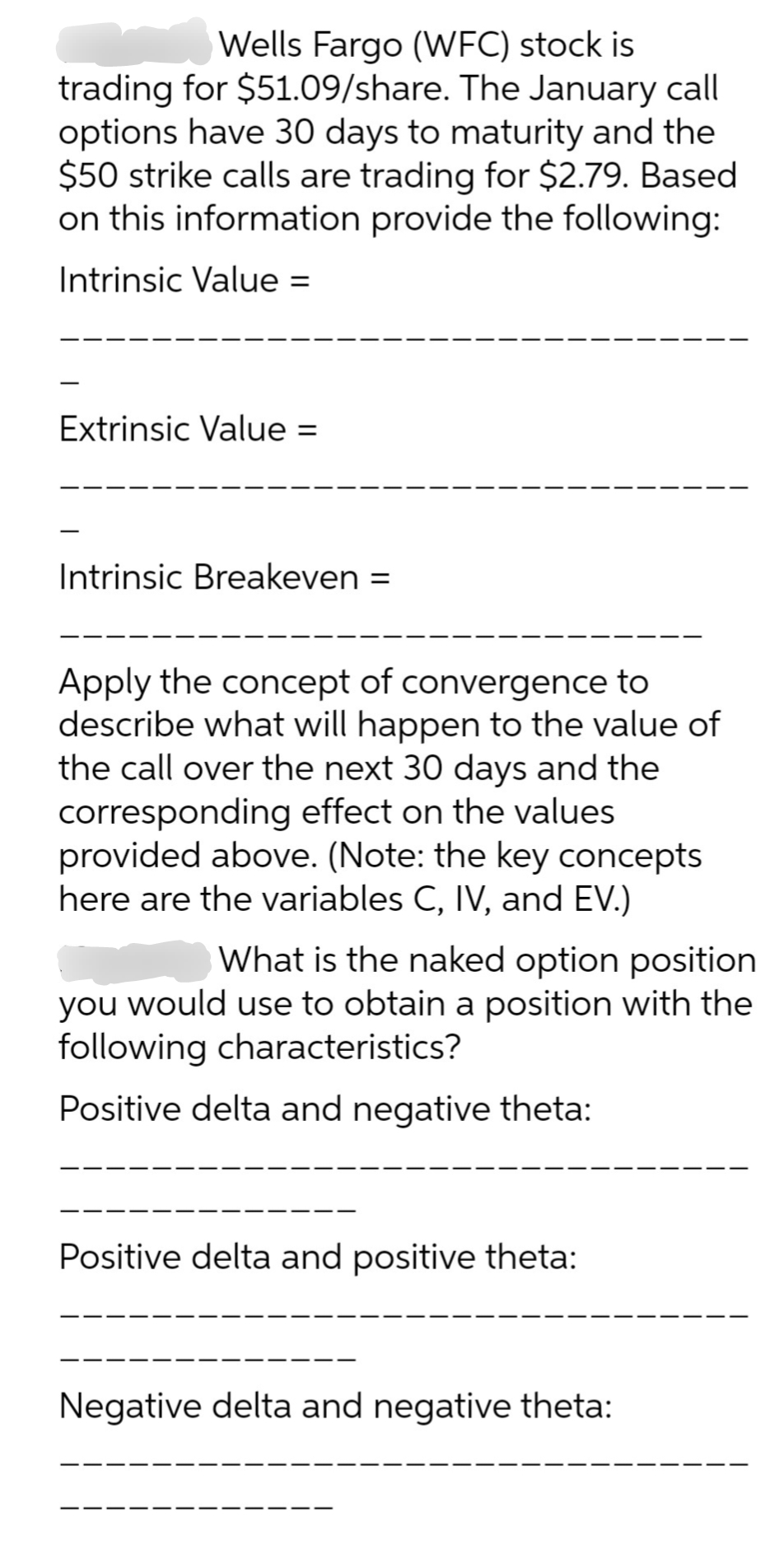

Wells Fargo (WFC) stock is trading for $51.09/share. The January call options have 30 days to maturity and the $50 strike calls are trading for $2.79. Based on this information provide the following: Intrinsic Value = Extrinsic Value = Intrinsic Breakeven= |

Wells Fargo (WFC) stock is trading for $51.09/share. The January call options have 30 days to maturity and the $50 strike calls are trading for $2.79. Based on this information provide the following: Intrinsic Value = Extrinsic Value = Intrinsic Breakeven= |

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter7: Linear Regression

Section: Chapter Questions

Problem 7P: The Dow Jones Industrial Average (DJIA) and the Standard Poors 500 (SP 500) indexes are used as...

Related questions

Question

9

Transcribed Image Text:Wells Fargo (WFC) stock is

trading for $51.09/share. The January call

options have 30 days to maturity and the

$50 strike calls are trading for $2.79. Based

on this information provide the following:

Intrinsic Value: =

Extrinsic Value =

Intrinsic Breakeven =

Apply the concept of convergence to

describe what will happen to the value of

the call over the next 30 days and the

corresponding effect on the values

provided above. (Note: the key concepts

here are the variables C, IV, and EV.)

What is the naked option position

you would use to obtain a position with the

following characteristics?

Positive delta and negative theta:

Positive delta and positive theta:

Negative delta and negative theta:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning