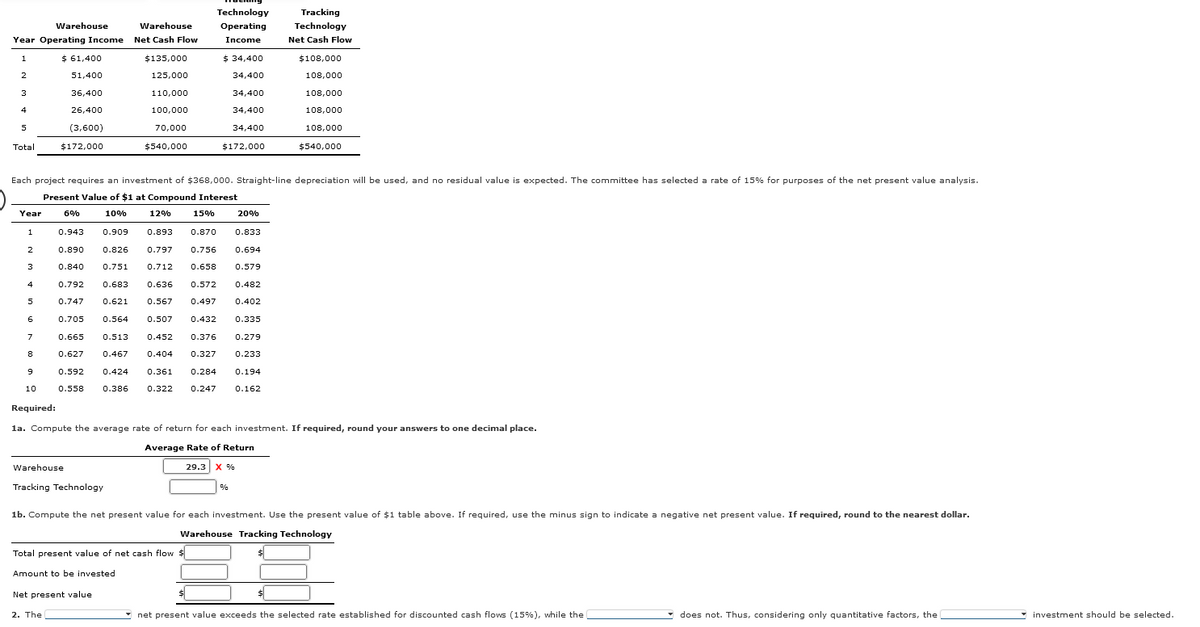

Warehouse Year Operating Income 1 $ 61,400 2 51,400 36,400 26,400 (3,600) $172,000 3 4 5 Total Year 1 2 3 4 5 6 7 8 9 10 Required: Each project requires an investment of $368,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis. Present Value of $1 at Compound Interest 6% 10% 15% 0.943 0.909 0.893 0.870 0.890 0.826 0.797 0.756 0.840 0.792 0.747 Warehouse Net Cash Flow $135,000 125,000 110,000 100,000 70,000 $540,000 Warehouse Tracking Technology 12% Technology Operating Income $ 34,400 34,400 34,400 34,400 34,400 $172,000 0.833 0.694 0.751 0.712 0.658 0.579 0.683 0.636 0.572 0.482 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.513 0.452 0.376 0.279 0.665 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.558 0.386 0.361 0.284 0.194 0.322 0.247 0.162 Net present value 2 The Total present value of net cash flow s Amount to be invested 20% 1a. Compute the average rate of return for each investment. If required, round your answers to one decimal place. Average Rate of Return 29.3 X % % Tracking Technology Net Cash Flow 1b. Compute the net present value for each investment. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest dollar. Warehouse Tracking Technology $108,000 108,000 108,000 108,000 108,000 $540,000 $ net present value exceeds the selected rate established for discounted cash flows (1586) while the ▾ does not Thus considering only quantitative factors the

Warehouse Year Operating Income 1 $ 61,400 2 51,400 36,400 26,400 (3,600) $172,000 3 4 5 Total Year 1 2 3 4 5 6 7 8 9 10 Required: Each project requires an investment of $368,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis. Present Value of $1 at Compound Interest 6% 10% 15% 0.943 0.909 0.893 0.870 0.890 0.826 0.797 0.756 0.840 0.792 0.747 Warehouse Net Cash Flow $135,000 125,000 110,000 100,000 70,000 $540,000 Warehouse Tracking Technology 12% Technology Operating Income $ 34,400 34,400 34,400 34,400 34,400 $172,000 0.833 0.694 0.751 0.712 0.658 0.579 0.683 0.636 0.572 0.482 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.513 0.452 0.376 0.279 0.665 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.558 0.386 0.361 0.284 0.194 0.322 0.247 0.162 Net present value 2 The Total present value of net cash flow s Amount to be invested 20% 1a. Compute the average rate of return for each investment. If required, round your answers to one decimal place. Average Rate of Return 29.3 X % % Tracking Technology Net Cash Flow 1b. Compute the net present value for each investment. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest dollar. Warehouse Tracking Technology $108,000 108,000 108,000 108,000 108,000 $540,000 $ net present value exceeds the selected rate established for discounted cash flows (1586) while the ▾ does not Thus considering only quantitative factors the

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 5BE

Related questions

Question

Transcribed Image Text:Year Operating Income

1

$ 61,400

2

51,400

36,400

26,400

(3,600)

$172,000

3

4

5

Total

Year

1

2

3

4

5

6

Warehouse

7

8

9

10

Required:

Each project requires an investment of $368,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis.

Present Value of $1 at Compound Interest

6%

10%

0.943

0.890

0.840 0.751

0.592

0.558

0.909

Warehouse

Warehouse

Net Cash Flow

Tracking Technology

$135,000

125,000

110,000

100,000

70,000

$540,000

0.386

0.826 0.797 0.756

0.694

0.712 0.658

0.579

0.792 0.683 0.636 0.572 0.482

0.747 0.621 0.567 0.497

0.402

0.705 0.564 0.507 0.432

0.665 0.513 0.452 0.376

0.627 0.467 0.404 0.327

0.424

Technology

Operating

Income

12%

$ 34,400

34,400

34,400

34,400

34,400

$172,000

15%

20%

0.893 0.870 0.833

0.335

0.279

0.233

0.361 0.284 0.194

0.322 0.247

Total present value of net cash flow $

Amount to be invested

Net present value

2. The

1a. Compute the average rate of return for each investment. If required, round your answers to one decimal place.

Average Rate of Return

29.3 X %

Tracking

Technology

Net Cash Flow

0.162

%

$108,000

108,000

108,000

108,000

108,000

$540,000

1b. Compute the net present value for each investment. Use the present value of $1 table above. If required, use the minus sign to indicate a negative net present value. If required, round to the nearest dollar.

Warehouse Tracking Technology

net present value exceeds the selected rate established for discounted cash flows (15%), while the

does not. Thus, considering only quantitative factors, the

investment should be selected.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning