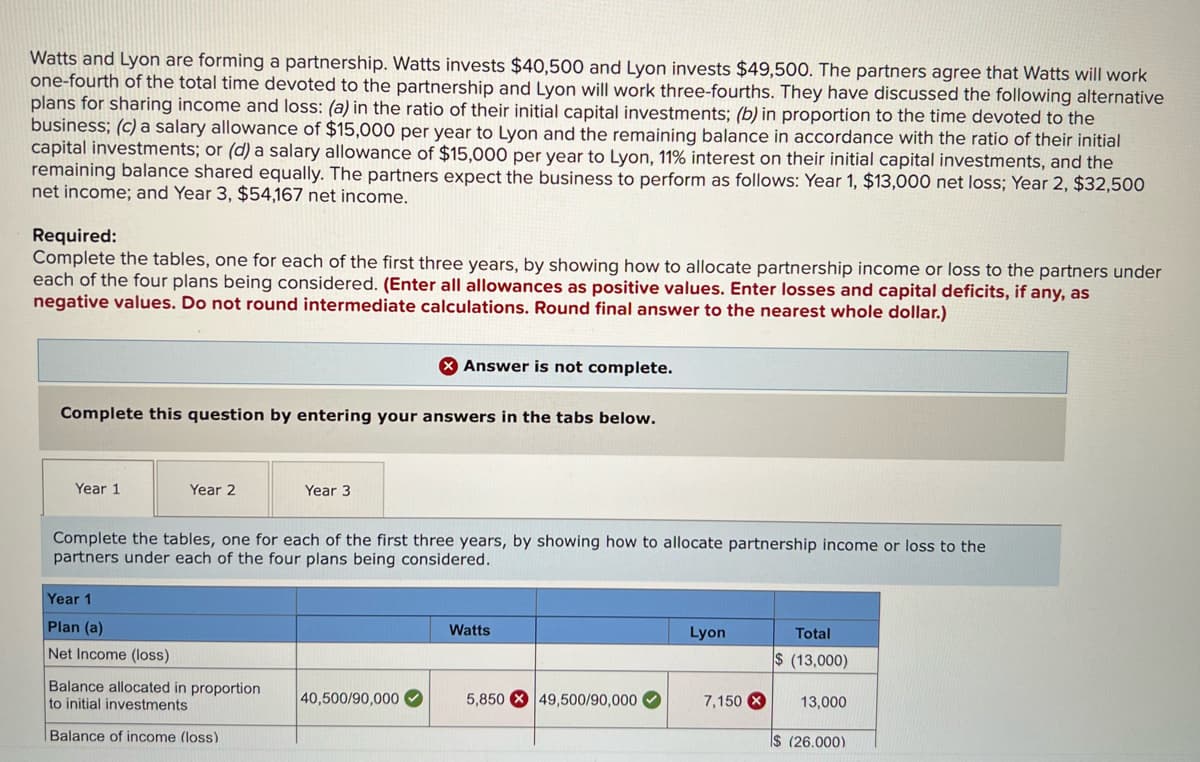

Watts and Lyon are forming a partnership. Watts invests $40,500 and Lyon invests $49,500. The partners agree that Watts will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss: (a) in the ratio of their initial capital investments; (b) in proportion to the time devoted to the business; (c) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments; or (d) a salary allowance of $15,000 per year to Lyon, 11% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $13,000 net loss; Year 2, $32,500 net income; and Year 3, $54,167 net income. Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. (Enter all allowances as positive values. Enter losses and capital deficits, if any, as negative values. Do not round intermediate calculations. Round final answer to the nearest whole dollar.)

Watts and Lyon are forming a partnership. Watts invests $40,500 and Lyon invests $49,500. The partners agree that Watts will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss: (a) in the ratio of their initial capital investments; (b) in proportion to the time devoted to the business; (c) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments; or (d) a salary allowance of $15,000 per year to Lyon, 11% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $13,000 net loss; Year 2, $32,500 net income; and Year 3, $54,167 net income. Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of the four plans being considered. (Enter all allowances as positive values. Enter losses and capital deficits, if any, as negative values. Do not round intermediate calculations. Round final answer to the nearest whole dollar.)

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:Watts and Lyon are forming a partnership. Watts invests $40,500 and Lyon invests $49,500. The partners agree that Watts will work

one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative

plans for sharing income and loss: (a) in the ratio of their initial capital investments; (b) in proportion to the time devoted to the

business; (c) a salary allowance of $15,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial

capital investments; or (d) a salary allowance of $15,000 per year to Lyon, 11% interest on their initial capital investments, and the

remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $13,000 net loss; Year 2, $32,500

net income; and Year 3, $54,167 net income.

Required:

Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under

each of the four plans being considered. (Enter all allowances as positive values. Enter losses and capital deficits, if any, as

negative values. Do not round intermediate calculations. Round final answer to the nearest whole dollar.)

X Answer is not complete.

Complete this question by entering your answers in the tabs below.

Year 1

Year 2

Year 3

Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the

partners under each of the four plans being considered.

Year 1

Plan (a)

Watts

Lyon

Total

$ (13,000)

Net Income (loss)

Balance allocated in proportion

to initial investments

40,500/90,000

5,850 49,500/90,000

13,000

Balance of income (loss)

$ (26.000)

7,150 X

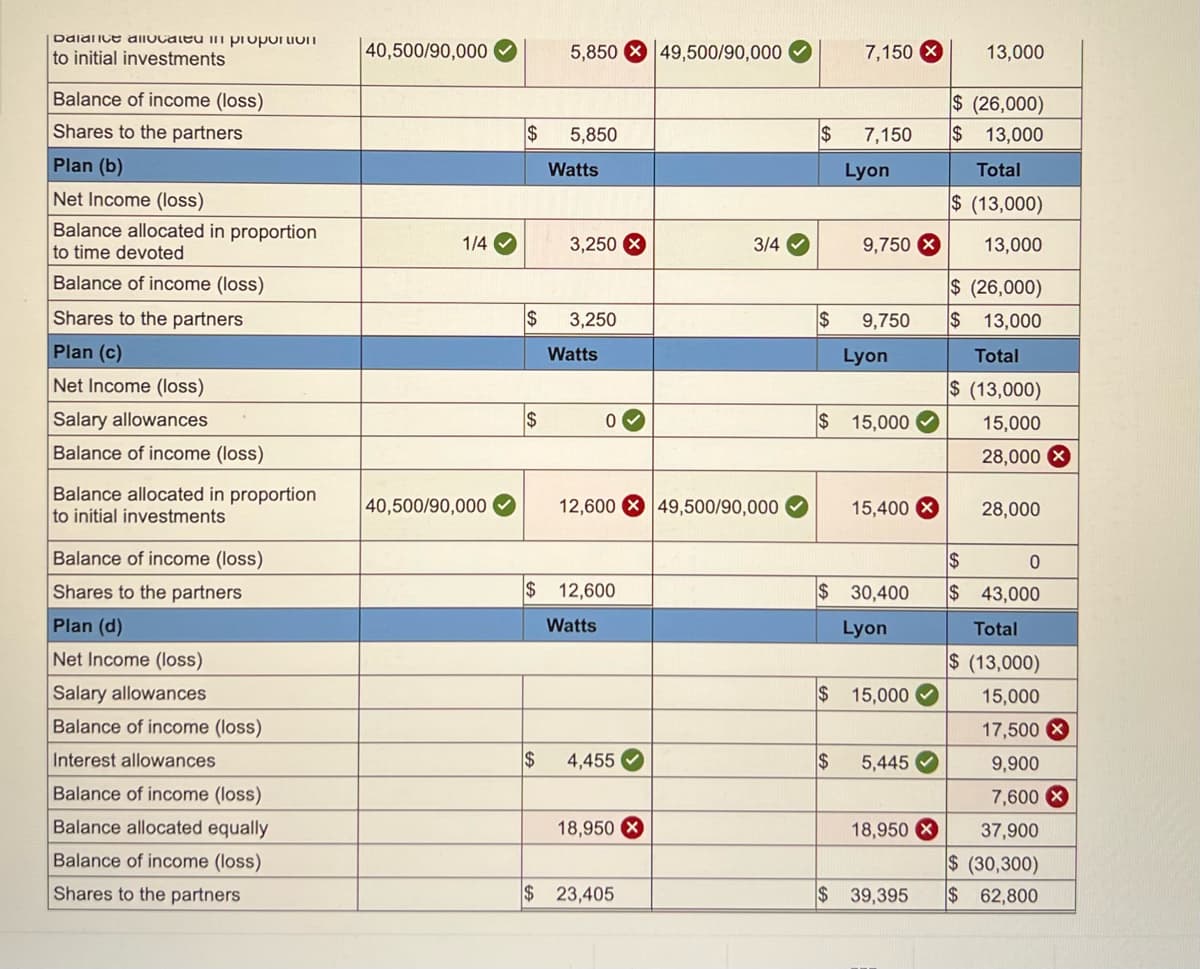

Transcribed Image Text:Dalalice allocated in proportion

to initial investments

Balance of income (loss)

Shares to the partners

Plan (b)

Net Income (loss)

Balance allocated in proportion

to time devoted

Balance of income (loss)

Shares to the partners

Plan (c)

Net Income (loss)

Salary allowances

Balance of income (loss)

Balance allocated in proportion

to initial investments

Balance of income (loss)

Shares to the partners

Plan (d)

Net Income (loss)

Salary allowances

Balance of income (loss)

Interest allowances

Balance of income (loss)

Balance allocated equally

Balance of income (loss)

Shares to the partners

40,500/90,000

1/4 ✔

40,500/90,000

$ 5,850

Watts

$

5,850 49,500/90,000

$

3,250

3,250

Watts

0✓

12,600

$ 12,600

Watts

$ 4,455

18,950 X

$ 23,405

3/4

49,500/90,000

$

$

$

7,150 X

7,150

Lyon

9,750 X

9,750

Lyon

15,000

15,400

$ 30,400

Lyon

$ 15,000

$

5,445

18,950 X

$ 39,395

13,000

$ (26,000)

$ 13,000

Total

$ (13,000)

13,000

$ (26,000)

$ 13,000

Total

$ (13,000)

15,000

28,000

28,000

$

0

$ 43,000

Total

$ (13,000)

15,000

17,500 X

9,900

7,600

37,900

$ (30,300)

$ 62,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT