Vanderheiden Herrenhouse Press Publishing $ 100,000 $ 80,000 Current assets 120,000 $ 200,000 Fixed assets (net) 100,000 Total assets $ 200,000 $ 20,000 $ 80,000 Short-term debt Long-term debt 80,000 20,000 Common stock 50,000 50,000 Retained earnings 50,000 $ 200,000 50,000 Total liabilities and equity $ 200,000

Q: The Sunflower Corporation reported the following information from their financial statements:…

A: Dollar amount of taxes the firm had to pay to the taxation office is the amount that is applicable…

Q: A firm has total assets of $1 million and a debt ratio of 30%. Currently, it has sales of $2.5…

A: Working note:

Q: LSP. Co, recently reported $200,000 of sales during the year 2016. The company had $20,000 of…

A: We need to find net income in this question. Net income is what available for distribution to…

Q: The financial breakeven point of Soillnc. is P90,000,while the tax rate applicable to the company is…

A: The financial breakeven can be calculated by using this equation EBITFinBE =Interest cost +Preffered…

Q: TRY Co., a company with 25% tax rate, has a free cash flow of P150,000,000 for the next year and is…

A:

Q: Consider two firms, Go Debt corporation and No Debt corporation. Both firms are expected to have…

A: Given that: Earnings before Interest and Taxes = $100,000

Q: JP Inc. had the following information expressed in millions of $: 2019 2020 Net Fixed Assets 2,000…

A: We need to find FCF to calculate the Intrinsic value of the firm:FCF 2020=After tax operating…

Q: Tartan Industries currently has total capital equal to $4 million, haszero debt, is in the 40%…

A: Calculation of Current Price per share and Current Price per share after recapitalization: Excel…

Q: Chamin, Inc. has earnings before interest and taxes (EBIT) of $375,000. Chamin has interest expense…

A: The degree of financial leverage shows the effect of fixed financial costs on the earnings of the…

Q: XYZ anticipates earning $1,800,000 and paying $300,000 in dividends this year. XYZ's capital…

A: equity break point=retained earningfraction of equity

Q: Altamonte Telecommunications has a target capital structure that consists of 60% debt and 40%…

A: Given: Capital budgeting = $2,000,000 Net income = $1,300,000 Debt weight = 60% Equity weight = 40%

Q: Dahlia Colby, CFO of Charming Florist Ltd., has created the firm’s pro forma balance sheet for the…

A: Proforma balance sheet is the estimated or projected balance sheet for future period of time.

Q: he Duval Corporation has recently reported the following information: Net income…

A: Formulas:

Q: a. How much of the firm's market value is accounted for by the debt-generated tax shield? b. What…

A: Information Provided: Tax rate = 21% R(debt) = 7.6% R(equity) = 15.4% Borrowing rate = 7.6%

Q: For 2018, Gourmet Kitchen Products reported $22 million of sales and $19 millionof operating costs…

A: Economic value added is used to determine the financial position of the company based on its…

Q: ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding…

A: Yield to maturity refers to the internal rate of return which is earned by the investor who makes…

Q: echcrunch has an equity cost of capital of 10%, a cost of debt is 6%, and a debt to value ratio (D/V…

A: Value of a firm- In free cash flow valuation, the intrinsic value of a company equals the present…

Q: Blue Co., a company with 25% tax rate, has a free cash flow of P150,000,000 for the next year and is…

A: FCF1 = P 150,000,000 Growth rate (g) = 4% Debt to equity (D/E) = 0.25 Cost of debt = Rd = 5% Cost of…

Q: Mudvayne, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with…

A: Face value =$100 Coupon payment =8% semiannual Price =107 Years to MATURITY =18 years =36…

Q: How much free cash flow did the firm generate during the current year? Round your answer to the…

A: Information Provided: Tax rate = 35% Previous operating capital = $2100 Current operating capital =…

Q: Here are book- and market-value balance sheets of the United Frypan Company (figures in $ millions):…

A: The question is based on the concept of Corporate valuation

Q: Percy's Wholesale Supply has earnings before interest and taxes of €106,000. Both the book and the…

A: The weighted average cost of capital (WACC) refers to the average cost that is paid by a company to…

Q: PWC Inc. has a policy of distributing 30% of its current year income after interest and taxes. Which…

A: Company's earning after interest and taxes are divided into two parts i.e. dividend payout and…

Q: A firm has total assets of $1,000,000 and a debt ratio of 30 percent. Currently, it has sales of…

A: Return on equity (ROE):It is a profitability measure that is related with the firm's equity. It is…

Q: Alpha Resources has sales revenue of $800,000, operating costs of $400,000, and depreciation expense…

A: Sales = $800,000 Operating cost = $400,000 Depreciation = $20,000 Bonds = $300,000 Interest rate =…

Q: Sunrise, Incorporated, is trying to determine its cost of debt. The firm has a debt issue…

A: The weighted average capital cost (WACC) consists of the measurement of the capital price of the…

Q: ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding…

A: The question is based on the valuation of bond concept to find cost (yield) of bond.

Q: Green Office Supplies recently reported $15,500 of sales, $8,250 of operating costs other than…

A: As per the Guidelines, only first question should be answered. Since you have asked multiple…

Q: In the past year, TVG had revenues of $2.93 million, cost of goods sold of $2.43 million, and…

A: Time interest earned ratio This give the ability of firm to pay interest on debt regularly. Time…

Q: The Alpha Beta Company is attempting to establish a current assets policy. Fixed assets are…

A: ROE is a ratio which shows the relation between net earnings and firm’s equity. It shows how much…

Q: Packaging's ROE last year was only 4%, but its management has developed a new operating plan that…

A:

Q: What is the return on equity for each firm if the interest rate on current liabilities is 10% and…

A: Return on equity is a financial metric that helps in evaluating the profitability position of a…

Q: Nobleford Inc. is trying to determine its cost of debt. The firm has a debt issue outstanding with…

A: After tax cost of debt = Before tax cost of debt * (1-tax rate) Before tax cost of debt = YTM of the…

Q: XYZ anticipates eaming $1,800,000 and paying $300,000 in dividends this year. XYZ's capital…

A: Given:Anticipates earnings=$1800000Dividend=$300000Capital structure=20% debt and 80% equityTax…

Q: ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding…

A: Cost of Debt refers to cost incurred by an entity for having debt fund in capital structure.

Q: Viserion, Incorporated, is trying to determine its cost of debt. The firm has a debt issue…

A: Coupon rate is 6% Coupon frequency is semi annual Price of bond is 106% Face value is $1000 Time…

Q: The S&H construction company expects to have total sales next year totaling $15,300. In addition,…

A: Sales = 15,300 Tax Rate = 35% Interest Expense = 280,000 Cost of goods sold = 57% of Sales Operating…

Q: Dahlia Colby, CFO of Charming Florist Ltd., has created the firm's pro forma balance sheet for the…

A: The next year's sales are $330 million which has grown by 20 percent. So, the current year's sales…

Q: Here is the condensed 2015 balance sheet for Skye Computer Company (in thousands of dollars):…

A: Assuming Face Value= 1000 Tax Rate = 35℅ Coupon Rate = 10℅ Value of debt = 1051.11 Time period = 7…

Q: Sunrise, Incorporated, is trying to determine its cost of debt. The firm has a debt issue…

A: Given: Particulars Years 23 Coupon 5% Completed years 0 Current price 96% Par value…

Q: Viserion, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with…

A: Here; Annual coupon rate = 4% Par value = $1,000 Maturity = 16 years Tax rate = 25% To Find:…

Q: The 2020 balance sheet of Osaka’s Tennis Shop, Incorporated, showed long-term debt of $2.25 million,…

A: Cashflow means movement of cash in the firm. It can be positive or negative. Positive movement means…

Q: In 2020, ABC corporation had sales revenue of $313,500, operating costs of $275,750, and year-end…

A: Given:

Q: National Co. has a financial break-even point at P260,000. Th company paid an annual interest of…

A: Fianancial Break even point is the minimum level of EBIT needed to satisfy all the fixed financial…

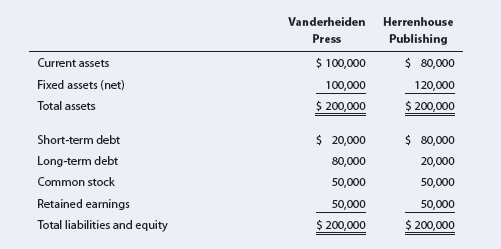

Vanderheiden Press Inc. and Herrenhouse Publishing

Company had the following balance sheets as of December 31, 2018 (thousands of dollars):

Earnings before interest and taxes for both firms are $30 million, and the effective federalplus-

state tax rate is 40%.

a. What is the

and the rate on long-term debt is 13%?

b. Assume that the short-term rate rises to 20%. Although the rate on new long-term debt

rises to 16%, the rate on existing long-term debt remains unchanged. What would be

the returns on equity for Vanderheiden Press and Herrenhouse Publishing under these

conditions?

c. Which company is in a riskier position? Why?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

- Brief ExerciseRatio Analysis Valiant Corporation has $1,800,000 in total liabilities, $800,000 of which arc current. Valiant has $400,000 of cash and cash equivalents, $300,000 of other current assets, and $2,000,000 in property, plant, and equipment. Required: Calculate Valiants debt to equity ratio.Current Assets P 1,375,000Property, plant and equipment 3,375,000Other non-current assets 500,000Total Assets P 5,250,000 Liabilities and Shareholders’ equity Total liabilities P 1,500,000Ordinary shares, P10 par value 4,000,000Additional paid in capital 750,000Deficit (1,000,000)Total liabilities and equity P 5,250,000The stockholders and creditors approved the quasi reorganization effective July 1,2011, to be accomplishedby a reduction in property, plant and equipment (net) P 875,000, a reduction in other non-current assets ofP375,000, and a reduction in par value from P10 to P51. Logan’s July 1 balan ce sheet after the quasi-reorganization should show total assets ofa. P 4,000,000b. P 2,500,000c. P 4,375,000d. P 3,875,0002. The balance in additional paid in capital after the quasi-reorganization on July 1 is:a. P 750,000b. P 2,000,000c. P 500,000d. P-0-3. Logan’s deficit after the quasi -reorganization on July 1,2011 should be:a. P 750,000b. P 250,000c.…Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…

- Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…Celloscope Ltd. Balance Sheet 31-Dec-19 Current Assets Cash 18000 Accounts Receivable 20000 Inventory 12000 Prepaid Insurance 600 Sub total 50600 Non-current Assets Land 80000 Building 60000 Less: Accumulated Depreciation 10,000 50000 Sub total 130000 Total Assets 180600 Current Liabilities Accounts payable 50000 Taxes Payable 8000 Sub total 58000 Non-Current Liabilities Bonds Payable (10%) 40000 40000 Owners’ Equity Share Capital 60000 Retained Earning 22600 Sub total 82600 Total Liabilities and Owners’ Equity 180600 The following are expected in the next 3 months January…Orbit Limited Statement of Financial Position as at 31 December: 2022 2021 R R ASSETS Non-current assets 11 810 000 7 560 000 Property, plant and equipment 10 025 000 6 250 000 Investments 1 785 000 1 310 000 Current assets 4 190 000 4 690 000 Inventories 1 875 000 2 350 000 Accounts receivable 1 925 000 2 200 000 Cash 390 000 140 000 Total assets 16 000 000 12 250 000 EQUITY AND LIABILITIES Equity ? ? Ordinary share capital 5 480 000 3 680 000 Retained earnings ? ? Non-current liabilities 4 500 000 3 800 000 Loan (20% p.a.) 4 500 000 3 800 000 Current liabilities 2 300 000 1 500 000 Accounts payable 2 300 000 1 500 000 Total equity and liabilities 16 000 000 12 250 000 Statement of Comprehensive Income for the year ended 31 December: 2022 2021 R R Sales 10 800 000 7 150 000 Cost of sales (6 000 000) (3 650 000) Gross profit 4 800 000 3 500 000 Operating expenses (1 800 000) (1 200 000) Depreciation 580 000 200 000…

- Orbit Limited : Statement of Financial Position as at 31 December 2022 2021 Non-current Assets R11 810 000 R7 560 000 Property, Plant, Equipment R10 025 000 R6 250 000 Investments R1 785 000 R1 310 000 Current Assets R4 190 000 R4 690 000 Inventories R 1 875 000 R2 350 000 Account Receivable R1 925 000 R2 200 000 Cash R390 000 R140 000 Toatal Assets R16 000 000 R12 250 000 Equities & Liabilities Equity ? ? Oridanary share capital R5 480 000 R3 680 000 Retained earnings ? ? Non-current Liabilities R4 500 000 R3 800 000 Loan (20% p.a) R4 500 000 R3 800 000 Current Liabilities R2 300 000 R1 500 000 Accounts payable? R2 300 000 R1 500 000 Calculate the increase in the retained earnings over the two-year period.Company A Company B Total Assets 250 million 300 million Debt (10%) 50 million 180 million Equity 200 million 120 million Calculate ROE of Company A and Company B when ROA for both of them is12% and 6% respectivelyPip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:a. Calculate the Goodwillb. Calculate the pricec. Record the purchase of the Pip Paw Patrol on the books of the BUYER, assume they issued100,000 shares of $2 par value common stock and paid $40,000 in legal and accounting fees and$50,000 in stock issuance costs to their broker.d. Record the sale of the company on the books of the seller.

- Pip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:a. Calculate the Goodwillb. Calculate the pricePip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:c. Record the purchase of the Pip Paw Patrol on the books of the BUYER, assume they issued100,000 shares of $2 par value common stock and paid $40,000 in legal and accounting fees and$50,000 in stock issuance costs to their broker.d. Record the sale of the company on the books of the sellerSandy Corporation’s balance sheet at January 2, 20x5 is as follows:Sandy-Dr(Cr)Cash and receivables P200,000,000Inventories 600,000,000.00Property, plant and equipment, net 7,500,000,000.00 Current liabilities (400,000,000.00)Long-term debt (7,200,000,000.00)Capital stock (7,200,000.00)Retained earnings (25,000,000.00)Accumulated othercomprehensive income (5,000,000.00) An analysis of Sandy’s assets and liabilities reveals that book values of some reported itemsdo not reflect their market values at the date of acquisition:● Inventories are overvalued by P200,000,000● Property, plant and equipment is overvalued by P2,000,000,000● Long-term debt is undervalued by P100,000,000 On January 2, 20x5, Velasco issues new stock with a market value of P700,000,000 toacquire the assets and liabilities of Sandy. Stock registration fees are P100,000,000, paid incash. Consulting, accounting, and legal fees connected with the merger are P150,000,000,paid in cash. In addition, Velasco enters into an…