В. Determine the Interest Expense relat will be reported in P' Income Statement for 2020 would be. How much foreign Exchange Gain (l that would be reported in P Income Statem С. 21 2021

В. Determine the Interest Expense relat will be reported in P' Income Statement for 2020 would be. How much foreign Exchange Gain (l that would be reported in P Income Statem С. 21 2021

Chapter9: Taxation Of International Transactions

Section: Chapter Questions

Problem 28P

Related questions

Question

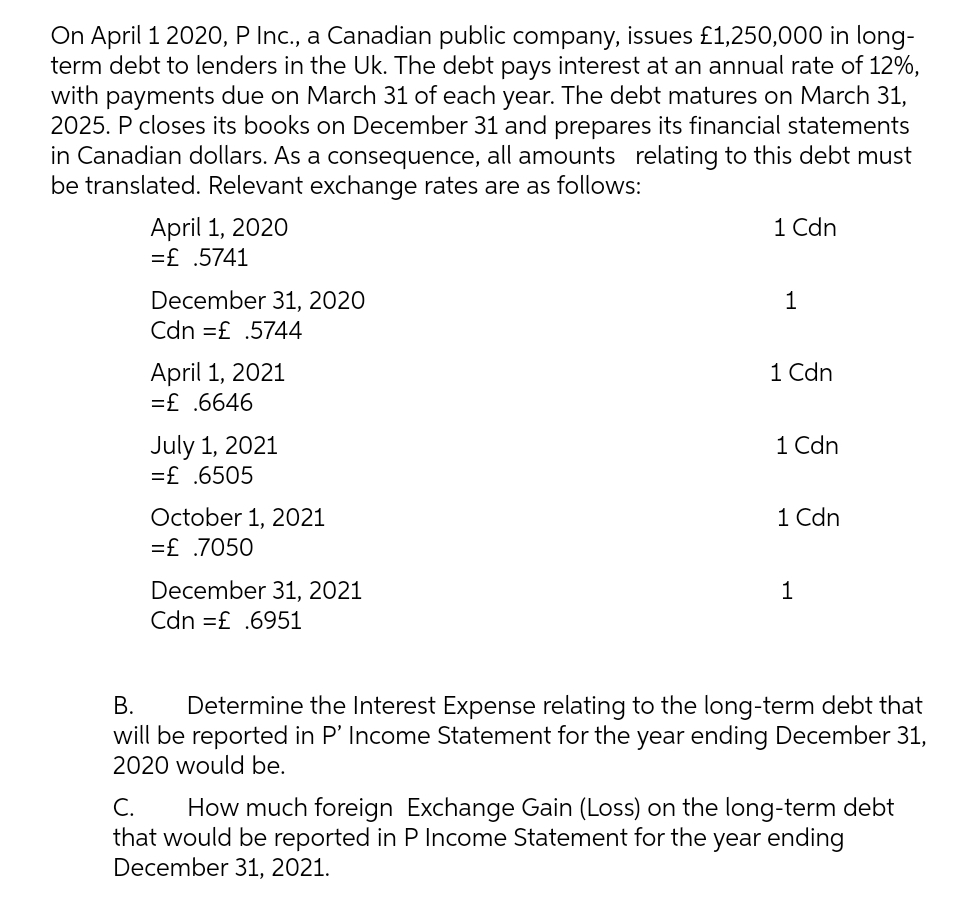

Transcribed Image Text:On April 1 202O, P Inc., a Canadian public company, issues £1,250,000 in long-

term debt to lenders in the Uk. The debt pays interest at an annual rate of 12%,

with payments due on March 31 of each year. The debt matures on March 31,

2025. P closes its books on December 31 and prepares its financial statements

in Canadian dollars. As a consequence, all amounts relating to this debt must

be translated. Relevant exchange rates are as follows:

1 Cdn

April 1, 2020

=£ .5741

December 31, 2020

Cdn =£ .5744

1

1 Cdn

April 1, 2021

=£ .6646

1 Cdn

July 1, 2021

=£ .6505

1 Cdn

October 1, 2021

=£ .7050

December 31, 2021

Cdn =£ .6951

1

В.

Determine the Interest Expense relating to the long-term debt that

will be reported in P' Income Statement for the year ending December 31,

2020 would be.

C.

How much foreign Exchange Gain (Loss) on the long-term debt

that would be reported in P Income Statement for the year ending

December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you