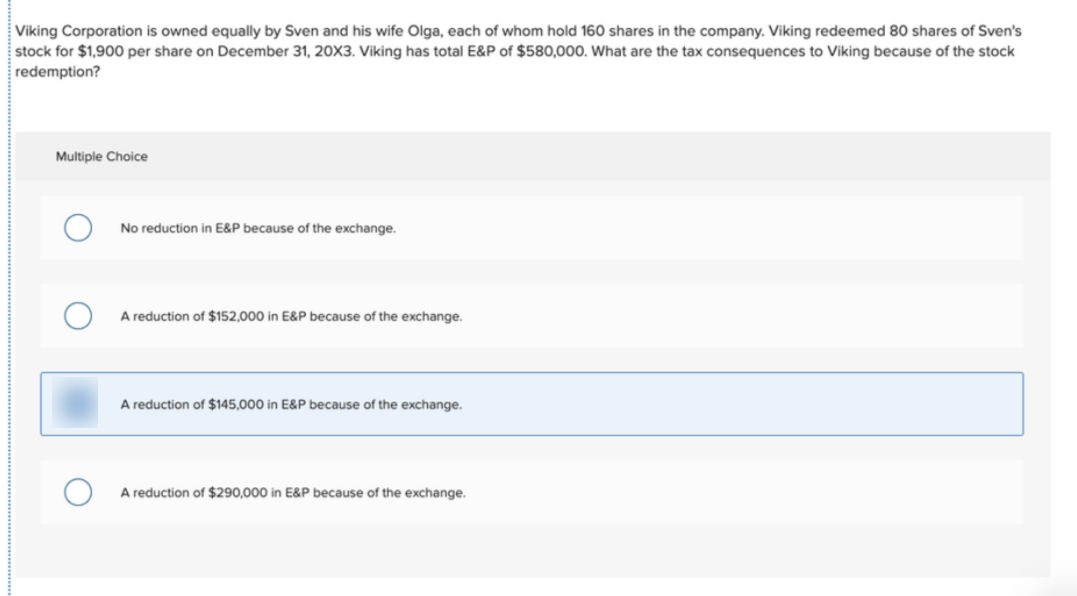

Viking Corporation is owned equally by Sven and his wife Olga, each of whom hold 160 shares in the company. Viking redeemed 80 shares of Sven's stock for $1,900 per share on December 31, 20X3. Viking has total E&P of $580,000. What are the tax consequences to Viking because of the stock redemption? Multiple Choice No reduction in E&P because of the exchange. A reduction of $152,000 in E&P because of the exchange. A reduction of $145,000 in E&P because of the exchange. A reduction of $290,000 in E&P because of the exchange.

Viking Corporation is owned equally by Sven and his wife Olga, each of whom hold 160 shares in the company. Viking redeemed 80 shares of Sven's stock for $1,900 per share on December 31, 20X3. Viking has total E&P of $580,000. What are the tax consequences to Viking because of the stock redemption? Multiple Choice No reduction in E&P because of the exchange. A reduction of $152,000 in E&P because of the exchange. A reduction of $145,000 in E&P because of the exchange. A reduction of $290,000 in E&P because of the exchange.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:Viking Corporation is owned equally by Sven and his wife Olga, each of whom hold 160 shares in the company. Viking redeemed 80 shares of Sven's

stock for $1,900 per share on December 31, 20X3. Viking has total E&P of $580,000. What are the tax consequences to Viking because of the stock

redemption?

Multiple Choice

No reduction in E&P because of the exchange.

A reduction of $152,000 in E&P because of the exchange.

A reduction of $145,000 in E&P because of the exchange.

A reduction of $290,000 in E&P because of the exchange.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you