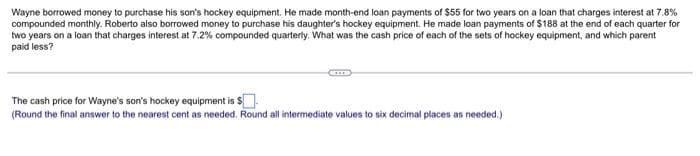

Wayne borrowed money to purchase his son's hockey equipment. He made month-end loan payments of $55 for two years on a loan that charges interest at 7.8% compounded monthly. Roberto also borrowed money to purchase his daughter's hockey equipment. He made loan payments of $188 at the end of each quarter for two years on a loan that charges interest at 7.2% compounded quarterly. What was the cash price of each of the sets of hockey equipment, and which parent paid less? The cash price for Wayne's son's hockey equipment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Wayne borrowed money to purchase his son's hockey equipment. He made month-end loan payments of $55 for two years on a loan that charges interest at 7.8% compounded monthly. Roberto also borrowed money to purchase his daughter's hockey equipment. He made loan payments of $188 at the end of each quarter for two years on a loan that charges interest at 7.2% compounded quarterly. What was the cash price of each of the sets of hockey equipment, and which parent paid less? The cash price for Wayne's son's hockey equipment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Chapter6: Business Expenses

Section: Chapter Questions

Problem 69P

Related questions

Question

Transcribed Image Text:Wayne borrowed money to purchase his son's hockey equipment. He made month-end loan payments of $55 for two years on a loan that charges interest at 7.8%

compounded monthly. Roberto also borrowed money to purchase his daughter's hockey equipment. He made loan payments of $188 at the end of each quarter for

two years on a loan that charges interest at 7.2% compounded quarterly. What was the cash price of each of the sets of hockey equipment, and which parent

paid less?

The cash price for Wayne's son's hockey equipment is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you