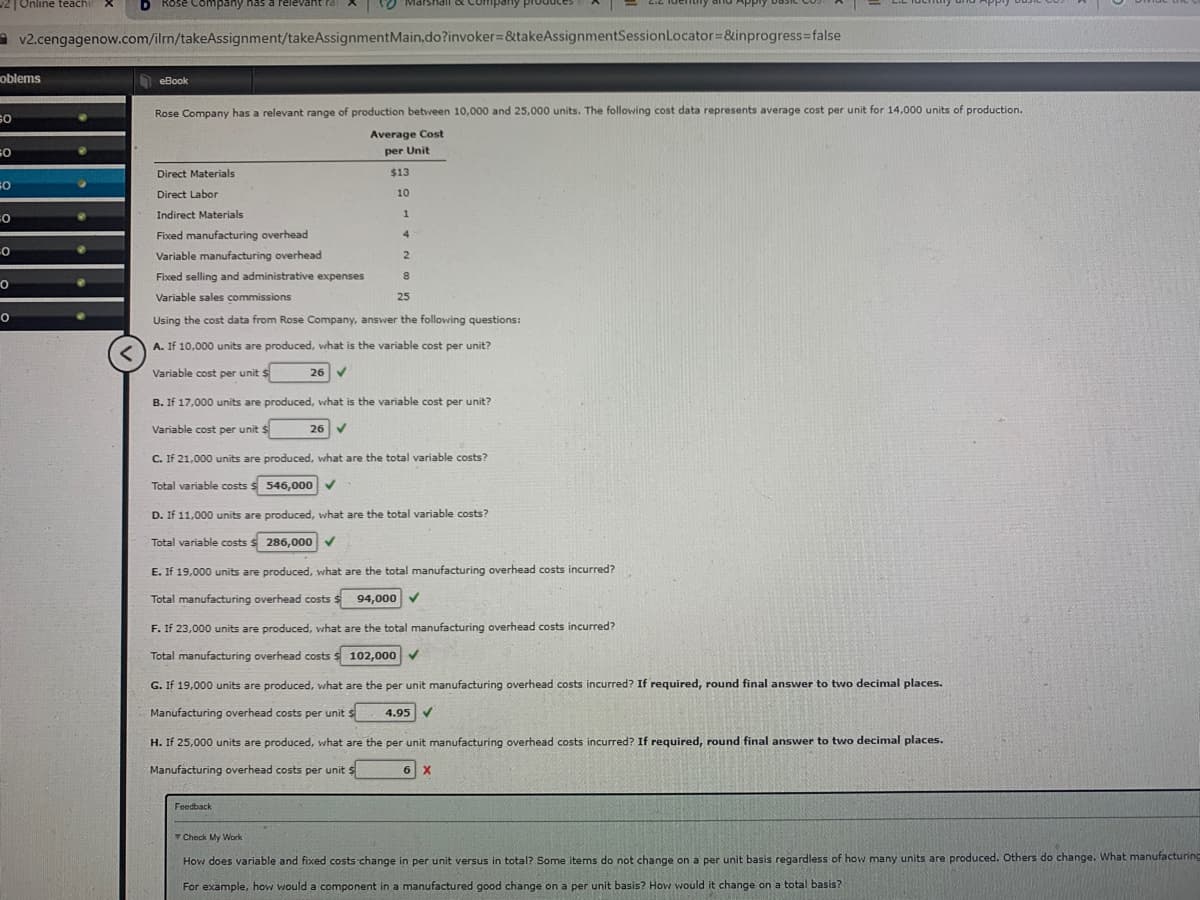

v2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain,do?invoker &takeAssignmentSessionLocator%38inprogress=false dems eBook Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data represents average cost per unit for 14,000 units of production. Average Cost per Unit Direct Materials %2413 Direct Labor 10 Indirect Materials 1. Fixed manufacturing overhead 4 Variable manufacturing overhead 2. Fixed selling and administrative expenses Variable sales commissions 25 Using the cost data from Rose Company, answer the following questions: A. If 10,000 units are produced, what is the variable cost per unit? Variable cost per unit s 26 V B. If 17,000 units are produced, what is the variable cost per unit? Variable cost per unit $ 26 V C. If 21,000 units are produced, what are the total variable costs? Total variable costs s 546,000 D. If 11,000 units are produced, what are the total variable costs? Total variable costs s 286,000 v E. If 19,000 units are produced, what are the total manufacturing overhead costs incurred? Total manufacturing overhead costs $ 94,000v F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred? Total manufacturing overhead costs s 102,000 G. If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If required, round final answer to two decimal places. Manufacturing overhead costs per unit s 4.95 V H. If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred? If required, round final answer to two decimal places. Manufacturing overhead costs per unit s 6 X Feedback Check My Work How does variable and fixed costs change in per unit versus in total? Some items do not change on a per unit basis regardless of how many units are produced. Others do change. What For example, how would a component in a manufactured good change on a per unit basis? How would it change on a total basis?

v2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain,do?invoker &takeAssignmentSessionLocator%38inprogress=false dems eBook Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data represents average cost per unit for 14,000 units of production. Average Cost per Unit Direct Materials %2413 Direct Labor 10 Indirect Materials 1. Fixed manufacturing overhead 4 Variable manufacturing overhead 2. Fixed selling and administrative expenses Variable sales commissions 25 Using the cost data from Rose Company, answer the following questions: A. If 10,000 units are produced, what is the variable cost per unit? Variable cost per unit s 26 V B. If 17,000 units are produced, what is the variable cost per unit? Variable cost per unit $ 26 V C. If 21,000 units are produced, what are the total variable costs? Total variable costs s 546,000 D. If 11,000 units are produced, what are the total variable costs? Total variable costs s 286,000 v E. If 19,000 units are produced, what are the total manufacturing overhead costs incurred? Total manufacturing overhead costs $ 94,000v F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred? Total manufacturing overhead costs s 102,000 G. If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If required, round final answer to two decimal places. Manufacturing overhead costs per unit s 4.95 V H. If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred? If required, round final answer to two decimal places. Manufacturing overhead costs per unit s 6 X Feedback Check My Work How does variable and fixed costs change in per unit versus in total? Some items do not change on a per unit basis regardless of how many units are produced. Others do change. What For example, how would a component in a manufactured good change on a per unit basis? How would it change on a total basis?

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 3.4C

Related questions

Question

Just need H, I’ve tried 6 as the answer and it was incorrect

Transcribed Image Text:2|Online teachi

D Rose Company has a relevant Pal

O Marshail oc Company produce

ldentily dnd Apply 0asic

A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false

oblems

eBook

so

Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data represents average cost per unit for 14,000 units of production.

Average Cost

per Unit

Direct Materials

$13

Direct Labor

10

Indirect Materials

Fixed manufacturing overhead

4

Variable manufacturing overhead

Fixed selling and administrative expenses

Variable sales commissions

25

Using the cost data from Rose Company, answer the following questions:

A. If 10,000 units are produced, what is the variable cost per unit?

Variable cost per unit $

26 V

B. If 17,000 units are produced, what is the variable cost per unit?

Variable cost per unit $

26 V

C. If 21,000 units are produced, what are the total variable costs?

Total variable costs $ 546,000

D. If 11,000 units are produced, what are the total variable costs?

Total variable costs s 286,000 v

E. If 19,000 units are produced, what are the total manufacturing overhead costs incurred?

Total manufacturing overhead costs $ 94,00o0 v

F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred?

Total manufacturing overhead costs s 102,000v

G. If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If required, round final answer to two decimal places.

Manufacturing overhead costs per unit s

4.95 V

H. If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred? If required, round final answer to two decimal places.

Manufacturing overhead costs per unit $

6 X

Feedback

Check My Work

How does variable and fixed costs change in per unit versus in total? Some items do not change on a per unit basis regardless of how many units are produced. Others do change. What manufacturing

For example, how would a component in a manufactured good change on a per unit basis? How would it change on a total basis?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning