Using the transactions attached and the Unadjusted trial balance please create a Statement of Retained Earnings

Using the transactions attached and the Unadjusted trial balance please create a Statement of Retained Earnings

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.10E

Related questions

Topic Video

Question

Using the transactions attached and the Unadjusted

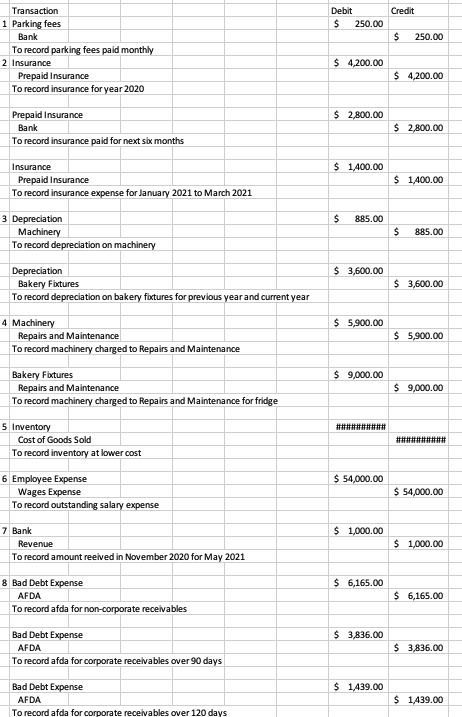

Transcribed Image Text:Transaction

Debit

Credit

1 Parking fees

250.00

Bank

250.00

To record parking fees paid monthly

2 Insurance

$ 4,200.00

Prepaid Insurance

$ 4,200.00

To record insurance for year 2020

Prepaid Insurance

$ 2,800.00

Bank

$ 2,800.00

To record insurance paid for next six months

Insurance

$ 1400.00

$ 1.400.00

Prepaid Insurance

To record insurance expense for January 2021 to March 2021

3 Depreciation

Machinery

To record depreciation on machinery

885.00

885.00

Depreciation

$ 3,600.00

Bakery Fixtures

To record depreciation on bakery fixtures for previous yearand current year

$ 3,600.00

$ 5,900.00

4 Machinery

Repairs and Maintenance

To record machinery charged to Repairs and Maintenance

$ 5,900.00

$ 9,000.00

Bakery Fixtures

Repairs and Maintenance

To record machinery charged to Repairs and Maintenance for fridge

$ 9,000.00

5 Inventory

Cost of Goods Sold

#### #

To record inventory at lower cost

6 Employee Expense

$ 54,000.00

$ 54,000.00

Wages Expense

To record outstanding salary expense

7 Bank

$ 1,000.00

Revenue

$ 1,000.00

To record amount reeived in November 2020 for May 2021

8 Bad Debt Expense

$ 6,165.00

AFDA

$ 6,165.00

To record afda for non-corporate receivables

Bad Debt Expense

$ 3,836.00

AFDA

$ 3,836.00

To record afda for corporate receivables over 90 days

Bad Debt Expense

$ 1439.00

AFDA

$ 1,439.00

To record afda for corporate receivables over 120 days

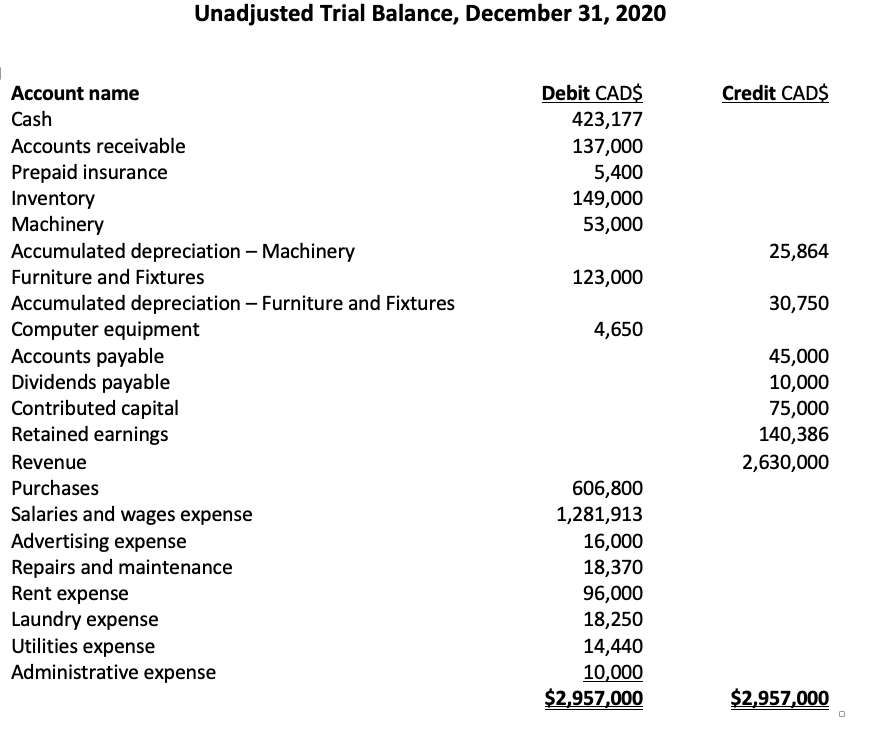

Transcribed Image Text:Unadjusted Trial Balance, December 31, 2020

Account name

Debit CAD$

Credit CADS

Cash

423,177

Accounts receivable

137,000

Prepaid insurance

Inventory

Machinery

Accumulated depreciation – Machinery

5,400

149,000

53,000

25,864

Furniture and Fixtures

123,000

Accumulated depreciation - Furniture and Fixtures

Computer equipment

Accounts payable

Dividends payable

Contributed capital

Retained earnings

30,750

4,650

45,000

10,000

75,000

140,386

Revenue

2,630,000

Purchases

606,800

Salaries and wages expense

Advertising expense

1,281,913

16,000

Repairs and maintenance

Rent expense

18,370

96,000

Laundry expense

Utilities expense

Administrative expense

18,250

14,440

10,000

$2,957,000

$2,957,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,