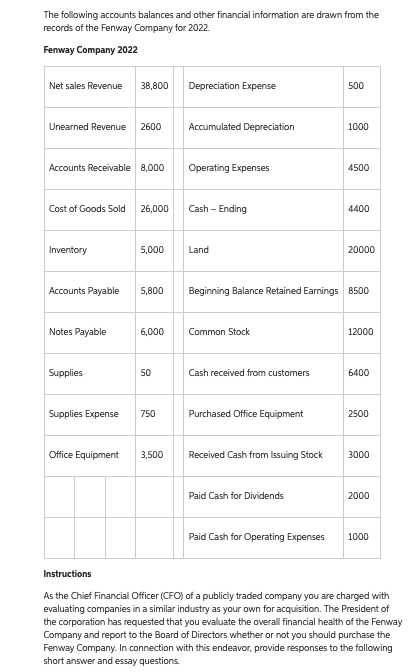

Using your knowledge from other business courses (e.g., Economics, Management, Marketing and Finance) provide three questions that one would ask the Fenway Company to consider in an acquisition decision in addition to the information.

Q: What should be your first priority when you become a team leader? a. Correct problems O b. Resolve…

A: Team leaders are the primary aspects of a business's success & are essential to motivating…

Q: Describe some common methods used in selecting human resources in the organization where you work.…

A: Note: The first part of the question is authored in a generalized manner without providing any…

Q: Which of the following statements accurately describe a 'stuck-in-the-middle' situation? Select one…

A: Note: “Since you have asked multiple question, we will solve the first question for you. If you want…

Q: what consequences can result from extremely high or low level of conflicts in the workplace ? how…

A: The consequences of extremely high or low levels of conflict in the workplace can have a significant…

Q: Discuss the accuracy of the following statement: Formal strategic planning is irrelevant for…

A: Formal strategic planning procedures are not the ideal when competing in high-technology industries…

Q: What do you mean by Conflict Mangement and its Types?

A: Conflict management is the body of techniques required to identify and handle conflict in the…

Q: How to improve customer focus in the workplace?

A: Customer focus refers to the strategies firms use to give customers' needs first priority in order…

Q: Discuss What are the basic management techniques for achieving coordination within the workplace ?

A: Introduction :- Coordination is the unification and integration of numerous operations for the…

Q: Break out the system's outputs, inputs, processes, performance, and controls.

A: Whether a system is basic or sophisticated, the outputs, inputs, process, performance, and controls…

Q: What issues did you want to solve when you started your Internet research? Is it conceivable to find…

A: When it comes to improving our lives, the internet can be an invaluable tool. From physical health…

Q: Corporate Social Responsibility (CSR) is very important for business activity. Discuss how is CSR…

A: Hi, as per our guidelines we are not authorized to provide references to the answer, hence providing…

Q: As a entreprenur, what are personal rewards that come with my business.

A: You can have both professional and personal independence when you run your own firm, including the…

Q: Discuss the significance of Organisation values.

A: An organization advances based on the principles and norms that serve as its compass. These hazy…

Q: identify the organizational development intervention techniques designed to affect the behavior of…

A: Introduction :- Organizational development intervention is an approach of management that aims to…

Q: Make a recommendation/ plans to improve the positive impacts of the business (Makati Shangri-La)

A: Note: As per the guidelines, the solution has been authored in a generalized manner. Makati…

Q: 18. A/An corporation has integrated worldwide operations through a centralized home office.

A: The legal position of a business is unique from that of its stockholders. Corporations share many of…

Q: Give some examples of companies that have used data to lead to discovery and innovation. In your own…

A: Note: A generalized solution has been provided to avoid any personal opinion as per our guidelines.…

Q: Every organization is made possible by: A. Free Movement of Services B. Free Movement of Goods…

A: A group of people who unite to accomplish a common objective is an organization. Most companies have…

Q: 20. An employee's right to be informed about an incident and be given a chance to improve is…

A: When you arrive at work, you like to feel at ease and protected, and you want to like what you do.…

Q: Give a valid explanation of why the change management strategies chosen in the hotel industry will…

A: INTRODUCTION: Change is a given in every company. Effective change management is necessary as a…

Q: It can be concluded that raising external capital to finance R&D activities, the implementation…

A: It is true that raising outside funding to support R&D initiatives, the adoption of cutting-edge…

Q: What is the importance of managing crisis in the hospitality sector.

A: Effective management increases economic output, which promotes human welfare. By preventing the…

Q: The SERVUCTION model consists of four factors that directly influence customers’ service experience.…

A: A framework for comprehending and controlling service delivery is the SERVUCTION model. It stands…

Q: What is the concern of competitive rivalry?

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Think of a Service or manufacturing organization of your choice and list down the main operations…

A: Within a company, roles, power, and duties are distributed and coordinated according to…

Q: A large number of projects either fail outright or are classified as challenged where they fail to…

A: Project failure is a phenomenon that can have serious implications for organizations. It can lead to…

Q: Question content area top Part 1 The reasons that make the study of International Business (IB)…

A: Business operations are being expanded across borders. In international business, firms start to…

Q: List what are the challenges that affect the quality of employee training?

A: Introduction :- Employee training is described as a structured series of actions for educating staff…

Q: Read the following scenarios, then answer the questions that follow. Situation 1 In the following…

A: A person who launches a business is called an entrepreneur. In addition to having a solid idea in…

Q: Lean and agile management in hotel industry

A: Introduction: Lean Management: In today's competitive world when companies and industries are…

Q: the

A: Entrepreneurs are the individuals who start new business by organizing capital, workforce and…

Q: How do Companies design a management plan for Risks?

A: The practice of identifying and reducing risks, hazards, and threats to a corporate operation,…

Q: Based on the information given in the image what's a media campaign possible solution that could…

A: Media Campaign is the planned activity which helps to achieve a particular goal in the society. It…

Q: The World Bank identifies 214 discrete economic environments in the world today—188 countries and 26…

A: In principle and in practice, each of these 214 business environments has radical cultural,…

Q: What are the challenges of defining culture and the role of geographic and historical forces shaping…

A: Culture is an ever-evolving and complex concept that is influenced by a variety of factors,…

Q: Please answer this - Why is management development management development one of the most common…

A: About Management - Management, is a type of concept, which is described or seen as a kind of…

Q: How might our particular tenure within an organization impact the way that we lead and manage…

A: INTRODUCTION: Change is a given in every company. Effective change management is necessary as a…

Q: 20. In Mass customization process there is Long runs, a standardized product from modules Large…

A: In the mass customization process, customers can customize products to their individual needs and…

Q: Define employee transfer and what are its benefits ?

A: Introduction :- Employee transfers are a type of horizontal mobility that involves changing the…

Q: Higher cohesiveness in a group leads to higher productivity . Discuss ?

A: Introduction :- Group cohesiveness in management is the degree to which a group or team is committed…

Q: What is the 90-day rule for human resource managers to keep talent on the job?

A: One of the most difficult yet crucial positions in the company is in the HR department. The success…

Q: Based on your own experiences as a computer, tablet, or smartphone user, how does Apple's strategy…

A: Note: This is a generalized answer. Competition is a given when one owns a business and is…

Q: What are ways our workforce are changing and what would be some hr implications of the chsnges

A: The business and operational environment of an organization may change frequently, which may have an…

Q: innovation

A: Innovation is the application of concepts in a way that results in the creation of new products or…

Q: Director of “We Care” hospital, want to apply for accrediting their healthcare facility. He knows…

A: Note: “The answer has been framed in a generalized manner.” Accreditation refers to a process…

Q: Critically analyse which frame of reference offers the most effective means of managing conflict…

A: For managers and leaders, resolving conflict within organizations is a crucial duty. Conflicts can…

Q: Discuss THREE (3) effects of job dissatisfaction on the education system in 2. Recommend TWO…

A: INTRODUCTION: In many workplaces, job unhappiness is a significant issue. It may result in low…

Q: The definition of scientific management Give three instances where the organization's core values…

A: Management coordinates an organization's efforts and resources to achieve objectives as effectively…

Q: How would one go about generating new concepts? In case you don't allow constructive criticism…

A: Introduction : Generating new concepts is an important part of creative problem solving. It is the…

Q: what is the reason for lowered motivation of employees in the organization in spite of taking care…

A: Any organization's performance depends heavily on employee motivation. Employees are more likely to…

6. Using your knowledge from other business courses (e.g., Economics, Management, Marketing and Finance) provide three questions that one would ask the Fenway Company to consider in an acquisition decision in addition to the information.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The state firefighters’ association has a membership of 15,000. The purpose of the organization is to provide some financial support to the families of deceased member firefighters and to organize a conference each year bringing together firefighters from all over the state. Annually, members are billed dues and calls. “Calls” are additional funds required to take care of payments made to the families of deceased members. The bookkeeping work for the association is handled by the elected treasurer, Bob Smith, although it is widely known that his wife, Laura, does all of the work. Bob runs unopposed each year at the election, since no one wants to take over the tedious and time consuming job of tracking memberships. Bob is paid a stipend of $8000 per year, but his wife spends well over 20 hours per week on the job. The organization, however, is not happy with their performance. A computer system is used to track the billing and receipt of funds. This system was developed in 1984 by a…During 2019, Susan incurred and paid the following expenses for Beth (her daughter), Ed (her father), and herself:Surgery for Beth $4,500Red River Academy charges for Beth:Tuition 5,100Room, board, and other expenses 4,800Psychiatric treatment 5,100Doctor bills for Ed 2,200Prescription drugs for Susan, Beth, and Ed 780Insulin for Ed 540Nonprescription drugs for Susan, Beth, and Ed 570Charges at Heartland Nursing Home for Ed:Medical care 5,000Lodging 2,700Meals 2,650 Beth qualifies as Susan’s dependent, and Ed would also qualify except that hereceives $7,400 of taxable retirement benefits from his former employer. Beth’s…Eastern Chemicals produces two types of lubricating fluids used in industrial manufacturing. Both products cost Eastern Chemicals $1 per gallon to produce. Based on an analysis of current inventory levels and outstanding orders for the next month, Eastern Chemicals’ management specified that at least 30 gallons of product 1 and at least 20 gallons of product 2 must be produced during the next two weeks. Management also stated that an existing inventory of highly perishable raw material required in the production of both fluids must be used within the next two weeks. The current inventory of the perishable raw material is 80 pounds. Although more of this raw material can be ordered if necessary, any of the current inventory that is not used within the next two weeks will spoil—hence, the management requirement that at least 80 pounds be used in the next two weeks. Furthermore, it is known that product 1 requires 1 pound of this perishable raw material per gallon and product 2 requires 2…

- Eastern Chemicals produces two types of lubricating fluids used in industrial manufacturing. Both products cost Eastern Chemicals $1 per gallon to produce. Based on an analysis of current inventory levels and outstanding orders for the next month, Eastern Chemicals’ management specified that at least 30 gallons of product 1 and at least 20 gallons of product 2 must be produced during the next two weeks. Management also stated that an existing inventory of highly perishable raw material required in the production of both fluids must be used within the next two weeks. The current inventory of the perishable raw material is 80 pounds. Although more of this raw material can be ordered if necessary, any of the current inventory that is not used within the next two weeks will spoil—hence, the management requirement that at least 80 pounds be used in the next two weeks. Furthermore, it is known that product 1 requires 1 pound of this perishable raw material per gallon and product 2 requires 2…A goldsmith makes two types of jewelry. A model A ring is made with 1 g of gold and 1.5 g of silver and sells for 25 UM.Another model B ring sells for 30 UM and is made of 1.5 g of gold and 1 g of silver. If you only have 750 gof each metal, how many rings should be made of each type to obtain maximum profit?Requested:- Make Initial Table of the problem.- Obtain the Case Variables- Obtain the Objective Function- Get Restrictions- Create the Simplex Table- Obtain the Optimal Solution and the Slack Variables.Solve this operational research exercise.Barlow Company manufactures three products—A, B, and C. The selling price, variable costs, and contribution margin for one unit of each product follow: Product A B C Selling price $ 180 $ 270 $ 240 Variable expenses: Direct materials 24 80 32 Other variable expenses 102 90 148 Total variable expenses 126 170 180 Contribution margin $ 54 $ 100 $ 60 Contribution margin ratio 30 % 37 % 25 % The same raw material is used in all three products. Barlow Company has only 6,000 pounds of raw material on hand and will not be able to obtain any more of it for several weeks due to a strike in its supplier’s plant. Management is trying to decide which product(s) to concentrate on next week in filling its backlog of orders. The material costs $8 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2.…

- The board of directors of General Wheels Company is considering seven large capital investments. Each investment can be made only once. These investments differ in the estimated long-run profit (net present value) that they will generate as well as in the amount of capital required, as shown by the following table. Investment Opportunity 1 2 3 4 5 6 7 Estimated Profit ($million) 17 10 15 19 7 13 9 Capital Required for Investment Opportunity ($million) Capital Available ($million) 1 2 3 4 5 6 7 Capital 43 28 34 48 17 32 23 100 The total amount of capital available for these investments is $100 million. Investment opportunities 1 and 2 are mutually exclusive, and so are 3 and 4. Furthermore, neither 3 nor 4 can be undertaken unless one of the first two opportunities is undertaken. There are no such restrictions on investment opportunities 5, 6, and 7. The objective is to select the combination of capital investments that will maximize the total estimated long-run…The cost data for Evencoat Paint for the year 2019 is as follows: Month Gallons ofPaintProduced EquipmentMaintenanceExpenses January 110,000 $70,700 February 68,000 66,800 March 71,000 67,000 April 77,000 68,100 May 95,000 69,200 June 101,000 70,300 July 125,000 70,400 August 95,000 68,900 September 95,000 69,500 October 89,000 68,600 November 128,000 72,800 December 122,000 71,450 A. Using the high-low method, express the company’s maintenance costs as an equation where x represents the gallons of paint produced. Then estimate the fixed and variable costs. Fixed cost $ Variable cost $Create spreadsheets and use Solver to determine the correct volumes to be produced to minimize cost for the following problem. Your company has two trucks that it wishes to use on a specific contract. One is a new truck the company is making payments on, and one is an old truck that is fully paid for. The new truck’s costs per mile are as follows: 54₵ (fuel/additives), 24₵ (truck payments), 36₵ (driver), 12₵ (repairs), and 1₵ (misc.). The old truck’s costs are 60₵ (fuel/additives), 0₵ (truck payments), 32₵ (rookie driver), 24₵ (repairs), and 1₵ (misc.). The company knows that truck breakdowns lose customers, so it has capped estimated repair costs at $14,000. The total distance involved is 90,000 miles (to be divided between the two trucks).

- Chiyeyeye Enterprises Ltd sells equestrian boots and has three brands: Riding boots, work boots and casual wear. Looking ahead to the financial year ending 31st may, 2022, the directors of Chiyeyeye Enterprises ltd are faced with a budget loss of ZMW 10 000. Product Riding Boots, work boots Casual Boot Number of units 1000 1000 1000 Sales (ZMW) 12 000 9 000 15 000 Fixed costs 5 000 5 000 7 000 Variable costs 5000 5 000 7 000 Profit 2000 (1000.00) 1000 Calculate the breakeven point for each product? Calculate contribution ratio for each product 3. Can Chiyeyeye close workbooks product line? ExplainDescribe the bounds, limitations, requirements, proportional relationships, and balance constraints: The International Chef, Inc., markets three blends of oriental tea: premium, Duke Grey, and breakfast. The firm uses tea leaves from India, China, and new domestic California sources. Net profit per pound for each blend is $0.50 for premium, $0.30 for Duke Grey, and $0.20 for breakfast. The firm’s regular weekly supplies are 20,000 pounds of Indian tea leaves, 22,000 pounds of Chinese tea leaves, and 16,000 pounds of California tea leaves.Edwards Manufacturing Company purchases two component parts from three different suppliers. The suppliers have limited capacity, and no one supplier can meet all the company’s needs. In addition, the suppliers charge different prices for the components. Component price data (in price per unit) are as follows: Supplier Component 1 2 3 1 $12 $12 $15 2 $11 $10 $12 Each supplier has a limited capacity in terms of the total number of components it can supply. However, as long as Edwards provides sufficient advance orders, each supplier can devote its capacity to component 1, component 2, or any combination of the two components, if the total number of units ordered is within its capacity. Supplier capacities are as follows: Supplier 1 2 3 Capacity 575 950 800 If the Edwards production plan for the next period includes 1050 units of component 1 and 775 units of component 2, what purchases do you recommend? That is, how many units of each component should be…