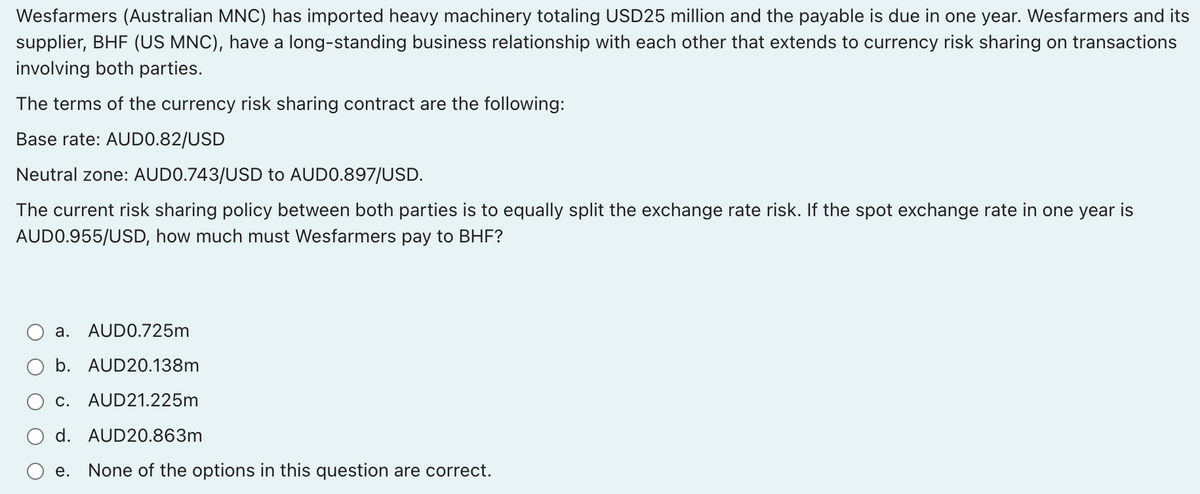

Wesfarmers (Australian MNC) has imported heavy machinery totaling USD25 million and the payable is due in one year. Wesfarmers and its supplier, BHF (US MNC), have a long-standing business relationship with each other that extends to currency risk sharing on transactions involving both parties. The terms of the currency risk sharing contract are the following: Base rate: AUD0.82/USD Neutral zone: AUDO.743/USD to AUDO.897/USD. The current risk sharing policy between both parties is to equally split the exchange rate risk. If the spot exchange rate in one year is AUDO.955/USD, how much must Wesfarmers pay to BHF? а. AUDO.725m O b. AUD20.138m O c. AUD21.225m d. AUD20.863m е. None of the options in this question are correct.

Wesfarmers (Australian MNC) has imported heavy machinery totaling USD25 million and the payable is due in one year. Wesfarmers and its supplier, BHF (US MNC), have a long-standing business relationship with each other that extends to currency risk sharing on transactions involving both parties. The terms of the currency risk sharing contract are the following: Base rate: AUD0.82/USD Neutral zone: AUDO.743/USD to AUDO.897/USD. The current risk sharing policy between both parties is to equally split the exchange rate risk. If the spot exchange rate in one year is AUDO.955/USD, how much must Wesfarmers pay to BHF? а. AUDO.725m O b. AUD20.138m O c. AUD21.225m d. AUD20.863m е. None of the options in this question are correct.

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 1ST

Related questions

Question

Please answer this quesiton thank you

Transcribed Image Text:Wesfarmers (Australian MNC) has imported heavy machinery totaling USD25 million and the payable is due in one year. Wesfarmers and its

supplier, BHF (US MNC), have a long-standing business relationship with each other that extends to currency risk sharing on transactions

involving both parties.

The terms of the currency risk sharing contract are the following:

Base rate: AUDO.82/USD

Neutral zone: AUDO.743/USD to AUD0.897/USD.

The current risk sharing policy between both parties is to equally split the exchange rate risk. If the spot exchange rate in one year is

AUDO.955/USD, how much must Wesfarmers pay to BHF?

a. AUDO.725m

b. AUD20.138m

c. AUD21.225m

d. AUD20.863m

e. None of the options in this question are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you