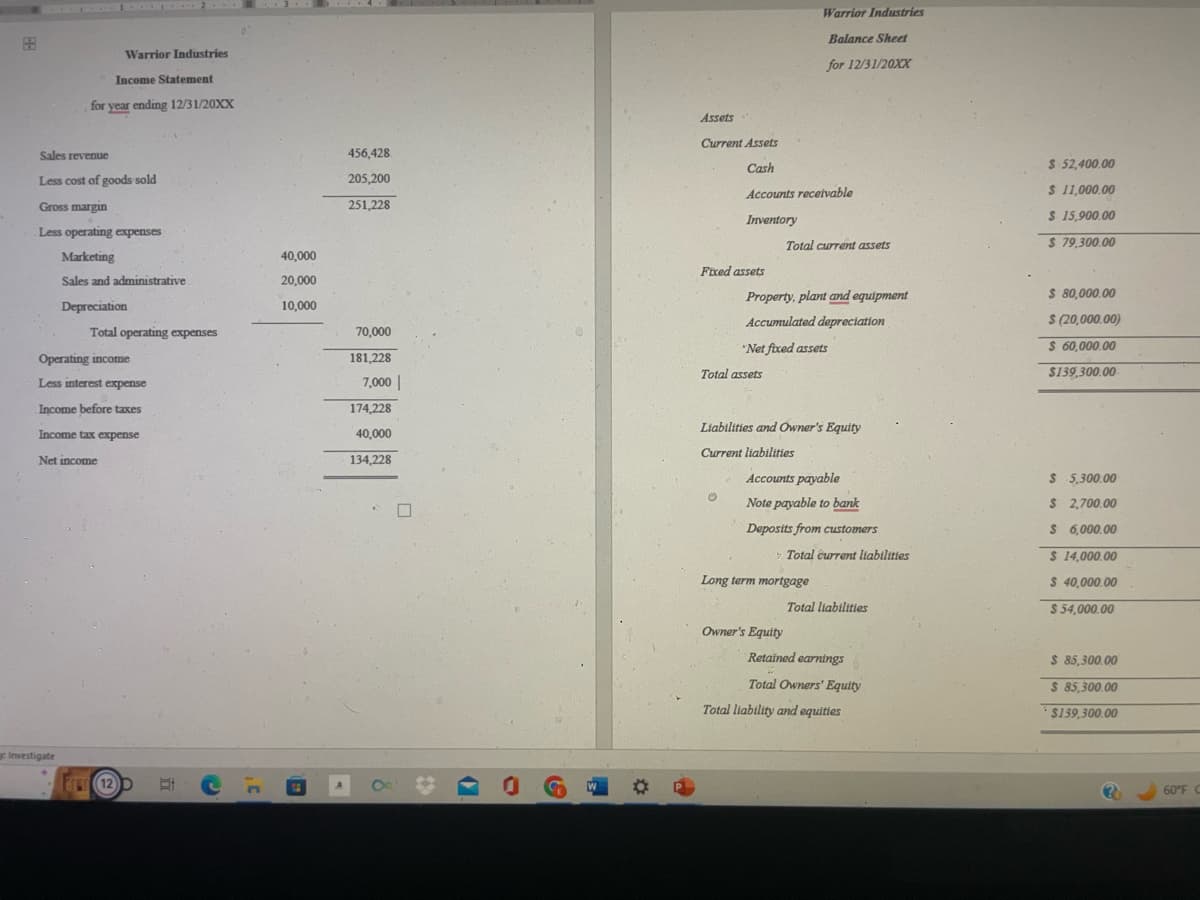

Warrior Industries Income Statement for year ending 12/31/20XX Sales revenue Less cost of goods sold Gross margin Less operating expenses Marketing Sales and administrative Depreciation Total operating expenses Operating income Less interest expense Income before taxes Income tax expense Net income 40,000 20,000 10,000 456,428 205,200 251,228 70,000 181,228 7,000 174,228 40,000 134,228 Assets Current Assets Cash Accounts receivable Inventory Fixed assets for 12/31/20XX Total assets Total current assets Property, plant and equipment Accumulated depreciation *Net fixed assets Liabilities and Owner's Equity Current liabilities $ 52,400.00 $ 11,000.00 $ 15,900.00 $ 79,300.00 $ 80,000.00 $(20,000.00) $ 60,000.00 $139,300.00

Warrior Industries Income Statement for year ending 12/31/20XX Sales revenue Less cost of goods sold Gross margin Less operating expenses Marketing Sales and administrative Depreciation Total operating expenses Operating income Less interest expense Income before taxes Income tax expense Net income 40,000 20,000 10,000 456,428 205,200 251,228 70,000 181,228 7,000 174,228 40,000 134,228 Assets Current Assets Cash Accounts receivable Inventory Fixed assets for 12/31/20XX Total assets Total current assets Property, plant and equipment Accumulated depreciation *Net fixed assets Liabilities and Owner's Equity Current liabilities $ 52,400.00 $ 11,000.00 $ 15,900.00 $ 79,300.00 $ 80,000.00 $(20,000.00) $ 60,000.00 $139,300.00

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

Transcribed Image Text:Warrior Industries

Income Statement

for year ending 12/31/20XX

Sales revenue

Less cost of goods sold

Gross margin

Less operating expenses

Marketing

Sales and administrative

Depreciation

Total operating expenses

Operating income

Investigate

Less interest expense

Income before taxes

Income tax expense

Net income

E12 D

0°

C

40,000

20,000

10,000

(E

456,428

205,200

251,228

70,000

181,228

7,000

174,228

40,000

134,228

Co

W

✿

Assets

Current Assets

Cash

Accounts receivable

Inventory

Fixed assets

Total assets

0

Warrior Industries

Balance Sheet

for 12/31/20XX

Property, plant and equipment

Accumulated depreciation

*Net fixed assets

Total current assets

Liabilities and Owner's Equity

Current liabilities

Accounts payable

Note payable to bank

Deposits from customers

Owner's Equity

Long term mortgage

Total current liabilities

Total liabilities

Retained earnings

Total Owners' Equity

Total liability and equities

$ 52,400.00

$ 11,000.00

$ 15,900.00

$ 79,300.00

$ 80,000.00

$ (20,000.00)

$ 60,000.00

$139,300.00

$ 5,300.00

$ 2,700.00

$ 6,000.00

$ 14,000.00

$ 40,000.00

$ 54,000.00

$ 85,300.00

$ 85,300.00

$139,300.00

(?)

60°F C

Transcribed Image Text:th

1.

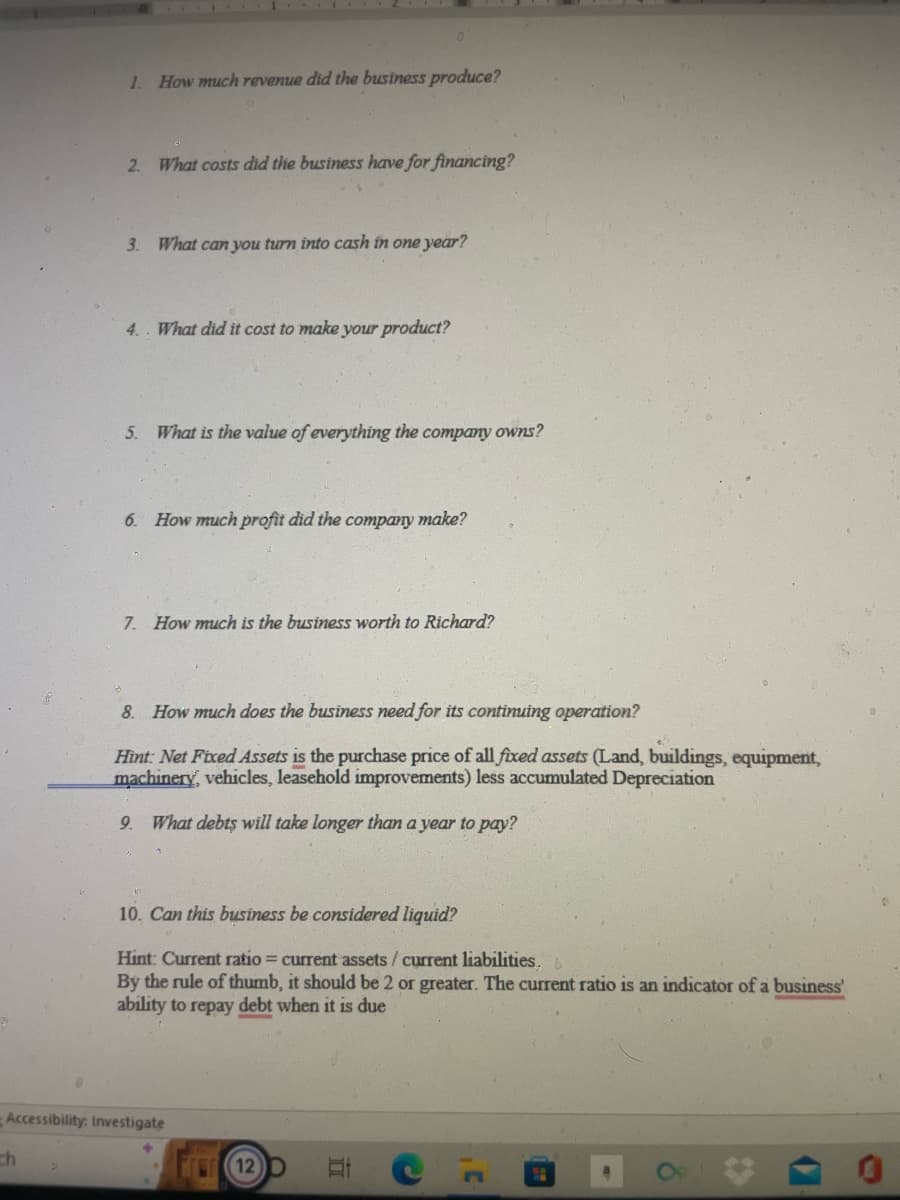

1. How much revenue did the business produce?

2. What costs did the business have for financing?

3. What can you turn into cash in one year?

4. What did it cost to make your product?

5. What is the value of everything the company owns?

6. How much profit did the company make?

7. How much is the business worth to Richard?

8. How much does the business need for its continuing operation?

Hint: Net Fixed Assets is the purchase price of all fixed assets (Land, buildings, equipment,

machinery, vehicles, leasehold improvements) less accumulated Depreciation

9. What debts will take longer than a year to pay?

Accessibility: Investigate

10. Can this business be considered liquid?

Hint: Current ratio = current assets/ current liabilities.

By the rule of thumb, it should be 2 or greater. The current ratio is an indicator of a business'

ability to repay debt when it is due

12) D

i

C

(1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning