Was the organizational structure presented by Kimberly‐Clark executives in 2004 better than the first structure proposed? Why or why not?

Was the organizational structure presented by Kimberly‐Clark executives in 2004 better than the first structure proposed? Why or why not?

Management, Loose-Leaf Version

13th Edition

ISBN:9781305969308

Author:Richard L. Daft

Publisher:Richard L. Daft

Chapter3: The Environment And Corporate Culture

Section: Chapter Questions

Problem 1ED

Related questions

Question

Was the organizational structure presented by Kimberly‐Clark executives in 2004 better

than the first structure proposed? Why or why not?

than the first structure proposed? Why or why not?

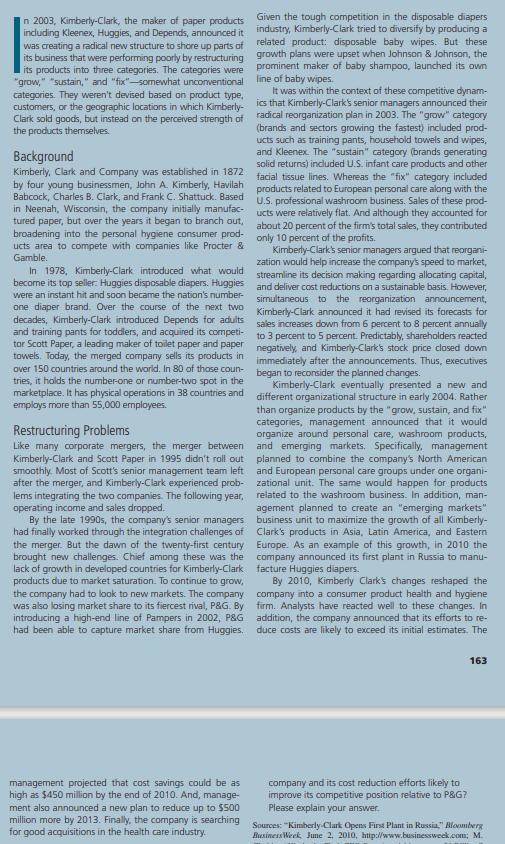

Transcribed Image Text:In 2003, Kimberly-Clark, the maker of paper products

including Kleenex, Huggies, and Depends, announced it

was creating a radical new structure to shore up parts of

its business that were performing poorly by restructuring

its products into three categories. The categories were

"grow," "sustain," and "fix"-somewhat unconventional

categories. They weren't devised based on product type,

customers, or the geographic locations in which Kimberly-

Clark sold goods, but instead on the perceived strength of

the products themselves.

Background

Kimberly, Clark and Company was established in 1872

by four young businessmen, John A. Kimberly, Havilah

Babcock, Charles B. Clark, and Frank C. Shattuck. Based

in Neenah, Wisconsin, the company initially manufac-

tured paper, but over the years it began to branch out,

broadening into the personal hygiene consumer prod-

ucts area to compete with companies like Procter &

Gamble.

In 1978, Kimberly-Clark introduced what would

become its top seller: Huggies disposable diapers. Huggies

were an instant hit and soon became the nation's number-

one diaper brand. Over the course of the next two

decades, Kimberly-Clark introduced Depends for adults

and training pants for toddlers, and acquired its competi-

tor Scott Paper, a leading maker of toilet paper and paper

towels. Today, the merged company sells its products in

over 150 countries around the world. In 80 of those coun-

tries, it holds the number-one or number-two spot in the

marketplace. It has physical operations in 38 countries and

employs more than 55,000 employees.

Restructuring Problems

Like many corporate mergers, the merger between

Kimberly-Clark and Scott Paper in 1995 didn't roll out

smoothly. Most of Scott's senior management team left

after the merger, and Kimberly-Clark experienced prob-

lems integrating the two companies. The following year,

operating income and sales dropped.

By the late 1990s, the company's senior managers

had finally worked through the integration challenges of

the merger. But the dawn of the twenty-first century

brought new challenges. Chief among these was the

lack of growth in developed countries for Kimberly-Clark

products due to market saturation. To continue to grow,

the company had to look to new markets. The company

was also losing market share to its fiercest rival, P&G. By

introducing a high-end line of Pampers in 2002, P&G

had been able to capture market share from Huggies.

management projected that cost savings could be as

high as $450 million by the end of 2010. And, manage-

ment also announced a new plan to reduce up to $500

million more by 2013. Finally, the company is searching

for good acquisitions in the health care industry.

Given the tough competition in the disposable diapers

industry, Kimberly-Clark tried to diversify by producing a

related product: disposable baby wipes. But these

growth plans were upset when Johnson & Johnson, the

prominent maker of baby shampoo, launched its own

line of baby wipes.

It was within the context of these competitive dynam-

ics that Kimberly-Clark's senior managers announced their

radical reorganization plan in 2003. The "grow" category

(brands and sectors growing the fastest) included prod-

ucts such as training pants, household towels and wipes,

and Kleenex. The "sustain" category (brands generating

solid returns) included U.S. infant care products and other

facial tissue lines. Whereas the "fix" category included

products related to European personal care along with the

U.S. professional washroom business. Sales of these prod-

ucts were relatively flat. And although they accounted for

about 20 percent of the firm's total sales, they contributed

only 10 percent of the profits.

Kimberly-Clark's senior managers argued that reorgani-

zation would help increase the company's speed to market,

streamline its decision making regarding allocating capital,

and deliver cost reductions on a sustainable basis. However,

simultaneous to the reorganization announcement,

Kimberly-Clark announced it had revised its forecasts for

sales increases down from 6 percent to 8 percent annually

to 3 percent to 5 percent. Predictably, shareholders reacted

negatively, and Kimberly-Clark's stock price closed down

immediately after the announcements. Thus, executives

began to reconsider the planned changes.

Kimberly-Clark eventually presented a new and

different organizational structure in early 2004. Rather

than organize products by the "grow, sustain, and fix"

categories, management announced that it would

organize around personal care, washroom products,

and emerging markets. Specifically, management

planned to combine the company's North American

and European personal care groups under one organi-

zational unit. The same would happen for products

related to the washroom business. In addition, man-

agement planned to create an "emerging markets"

business unit to maximize the growth of all Kimberly-

Clark's products in Asia, Latin America, and Eastern

Europe. As an example of this growth, in 2010 the

company announced its first plant in Russia to manu-

facture Huggies diapers.

By 2010, Kimberly Clark's changes reshaped the

company into a consumer product health and hygiene

firm. Analysts have reacted well to these changes. In

addition, the company announced that its efforts to re-

duce costs are likely to exceed its initial estimates. The

company and its cost reduction efforts likely to

improve its competitive position relative to P&G?

Please explain your answer.

163

Sources: "Kimberly-Clark Opens First Plant in Russia," Bloomberg

BusinessWeek, June 2, 2010, http://www.businessweek.com; M.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Management, Loose-Leaf Version

Management

ISBN:

9781305969308

Author:

Richard L. Daft

Publisher:

South-Western College Pub

Management, Loose-Leaf Version

Management

ISBN:

9781305969308

Author:

Richard L. Daft

Publisher:

South-Western College Pub