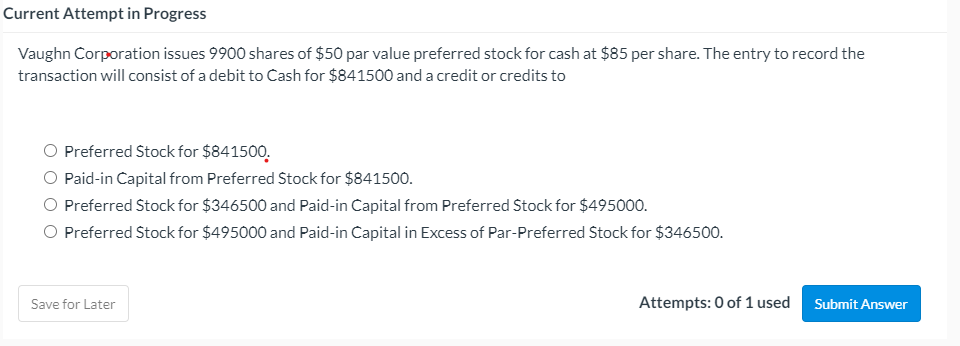

Vaughn Corporation issues 9900 shares of $50 par value preferred stock for cash at $85 per share. The entry to record the transaction will consist of a debit to Cash for $841500 and a credit or credits to O Preferred Stock for $841500. O Paid-in Capital from Preferred Stock for $841500. O Preferred Stock for $346500 and Paid-in Capital from Preferred Stock for $495000. O Preferred Stock for $495000 and Paid-in Capital in Excess of Par-Preferred Stock for $346500.

Q: Oriole Company has issued 2,500 shares of common stock and 500 shares of preferred stock for a lump…

A: Common stock and Preference stock are two types of stock or shares that is being issued by the…

Q: On January 1,2022, the stockholders equity section of concord corporation shows common stock ($5…

A: Treasury stock refers to a method used by the organization to repurchase the issued stock. It is…

Q: Swifty Corporation sold 310 shares of treasury stock for $35 per share. The cost for the shares was…

A: Treasury stock: Shares which are bought back by the company from the open market but not retired…

Q: If Swifty Corporation issues 3500 shares of $10 par value common stock for $351000, the account…

A: Common stock: These are the shares issued by a company to an outsider. These shares entitle a share…

Q: If Dakota Company issues 1,500 shares of $6 par common stock for $75,000, O Common Stock will be…

A: Lets understand the basics. Journal entry is required to make to record event and transaction that…

Q: A corporation originally issued $6 par value common stock for $11 per share. It purchased the stock…

A: Treasury stock refers to a method used by the organization to repurchase the issued stock. It is…

Q: Which of the following would be included in the entry to record the issuance of 7,000 shares of $4…

A: The firm can raise funds for the operation of the business. It can be from issuing common stock,…

Q: "XYZ, Inc. has 1000 shares treasury stock, sells 100 shares of JD 1 par value treasury stock at JD 8…

A: Treasury shares are those shares which are issued to public and then repurchased by the corporation.…

Q: Dexter Corporation purchased from its stockholders 4,000 shares of its own previously issued stock…

A: >Treasury stock are the shares that have been purchased by the original issuing company from its…

Q: If Marigold Company issues 8800 shares of $5 par value common stock for $160600, the account O Cash…

A: Given, Par value = $5 Total shares issued for $160,600 Number of shares issued = 8,800 shares

Q: International Co. issues 4,000 shares of its $5 par value common stock having a fair value of $25…

A: The different shares are issued at lump sum amount, then at can be allocated to different shares…

Q: Cempany was formed on January 1, 2020 and the following transactions occurred du O: uary 1: Issued…

A: Journal entries (all amount in $) January 1. Bank. A/c Dr 130000 To…

Q: Stockholders' Equity section of the Balance Sheet

A: Stockholders' equity is the worth of what business owes to stockholders.

Q: Prepare the journal entry to record Autumn Company's issuance of 63,000 shares of no-par value…

A: Issue of Shares: In business, the issuance of shares refers to the process through which companies…

Q: Before Pronghorn Corporation engages in the following treasury stock transactions, its general…

A: Sno Account Titles and Explanation Debit Credit A Treasury Stock (370 shares X $ 40 per…

Q: Bentiey Corporation received cash from issuing 12,000 shares of common stock at par on January 1,…

A: Issue of common stock is one of the ways in which the companies can raise funds for financing the…

Q: 30. The market price of each ordinary share is 27 on October 1, 24 pesos on October 30 and 35 pesos…

A: Journal entry: Journal entry is the book of original entry where first transactions are recorded in…

Q: Concord, Inc. issued 9800 shares of stock at a stated value of $7/share. The total issue of stock…

A: Given, Stated value = $7 per share Issue price = $12 per share Number of shares issued = 9,800…

Q: Columbia Clay, Inc. issues 1.18 million shares of preferred stock with a par value of $11.00 at its…

A: It is pertinent to note that when preferred stock is issued at a premium then the journal entry…

Q: Huxley Company has 239699 shares of common stock authorized, 190997 issued, and 57975 shares of…

A: Dividend paid = No. of shares issued and outstanding x Dividend per share where, No. of shares…

Q: Coronado Industries has issued 1,500 shares of common stock and 300 shares of preferred stock for a…

A: The issue price of the stock could be issued at par, premium or discount. If the proceed from…

Q: Asuoba Plc has issued 500,000 equity shares at GHc5.80 per share. All shares were subscribed and…

A: Share issue is a process through which an entity offer shares in the exchange of money received from…

Q: Watson Corporation is authorized to issue 7,500 shares of $100 par value, 6%, cumulative preferred…

A: Dividend is the part or share of profits being distributed to the shareholders. It is being paid to…

Q: Villarama Corporation was organized on Jan. 1, 2018. It is authorized to issue shares of 6%, P50 par…

A: 1) Journal Entry Date Particulars Debit Credit Jan. 10 Cash (10000 * 35) 350000…

Q: Dave Matthew Inc. issues 500 shares of $10 par value common stock and 100 shares of $100 par value…

A: Requirement a: Pass necessary journal entry to record the issuance of common stock and preferred…

Q: Facturanan Corporation was organized on Jan. 1, 202x. It is authorized to issue 20,000 shares of 6%,…

A: Share capital issue is the main source of raising the equity needed by an organization to carry out…

Q: Prepare the journal entry to record Jevonte Company’s issuance of 36,000 shares of its common stock…

A: Journal entry: It is a systematic record of a financial transaction of an organization recorded in…

Q: The Snow Corporation issues 9,900 shares of $54 par value preferred stock for cash at $62 per share.…

A: Whenever the preferred stock shares are issued at premium i.e above their par value, the par value…

Q: The following accounts are found in the trial balance of Dawn Corporation as December 31, 2019.…

A: Authorized share capital means the amount which the company can legally issued. Issued share capital…

Q: ABC Corporation issues 5,000 ordinary shares with a $50 par value for cash at $55 per share. The…

A: At the time of issue of shares, any amount received over and above par value of shares is known as…

Q: Prepare the journal entry to record Jevonte Company's issuance of 36,000 shares of its common stock…

A: Solution: When common stock are issued for cash, cash is debited for issue price and common stock is…

Q: The charter of Zion Associates provides for the issuance of 100,000 shares of common stock. Assume…

A: The charter shows the authorized number of shares which in this case is 100000 shares. Subsequently…

Q: Concord Corporation has the following shareholders'equity on December 31, 2021: Shareholders' equity…

A: Journal entries are the building blocks of accounting, which is the act of recording the economic…

Q: The Sneed Corporation issues 12,700 shares of $46 par preferred stock for cash at $63 per share. The…

A: The organization can raise funds for the operation by issuing common stock, preferred stock for…

Q: Villarama Corporation

A: Share Capital section of shareholders equity shows total amount attributable to the shareholders of…

Q: Sunland Corporation was organized on January 1, 2022. It is authorized to issue 9,600 shares of 8%,…

A: The journal keeps the record for day to day transactions of the business on regular basis.

Q: BFAR Corp. was formed on June 1 with 100,000 authorized shares having a par value of P20. The…

A: when company issue share capital and shares to the shareholders there received application allotment…

Q: The Snow Corporation issues 9,800 shares of $52 par value preferred stock for cash at $66 per share.…

A: Definition: Preferred stock: The stock that provides a fixed amount of return (dividend) to its…

Q: Tropical Rainwear issues 2,000 shares of its $16 par value preferred stock for cash at $18 per…

A: If common stock or preference stock is issued at premium then the journal entry comprises of credit…

Q: Llewelyn Company purchased 1,800 shares of its own $6 par value common stock when the market price…

A: Buyback of own shares: Sometimes company repurchases its own stock shares from the market to improve…

Q: Sheffield Corp. issues 8,500 shares of $100 par value preferred stock for cash at $106 per share.…

A: Additional paid in capital = (Issue price per share - face value per share)*No. of shares issued =…

Q: hester Inc. issued shares of its $6.60 par value common stock for $17.00 per share. In recording the…

A: SOLUTION- SHARES MEANS A COMPANY'S CAPITAL IS DIVIDED IN TO SMALL UNITS OF A FINITE NUMBER .EACH…

Q: Sneed Corporation issues 11,700 shares of $55 par preferred stock for cash at $60 per share. The…

A: Stocks: Stocks are shares in the ownership of the company. It represents the capital raised by a…

Q: Taylor Corporation issues 20,000 shares of $50 par value preferred stock for cash at $90 per share.…

A: Issue price of preferred stock=Number of Shares×Issue price=20,000×$90=$1,800,000

Q: The Sneed Corporation issues 10,000 shares of $50 par preferred stock for cash at $75 per share. The…

A: Cash received = 10,000 x $75 = $750,000 Preferred stock = 10,000 x $50 = $500,000 Excess = 10,000 x…

Q: The Sneed Corporation issues 10,000 shares of $50 par preferred stock for cash at $62 per share. The…

A: Cash received = 10,000 shares x $62 = $620,000 Par value per share = $50 Paid in capital in excess…

Q: Ravonette Corporation issued 300 shares of $10 par value common stock and 100 shares of $50 par…

A: Total market value of Common Stock = No. of shares x Market value per share = 300 shares x $20 per…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Prepare general journal entries for the following transactions of GOTE Company: (a) Received subscriptions for 10,000 shares of 2 par common stock for 80,000. (b) Received payment of 30,000 on the stock subscription in transaction (a). (c) Received the balance in full for the stock subscription in transaction (a) and issued the stock. (d) Purchased 1,000 shares of its own 2 par common stock for 7.50 a share. (e) Sold 500 shares of the stock on transaction (d) for 8.50 a share.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.

- Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. (a)Received 20,000 for the balance due on subscriptions for preferred stock with a par value of 40,000 and issued the stock. (b)Purchased 10,000 shares of common treasury stock for 18 per share. (c)Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d)Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e)Sold 5,000 shares of common treasury stock for Si00,000. (f)Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g)Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Issuances of Stock Cada Corporation is authorized to issue 10,000 shares of 100 par, convertible, callable preferred stock and 80,000 shares of no-par, no-stated value common stock. There are currently 7,000 shares of preferred and 30,000 shares of common stock outstanding. The following are several alternative transactions: 1. Purchased land by issuing 640 shares of preferred stock and 1,000 shares of common stock. Preferred and common are currently selling at 113 and 36 per share, respectively, No reliable appraisal of the land is available. 2. Same as Transaction 1, except that land is appraised at 104,000, and the preferred stock has no current market value. 3. Issued, for 99,000 cash, a combination of 400 shares of preferred stock and bonds payable with a face value of 50,000. Currently, the preferred stock is selling for 120 per share and the bonds at 104. 4. Same as Transaction 3, except that the bonds do not have a current market value. 5. Same as Transaction 3, except that the preferred stock does not have a current market value. 6. Preferred shareholders (who had originally paid the corporation 110 per share for their stock) convert 6,500 preferred shares into 19,500 shares of common stock. The current market prices of the preferred stock and the common stock are 120 and 41 per share, respectively. 7. The corporation calls the 7,000 shares of preferred stock (originally issued at 110 per share) at 123 per share. Common stock is currently selling for 42 per share. Shareholders elect not to convert into common stock. 8. Same as Transaction 7, except that shareholders owning 2,000 shares of preferred stock elect to convert each share into 3 shares of common stock The remaining 5,000 preferred shares are retired. Required: Next Level Prepare the journal entry necessary to record each transaction. Below each entry, explain your reason for the values used.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.A corporation issued 100 shares of $100 par value preferred stock for $150 per share. The resulting journal entry would include which of the following? A. a credit to common stock B. a credit to cash C. a debit to paid-in capital in excess of preferred stock D. a debit to cash

- Sun Corporation issues 500 shares of 8 par common stock for a patent. The stock is currently selling for 37 per share on the open market, and no significant impact on the market price is expected by the issuance of the additional shares. Prepare the journal entry to record this transaction.STOCK SUBSCRIPTIONS Juneau Associates had the following stock transactions during the year: (a) Received subscriptions for 100,000 shares of 1 par common stock for 105,000. (b) Received subscriptions for 5,000 shares of 15 par, 8% preferred stock for 80,000. (c) Received a payment of 55,000 on the common stock subscription. (d) Received a payment of 40,000 on the preferred stock subscription. (e) Issued 40,000 shares of 1 par common stock in exchange for a truck with a fair market value of 48,000. (f) Received the balance in full for the common stock subscription and issued the stock. (g) Received the balance in full for the preferred stock subscription and issued the stock. REQUIRED Prepare general journal entries for these transactions, identifying each by letter.Winona Company began 2019 with 10,000 shares of 10 par common stock and 2,000 shares of 9.4%, 100 par, convertible preferred stock outstanding. On April 2 and June 1, respectively, the company issued 2,000 and 6,000 additional shares of common stock. On November 16, Winona declared a 2-for-1 stock split. The preferred stock was issued in 2018. Each share of preferred stock is currently convertible into 4 shares of common stock. To date, no preferred stock has been converted. Current dividends have been paid on both preferred and common stock. Net income after taxes for 2019 totaled 109,800. The company is subject to a 30% income tax rate. The common stock sold at an average market price of 24 per share during 2019. Required: 1. Prepare supporting calculations for Winona and compute its: a. basic earnings per share b. diluted earnings per share 2. Show how Winona would report the earnings per share on its 2019 income statement. Include an accompanying note to the financial statements. 3. Next Level Assume Winona uses IFRS. Discuss what Winona would do differently for computing earnings per share, and then repeat Requirement 1 under IFRS.