Wesley is offered an investment savings plan which will require him to commit a ixed amount of deposit every month for a span of 5 years. If the amounts are in increments of P1,000 and the plan is offering to yield a return of 6% annu- ally, how much should he commit every month in order to reach P500,000 at the end of 5 years? Gabriel is able to save P10,000 every month from his salary. If he decides to invest in a special deposit account offering an interest rate of 5% annually, how much money would he have at the end of 3 years?

Wesley is offered an investment savings plan which will require him to commit a ixed amount of deposit every month for a span of 5 years. If the amounts are in increments of P1,000 and the plan is offering to yield a return of 6% annu- ally, how much should he commit every month in order to reach P500,000 at the end of 5 years? Gabriel is able to save P10,000 every month from his salary. If he decides to invest in a special deposit account offering an interest rate of 5% annually, how much money would he have at the end of 3 years?

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 15MC: If current assets are $112,000 and current liabilities are $56,000, what is the current ratio? A....

Related questions

Question

answer letter c number 1 and 2 with solution thank you

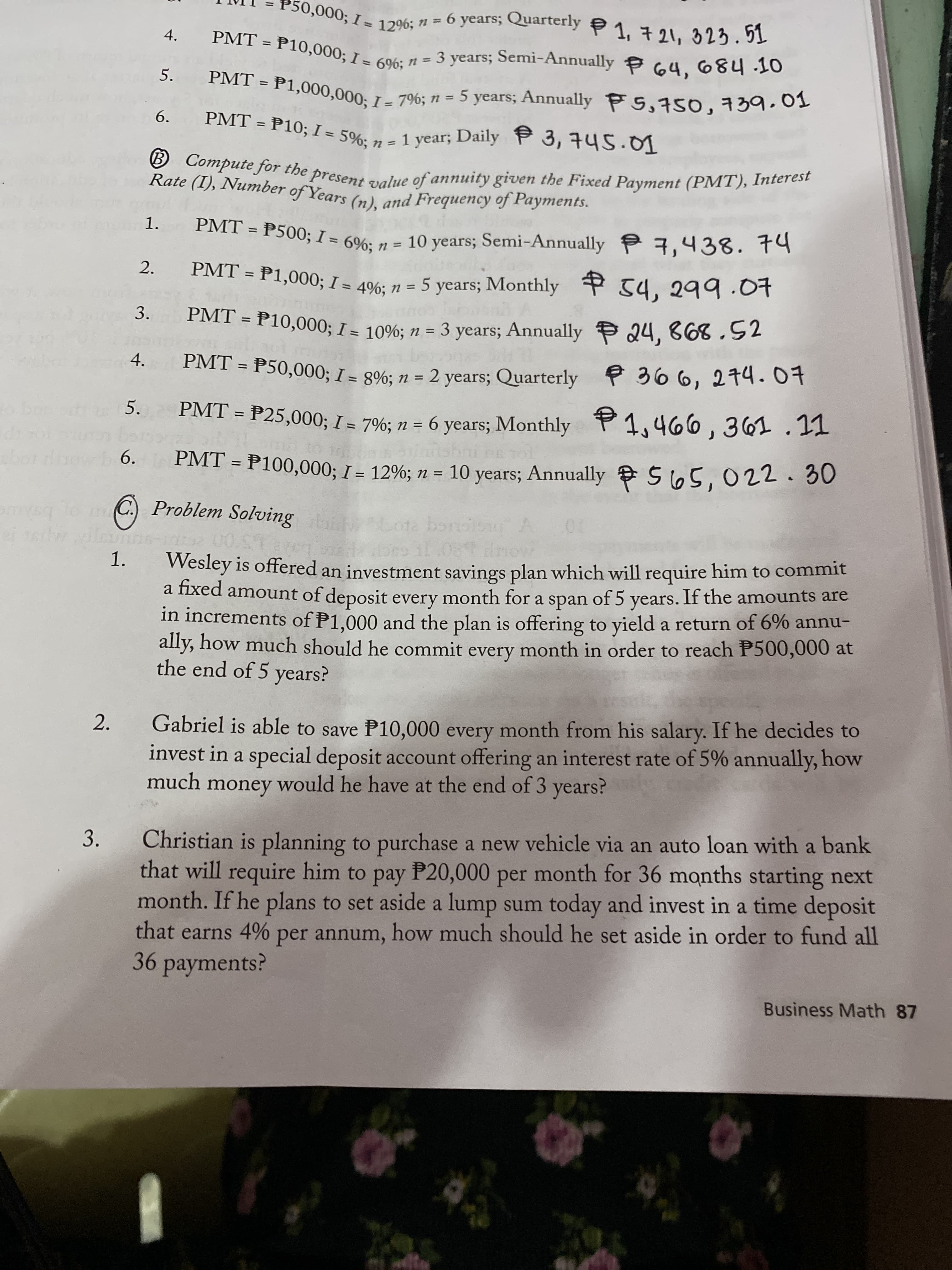

Transcribed Image Text:0,000; I = 129%6; n = 6 years; Quarterly P 1, 7 21, 323.51

%3D

4.

PMT = P10,000; 7- co6: 1 = 3 years; Semi-Annually P 64, 68410

%3D

5.

PMT = P1,000,000; I = 796%; 71 =

5 years; Annually F5,750,739.01

%3D

%3D

%3D

6.

PMT = P10; I = 5%. . - 1 year; Daily P 3, 745.01

%3D

Rate (1), Number of Years () and Frequency of Payments.

1.

PMT = P500; I = 6%: n = 10 years; Semi-Annually P 7,438. t9

%3D

%3D

2.

PMT = P1,000; I = 49%: n = 5 years; Monthly P 54, 299.0t

3.

PMT = P10,000; I = 10%; n = 3 years; Annually 24, 868.52

%3D

4.

PMT = P50,000; I = 8%; n = 2 years; Quarterly 366, 274.07

%3D

%3D

%3D

5.

PMT = P25,000; I = 7%; n = 6 years; Monthly P1,466,361.11

6.

PMT = P100,000; I = 12%;

n = 10 years; Annually 565,022.30

%3D

%3D

C.) Problem Solving

ote bor

1. Wesley is offered an investment savings plan which will require him to commit

a fixed amount of deposit every month for a span of 5 years. If the amounts are

in increments of P1,000 and the plan is offering to yield a return of 6% annu-

ally, how much should he commit every month in order to reach P500,000 at

the end of 5 years?

2. Gabriel is able to save P10,000 every month from his salary. If he decides to

invest in a special deposit account offering an interest rate of 5% annually, how

much money would he have at the end of 3 years?

Christian is planning to purchase a new vehicle via an auto loan with a bank

that will require him to pay P20,000 per month for 36 months starting next

month. If he plans to set aside a lump sum today and invest in a time deposit

that earns 4% per annum, how much should he set aside in order to fund all

3.

36 payments?

Business Math 87

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College