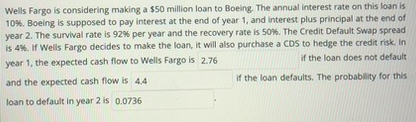

Wells Fargo is considering making a $50 million loan to Boeing. The annual interest rate on this loan is 10%. Boeing is supposed to pay interest at the end of year 1, and interest plus principal at the end of year 2. The survival rate is 92% per year and the recovery rate is 50%. The Credit Default Swap spread is 4%. If Wells Fargo decides to make the loan, it will also purchase a CDS to hedge the credit risk. In year 1, the expected cash flow to Wells Fargo is 2.76 if the loan does not default if the loan defaults. The probability for this and the expected cash flow is 4.4 loan to default in year 2 is 0.0736

Wells Fargo is considering making a $50 million loan to Boeing. The annual interest rate on this loan is 10%. Boeing is supposed to pay interest at the end of year 1, and interest plus principal at the end of year 2. The survival rate is 92% per year and the recovery rate is 50%. The Credit Default Swap spread is 4%. If Wells Fargo decides to make the loan, it will also purchase a CDS to hedge the credit risk. In year 1, the expected cash flow to Wells Fargo is 2.76 if the loan does not default if the loan defaults. The probability for this and the expected cash flow is 4.4 loan to default in year 2 is 0.0736

A First Course in Probability (10th Edition)

10th Edition

ISBN:9780134753119

Author:Sheldon Ross

Publisher:Sheldon Ross

Chapter1: Combinatorial Analysis

Section: Chapter Questions

Problem 1.1P: a. How many different 7-place license plates are possible if the first 2 places are for letters and...

Related questions

Question

Transcribed Image Text:Wells Fargo is considering making a $50 million loan to Boeing. The annual interest rate on this loan is

10%. Boeing is supposed to pay interest at the end of year 1, and interest plus principal at the end of

year 2. The survival rate is 92% per year and the recovery rate is 50%. The Credit Default Swap spread

is 4%. If Wells Fargo decides to make the loan, it will also purchase a CDS to hedge the credit risk. In

year 1, the expected cash flow to Wells Fargo is 2.76

if the loan does not default

and the expected cash flow is 4.4

if the loan defaults. The probability for this

loan to default in year 2 is 0.0736

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 21 images

Recommended textbooks for you

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON