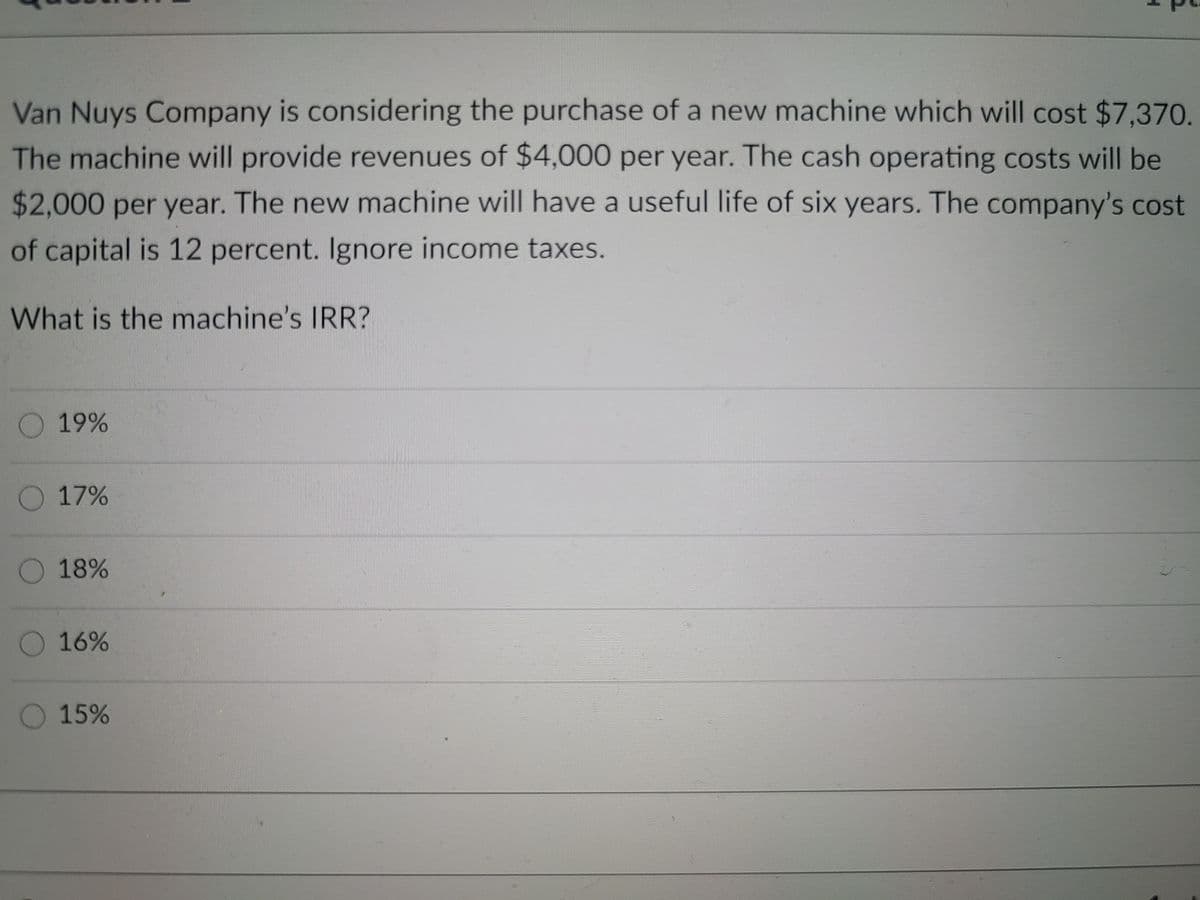

Van Nuys Company is considering the purchase of a new machine which will cost $7,370 The machine will provide revenues of $4,000 per year. The cash operating costs will be %242,000 per year. The new machine will have a useful life of six years. The company's cost of capital is 12 percent. Ignore income taxes. What is the machine's IRR?

Van Nuys Company is considering the purchase of a new machine which will cost $7,370 The machine will provide revenues of $4,000 per year. The cash operating costs will be %242,000 per year. The new machine will have a useful life of six years. The company's cost of capital is 12 percent. Ignore income taxes. What is the machine's IRR?

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 17PROB

Related questions

Question

100%

How would I calculate this? Any help please?

Transcribed Image Text:Van Nuys Company is considering the purchase of a new machine which will cost $7,370.

The machine will provide revenues of $4,000 per year. The cash operating costs will be

$2,000 per year. The new machine will have

a useful life of six years. The company's cost

of capital is 12 percent. Ignore income taxes.

What is the machine's IRR?

19%

17%

O 18%

O 16%

O15%

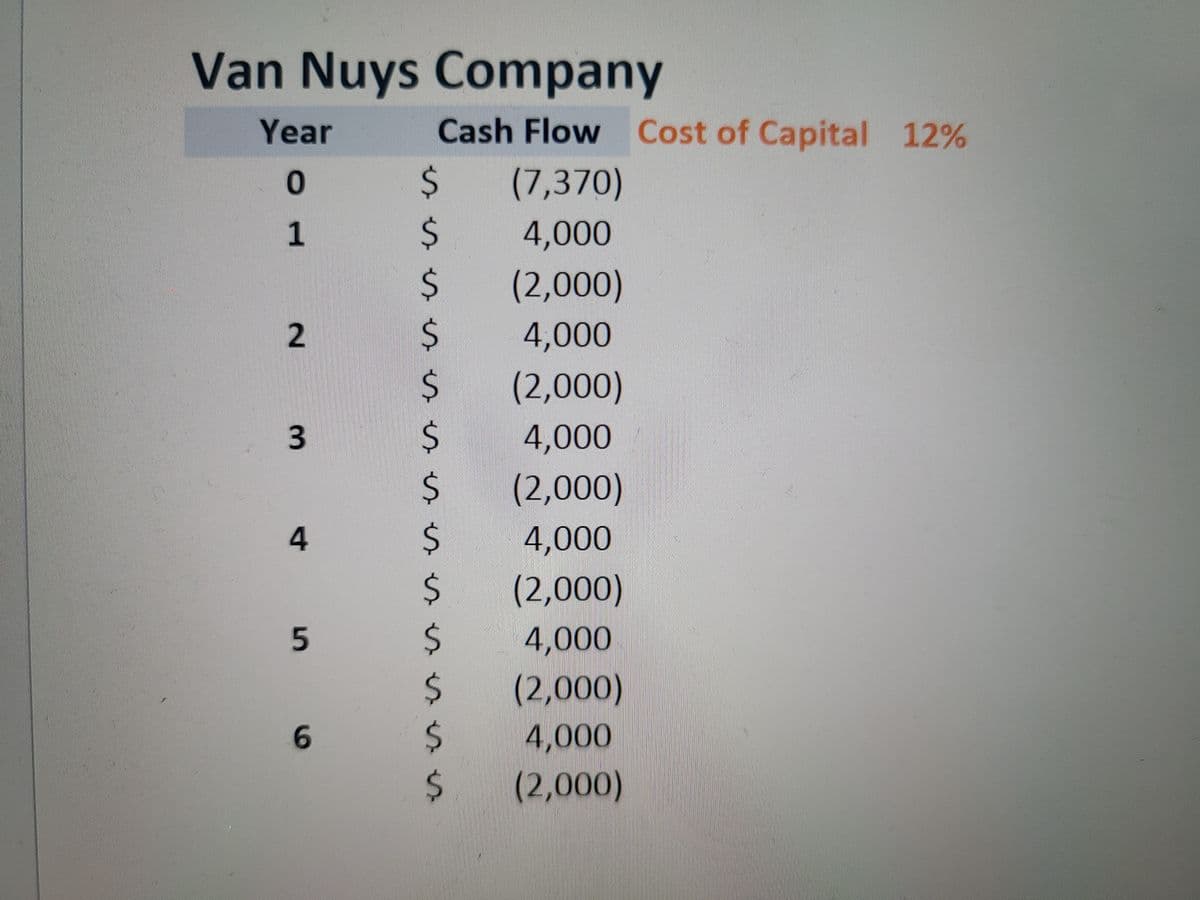

Transcribed Image Text:Van Nuys Company

Year

Cash Flow Cost of Capital 12%

2$

(7,370)

2$

4,000

24

(2,000)

24

4,000

24

(2,000)

24

4,000

24

(2,000)

24

4,000

24

(2,000)

24

4,000

24

(2,000)

24

4,000

2.

(2,000)

1.

2.

3.

4.

6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning