WBE enterprises for the 2021 and 2022 financial years. If all purchases are on credit, calculate the creditors payment period of WBE enterprises the 2022 financial year. Sales (80% credit sales) Cost of sales Inventories Accounts receivable Accounts payable Cash and cash equivalents Other current liabilities OA. 214 days OB. 163 days OC. 66 days OD. 168 days 2022 R 480 000 264 000 270 000 204 000 177 000 45 750 82 500 2021 R 375 000 192 000 243 000 183 000 165 000 27 300 rom the annual financial reports 58 500

WBE enterprises for the 2021 and 2022 financial years. If all purchases are on credit, calculate the creditors payment period of WBE enterprises the 2022 financial year. Sales (80% credit sales) Cost of sales Inventories Accounts receivable Accounts payable Cash and cash equivalents Other current liabilities OA. 214 days OB. 163 days OC. 66 days OD. 168 days 2022 R 480 000 264 000 270 000 204 000 177 000 45 750 82 500 2021 R 375 000 192 000 243 000 183 000 165 000 27 300 rom the annual financial reports 58 500

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 27BEB: Last year, Tobys Hats had net sales of 45,000,000 and cost of goods sold of 29,000,000. Tobys had...

Related questions

Question

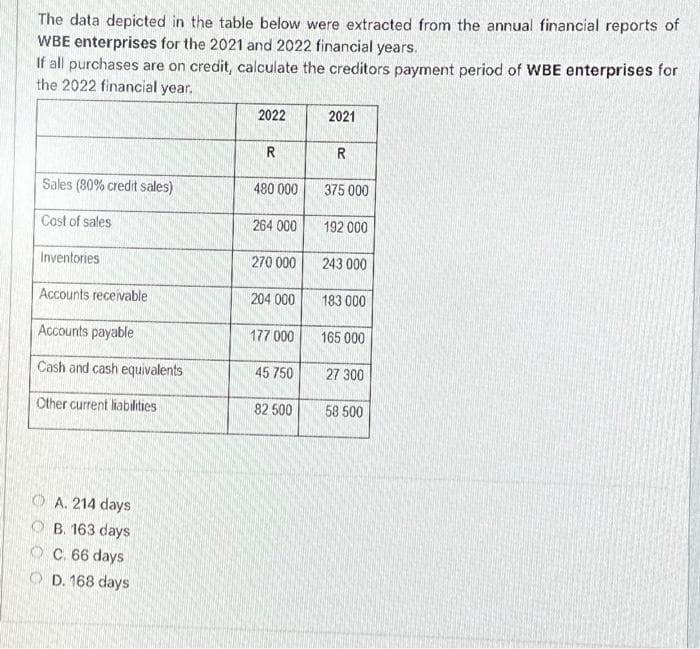

Transcribed Image Text:The data depicted in the table below were extracted from the annual financial reports of

WBE enterprises for the 2021 and 2022 financial years.

If all purchases are on credit, calculate the creditors payment period of WBE enterprises for

the 2022 financial year.

Sales (80% credit sales)

Cost of sales

Inventories

Accounts receivable

Accounts payable

Cash and cash equivalents

Other current liabilities

OA. 214 days

OB. 163 days

OC. 66 days

OD. 168 days

2022

R

480 000

264 000

270 000

204 000

177 000

45 750

82 500

2021

R

375 000

192 000

243 000

183 000

165 000

27 300

58 500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning