WACC Weights BetterPie Industries has 3 million shares of common stock out- standing, 2 million shares of preferred stock outstanding, and 10,000 bonds. If the common shares are selling for $47 per share, the preferred shares are selling fo $24.50 per share, and the bonds are selling for 99 percent of par, what would be the weights used in the calculation of BetterPie's WACC? (LG11-4)

WACC Weights BetterPie Industries has 3 million shares of common stock out- standing, 2 million shares of preferred stock outstanding, and 10,000 bonds. If the common shares are selling for $47 per share, the preferred shares are selling fo $24.50 per share, and the bonds are selling for 99 percent of par, what would be the weights used in the calculation of BetterPie's WACC? (LG11-4)

Chapter3: The Financial Environment: Markets, Institutions And Investment Banking

Section: Chapter Questions

Problem 20PROB

Related questions

Question

100%

11-21 weight of bonds =5%

11-25 project A actual required return is 7.5%

Transcribed Image Text:11-21 WACC Weights BetterPie Industries has 3 million shares of common stock out-

standing, 2 million shares of preferred stock outstanding, and 10,000 bonds. If the

common shares are selling for $47 per share, the preferred shares are selling for

$24.50 per share, and the bonds are selling for 99 percent of par, what would be the

weights used in the calculation of BetterPie's WACC? (LG11-4)

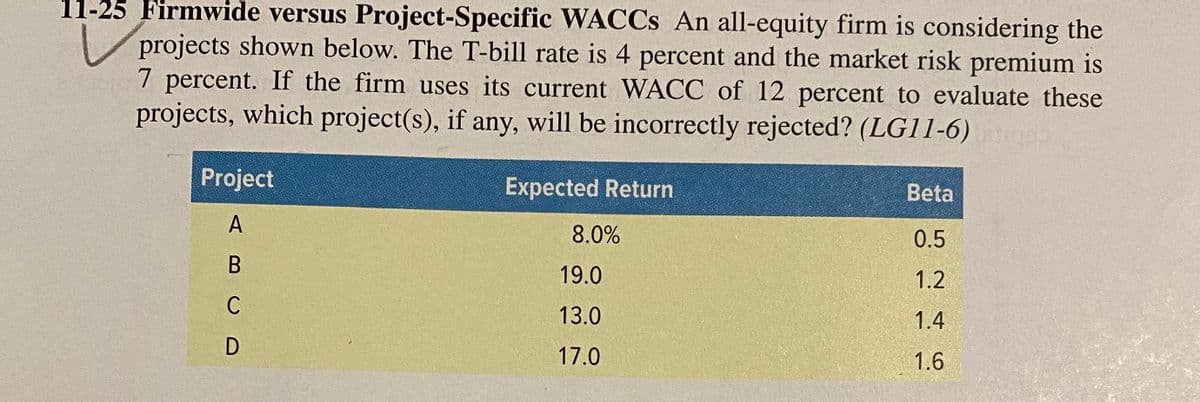

Transcribed Image Text:11-25 Firmwide versus Project-Specific WACCS An all-equity firm is considering the

projects shown below. The T-bill rate is 4 percent and the market risk premium is

7 percent. If the firm uses its current WACC of 12 percent to evaluate these

projects, which project(s), if any, will be incorrectly rejected? (LG11-6)

Project

Expected Return

Beta

A

8.0%

0.5

19.0

1.2

C

13.0

1.4

17.0

1.6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning