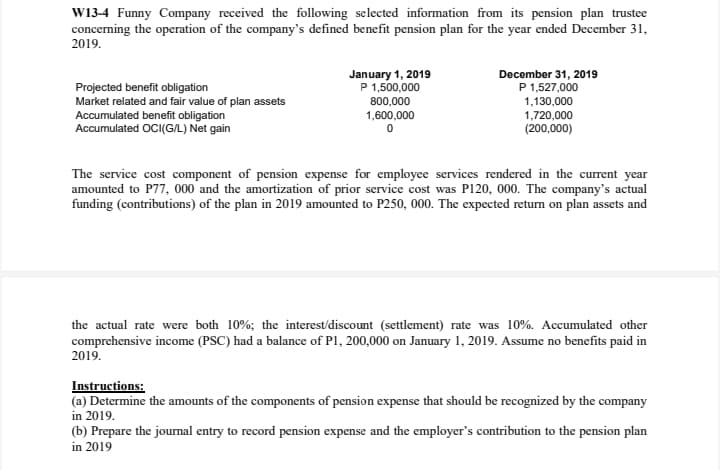

W13-4 Funny Company received the following selected information from its pension plan trustee concerning the operation of the company's defined benefit pension plan for the year ended December 31, 2019. January 1, 2019 P 1,500,000 December 31, 2019 P 1,527,000 Projected benefit obligation Market related and fair value of plan assets Accumulated benefit obligation Accumulated OCI(G/L) Net gain 800,000 1,600,000 1,130,000 1,720,000 (200,000) The service cost component of pension expense for employee services rendered in the current year amounted to P77, 000 and the amortization of prior service cost was PI20, 000. The company's actual funding (contributions) of the plan in 2019 amounted to P250, 000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of PI, 200,000 on January 1, 2019. Assume no benefits paid in 2019. Instructions: (a) Determine the amounts of the components of pension expense that should be recognized by the company in 2019. (b) Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2019

W13-4 Funny Company received the following selected information from its pension plan trustee concerning the operation of the company's defined benefit pension plan for the year ended December 31, 2019. January 1, 2019 P 1,500,000 December 31, 2019 P 1,527,000 Projected benefit obligation Market related and fair value of plan assets Accumulated benefit obligation Accumulated OCI(G/L) Net gain 800,000 1,600,000 1,130,000 1,720,000 (200,000) The service cost component of pension expense for employee services rendered in the current year amounted to P77, 000 and the amortization of prior service cost was PI20, 000. The company's actual funding (contributions) of the plan in 2019 amounted to P250, 000. The expected return on plan assets and the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other comprehensive income (PSC) had a balance of PI, 200,000 on January 1, 2019. Assume no benefits paid in 2019. Instructions: (a) Determine the amounts of the components of pension expense that should be recognized by the company in 2019. (b) Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2019

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 12E

Related questions

Question

Transcribed Image Text:W13-4 Funny Company received the following selected information from its pension plan trustee

concerning the operation of the company's defined benefit pension plan for the year ended December 31,

2019.

January 1, 2019

P 1,500,000

December 31, 2019

P 1,527,000

Projected benefit obligation

Market related and fair value of plan assets

Accumulated benefit obligation

Accumulated OCI(G/L) Net gain

800,000

1,130,000

1,600,000

1,720,000

(200,000)

The service cost component of pension expense for employee services rendered in the current year

amounted to P77, 000 and the amortization of prior service cost was P120, 000. The company's actual

funding (contributions) of the plan in 2019 amounted to P250, 000. The expected return on plan assets and

the actual rate were both 10%; the interest/discount (settlement) rate was 10%. Accumulated other

comprehensive income (PSC) had a balance of Pl, 200,000 on January 1, 2019. Assume no benefits paid in

2019.

Instructions:

(a) Determine the amounts of the components of pension expense that should be recognized by the company

in 2019.

(b) Prepare the journmal entry to record pension expense and the employer's contribution to the pension plan

in 2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning