Using the sources and your knowledge of US history, explain one reason why some people were critical of President Reagan’s economic policies in the 1980’s.

Using the sources and your knowledge of US history, explain one reason why some people were critical of President Reagan’s economic policies in the 1980’s.

Related questions

Question

Using the sources and your knowledge of US history, explain one reason why some people were critical of President Reagan’s economic policies in the 1980’s.

Transcribed Image Text:The "Background Information"

During the campaign of 1980, Ronald Reagan announced a recipe to fix the nation's economic mess. He claimed an undue tax burden, excessive

government regulation, and massive social spending programs hampered growth. Reagan proposed a phased 30% tax cut for the first three years of

his Presidency. The bulk of the cut would be concentrated at the upper income levels.

The idea was that tax relief for the rich would enable them to spend and invest more. This new spending would stimulate the economy and create

new jobs. Reagan believed that a tax cut of this nature would ultimately generate even more revenue for the federal government. The Congress was

not as sure as Reagan, but they did approve a 25% cut during Reagan's first term.

The results of this plan were mixed. Initially, the Federal Reserve Board believed the tax cut would re-ignite inflation and raise interest rates. This

sparked a deep recession in 1981 and 1982. Eventually, though, the economy stabilized in 1983, and the remaining years of Reagan's

administration showed national growth.

The defense industry boomed as well. Reagan insisted that the United States was vulnerable to the Soviet Union regarding nuclear defense.

Massive government spending contracts were awarded to defense firms to upgrade the nation's military. Reagan even proposed a space-based

missile defense system called the Strategic Defense Initiative (SDI). Scientists were dubious about the feasibility ofa laser-guided syste

that could

shoot down enemy missiles.

Economists disagreed over the achievements of "Reaganomics". Tax cuts plus increased military spending would cost the federal government

trillions of dollars. Reagan advocated paying for these expenses by slashing government domestic social spending programs such as Food Stamps,

Social Security and Disability Insurance. The results were skyrocketing deficits and the national debt tripled from one to three trillion dollars during

the Reagan years.

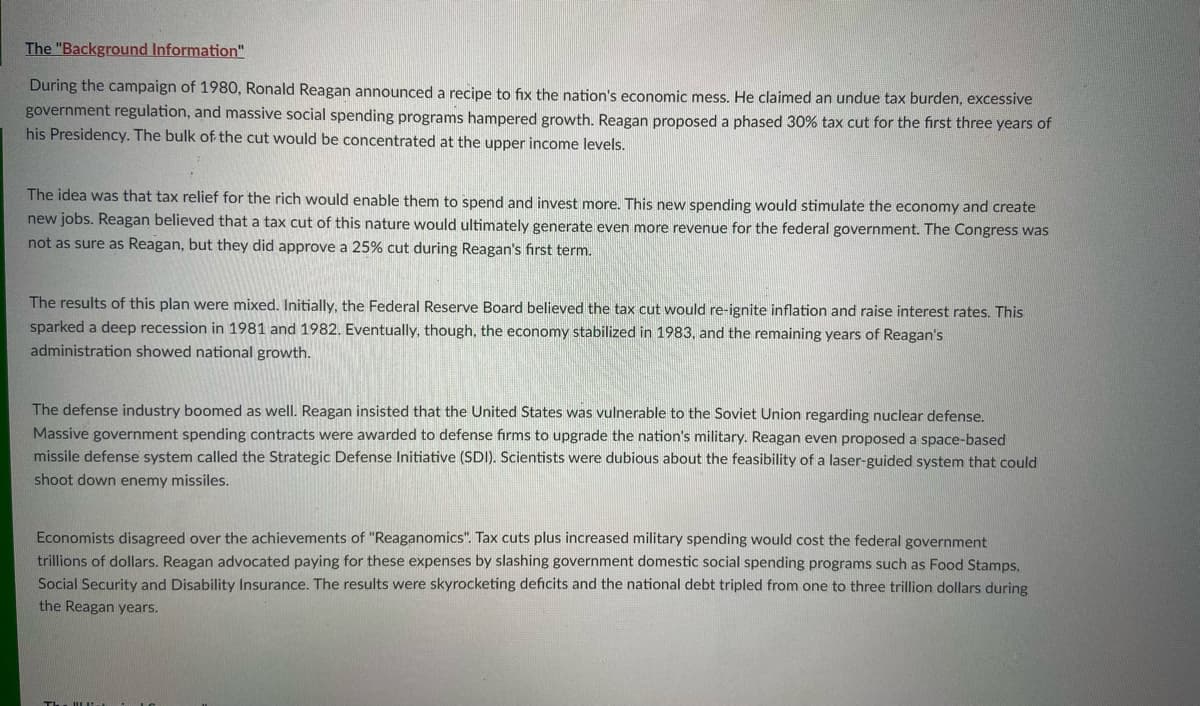

Transcribed Image Text:Source 1: Source 1: A political cartoon by Paul Conrad in the LA Times, 1982.

WELFARE CUTS

FOOD STAMP

CUTS

SCHOOL LUNCH

CUTS

LEGAL SERVICES

CUTS

MEDICARE CUTS

EDUCATIÓN CUTS

STUDENT LOAN

CUTS

JOB OPPORTUNITY

CUTS

SOCIAL SECURrTY

CUTS

AID TO CITES

CUTS

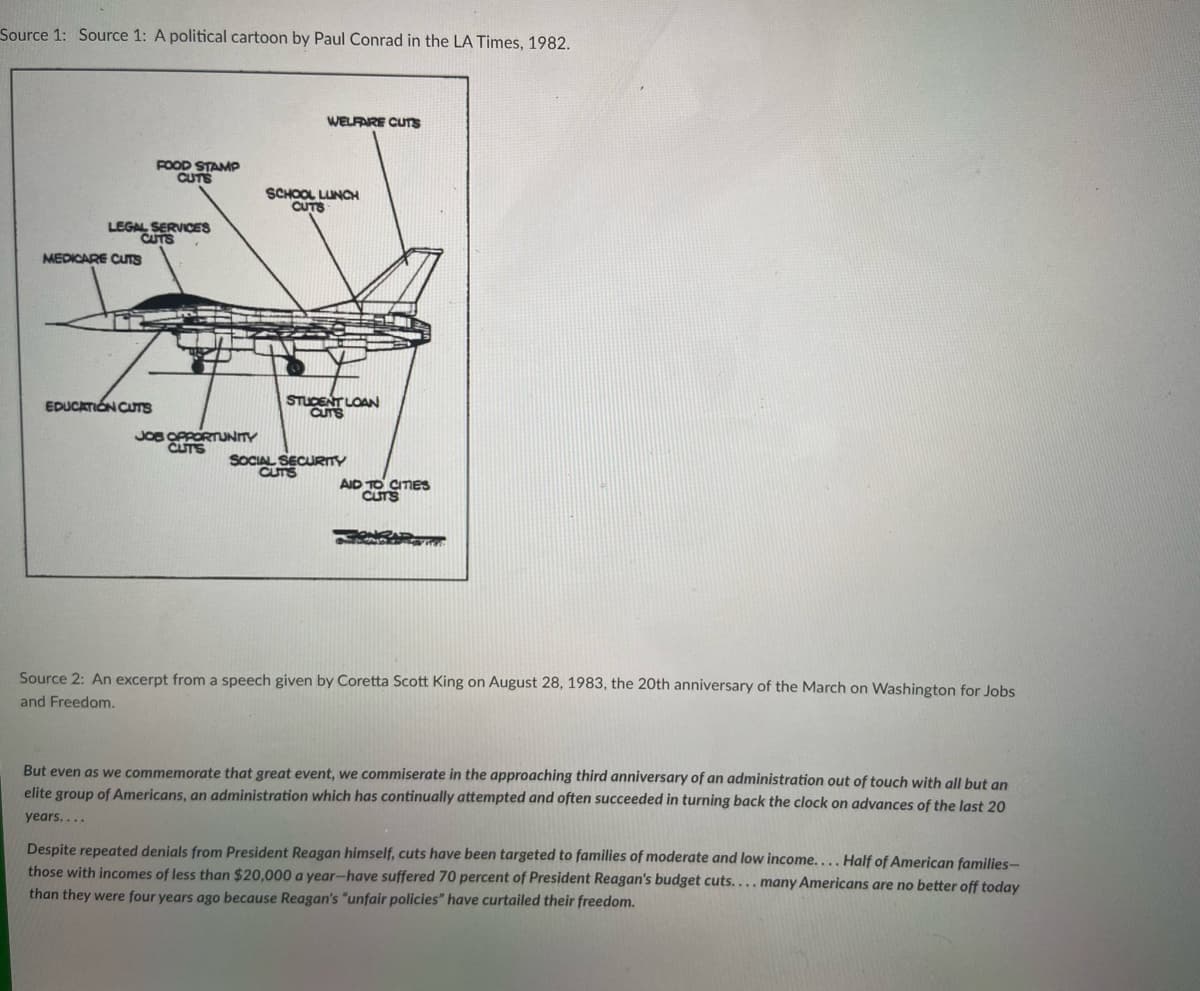

Source 2: An excerpt from a speech given by Coretta Scott King on August 28, 1983, the 20th anniversary of the March on Washington for Jobs

and Freedom.

But even as we commemorate that great event, we commiserate in the approaching third anniversary of an administration out of touch with all but an

elite group of Americans, an administration which has continually attempted and often succeeded in turning back the clock on advances of the last 20

years....

Despite repeated denials from President Reagan himself, cuts have been targeted to families of moderate and low income.... Half of American families-

those with incomes of less than $20,000 a year-have suffered 70 percent of President Reagan's budget cuts.... many Americans are no better off today

than they were four years ago because Reagan's "unfair policies" have curtailed their freedom.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps