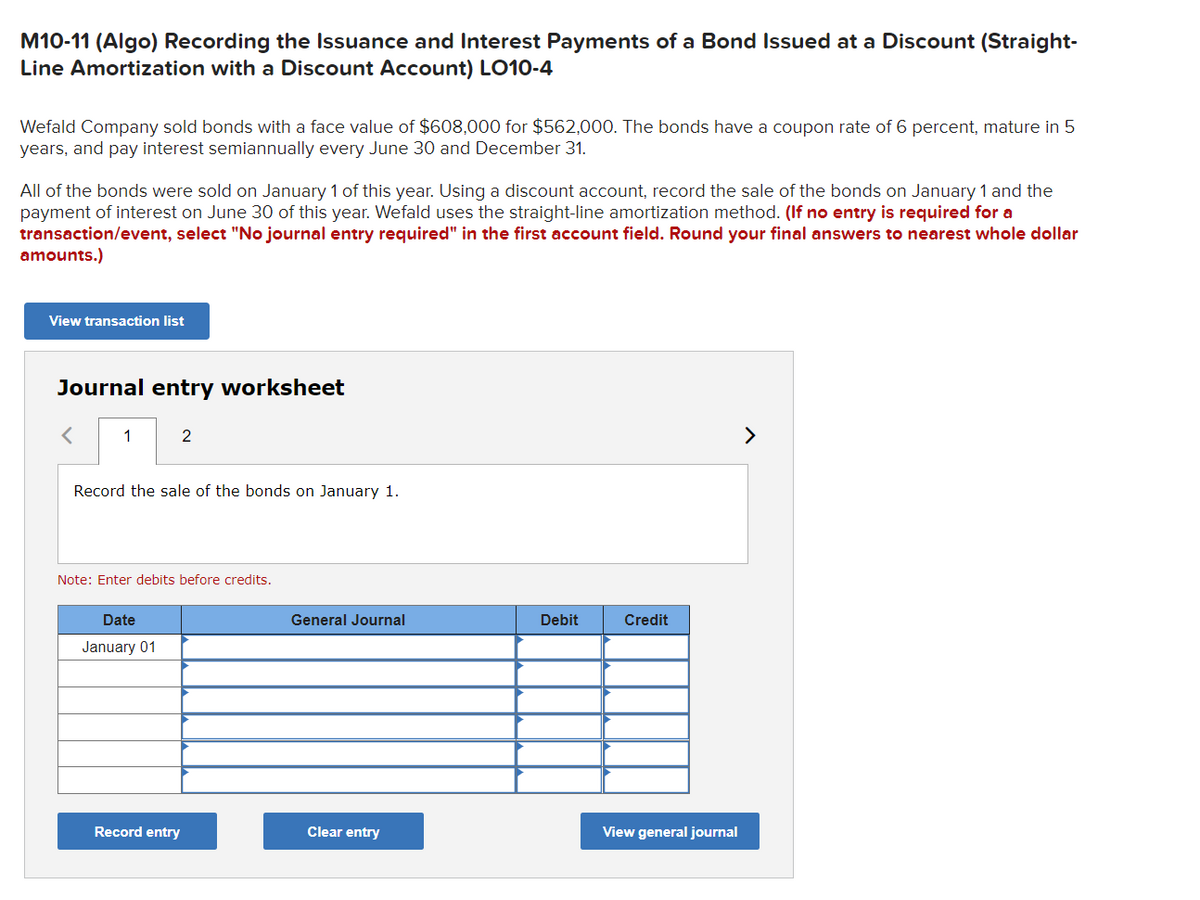

Wefald Company sold bonds with a face value of $608,000 for $562,000. The bonds have a coupon rate of 6 percent, mature in 5 years, and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Using a discount account, record the sale of the bonds on January 1 and the payment of interest on June 30 of this year. Wefald uses the straight-line amortization method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dollar amounts.)

Wefald Company sold bonds with a face value of $608,000 for $562,000. The bonds have a coupon rate of 6 percent, mature in 5 years, and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. Using a discount account, record the sale of the bonds on January 1 and the payment of interest on June 30 of this year. Wefald uses the straight-line amortization method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dollar amounts.)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 22E

Related questions

Question

100%

Transcribed Image Text:M10-11 (Algo) Recording the Issuance and Interest Payments of a Bond Issued at a Discount (Straight-

Line Amortization with a Discount Account) LO10-4

Wefald Company sold bonds with a face value of $608,000 for $562,000. The bonds have a coupon rate of 6 percent, mature in 5

years, and pay interest semiannually every June 30 and December 31.

All of the bonds were sold on January 1 of this year. Using a discount account, record the sale of the bonds on January 1 and the

payment of interest on June 30 of this year. Wefald uses the straight-line amortization method. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dollar

amounts.)

View transaction list

Journal entry worksheet

1

2

Record the sale of the bonds on January 1.

Note: Enter debits before credits.

Date

January 01

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning