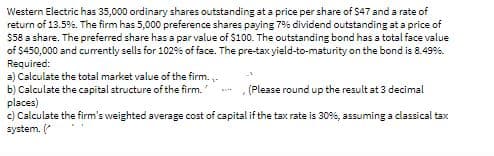

Western Electric has 35,000 ordinary shares outstanding at a price per share of $47 and a rate of return of 13.5%. The firm has 5,000 preference shares paying 7% dividend outstanding at a price of $58 a share. The preferred share has a par value of $100. The outstanding bond has a total face value of $450,000 and currently sells for 102% of face. The pre-tax yield-to-maturity on the bond is 8.499%. Required: a) Calculate the total market value of the firm. - b) Calculate the capital structure of the firm. places) c) Calculate the firm's weighted average cost of capital if the tax rate is 30%, assuming a classical tax system. ( (Please round up the result at 3 decimal

Western Electric has 35,000 ordinary shares outstanding at a price per share of $47 and a rate of return of 13.5%. The firm has 5,000 preference shares paying 7% dividend outstanding at a price of $58 a share. The preferred share has a par value of $100. The outstanding bond has a total face value of $450,000 and currently sells for 102% of face. The pre-tax yield-to-maturity on the bond is 8.499%. Required: a) Calculate the total market value of the firm. - b) Calculate the capital structure of the firm. places) c) Calculate the firm's weighted average cost of capital if the tax rate is 30%, assuming a classical tax system. ( (Please round up the result at 3 decimal

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:Western Electric has 35,000 ordinary shares outstanding at a price per share of $47 and a rate of

return of 13.5%. The firm has 5,000 preference shares paying 7% dividend outstanding at a price of

$58 a share. The preferred share has a par value of $100. The outstanding bond has a total face value

of $450,000 and currently sells for 102% of face. The pre-tax yield-to-maturity on the bond is 8.499%.

Required:

a) Calculate the total market value of the firm. -

b) Calculate the capital structure of the firm.

places)

c) Calculate the firm's weighted average cost of capital if the tax rate is 30%, assuming a classical tax

system. (

(Please round up the result at 3 decimal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT