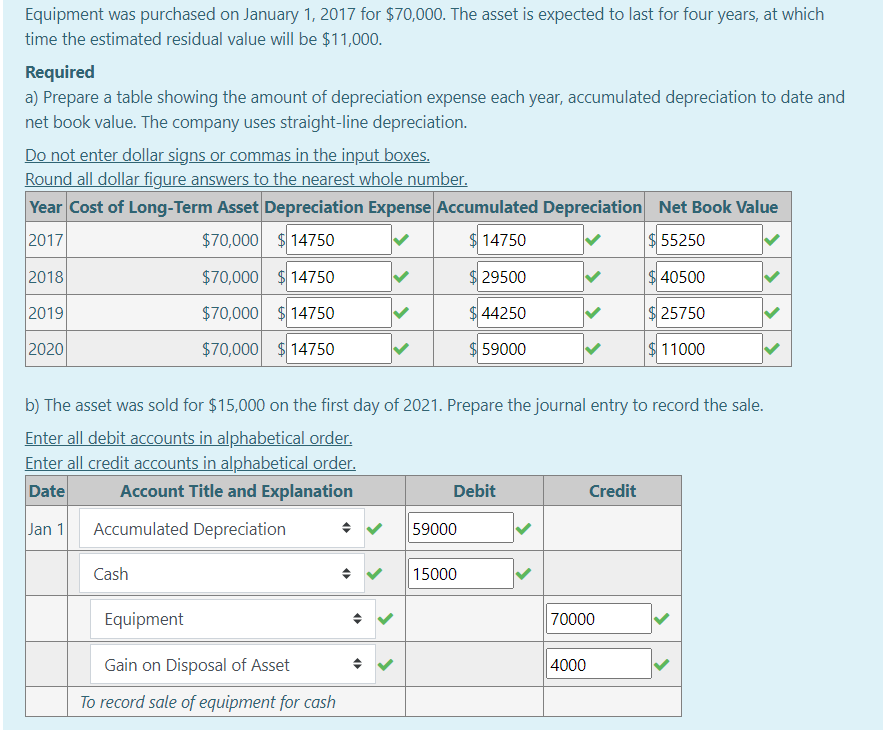

Transcribed Image Text:Equipment was purchased on January 1, 2017 for $70,000. The asset is expected to last for four years, at which

time the estimated residual value will be $11,000.

Required

a) Prepare a table showing the amount of depreciation expense each year, accumulated depreciation to date and

net book value. The company uses straight-line depreciation.

Do not enter dollar signs or commas in the input boxes.

Round all dollar figure answers to the nearest whole number.

Year Cost of Long-Term Asset Depreciation Expense Accumulated Depreciation Net Book Value

2017

$70,000 $14750

14750

$55250

2018

40500

25750

11000

2019

2020

Jan 1

$70,000 $14750

$70,000 $14750

$70,000 $14750

b) The asset was sold for $15,000 on the first day of 2021. Prepare the journal entry to record the sale.

Enter all debit accounts in alphabetical order.

Enter all credit accounts in alphabetical order.

Date

Account Title and Explanation

Accumulated Depreciation

Cash

Equipment

Gain on Disposal of Asset

To record sale of equipment for cash

O

4

29500

44250

59000

Debit

59000

15000

Credit

70000

4000

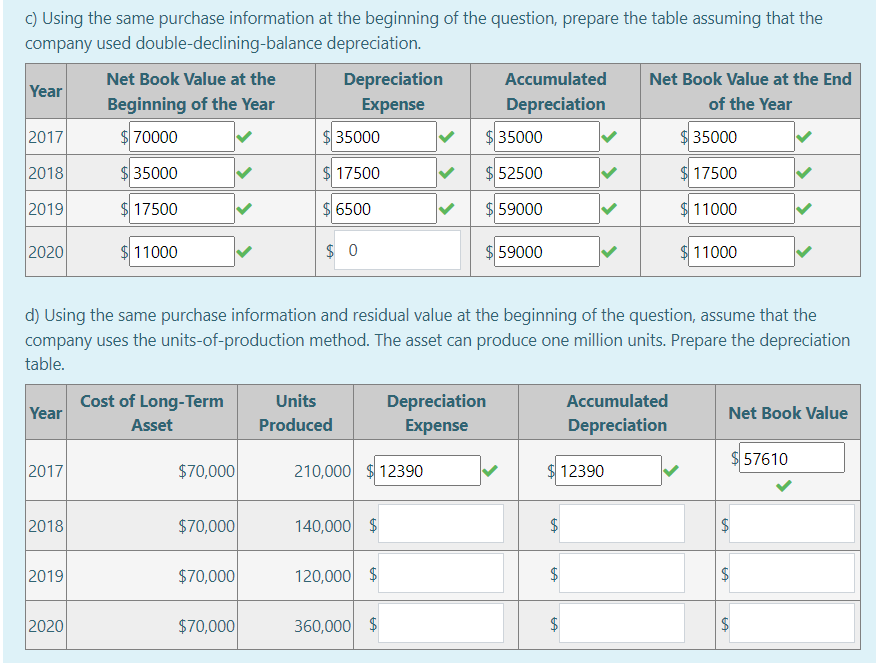

Transcribed Image Text:c) Using the same purchase information at the beginning of the question, prepare the table assuming that the

company used double-declining-balance

depreciation.

Year

2017

2018

2019

2020

Year

2017

2018

2019

Net Book Value at the

Beginning of the Year

$70000

$35000

$17500

2020

11000

Cost of Long-Term

Asset

$70,000

$70,000

d) Using the same purchase information and residual value at the beginning of the question, assume that the

company uses the units-of-production method. The asset can produce one million units. Prepare the depreciation

table.

$70,000

$70,000

Depreciation

Expense

$ 35000

$ 17500

$ 6500

$0

Units

Produced

210,000 $12390

140,000 $

120,000 $

Depreciation

Expense

360,000 $

Accumulated

Depreciation

$ 35000

$ 52500

$59000

59000

$

$

LA

BA

$

Net Book Value at the End

of the Year

12390

Accumulated

Depreciation

$ 35000

$ 17500

$11000

11000

Net Book Value

tA

GA

TA

57610

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College