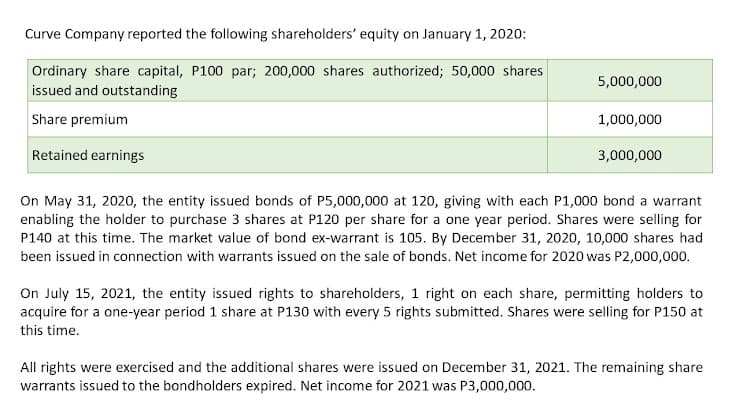

What amount should be credited to Share Premium when the rights in connection with the warrants were exercised on December 31, 2020?

Q: Calculate Eric’s capital gain for the year of assessment 2021/22 after the annual exemption and the ...

A: During the year ended 5 April 2022 Eric (a higher rate taxpayer) disposed of some of his assets. Let...

Q: Ali Baba Company uses the perpetual inventory system and the FIFO method. The following information ...

A: Under Perpetual Inventory system cost of goods sold is recorded as when the goods are sold , thus th...

Q: The following is the accounts found in the trial balance of Lei, Inc., an SME: 2020 2019 Lease li...

A: The correct answer for the above mentioned question is given in the following steps.

Q: On January 1, 2021, Fingerstyle Co. (lessee) enters into a ten-year lease of equipment, with fixed a...

A: There are two components of considerations: Lease component i.e. P156,000 Non-lease component i.e. ...

Q: Suppose you borrow $38499.71M when financing a gym with a cost of $87624.83M. You expect to generate...

A: Cost of capital- From the investor's perspective, cost of capital is the minimum return that the inv...

Q: For each independent situation below, calculate the missing values.

A: Gains and losses seem to be the contrasting financial outcomes created by a company's non-primary ac...

Q: Burrell Company purchased a machine for $21,000 on January 2, 2019. The machine has an estimated ser...

A: Straight line method: Straight line basis is a method of calculating depreciation and amortization, ...

Q: 5 years or 10,000 hours 180,000 units ue $ 18,000 man uses the machine for 1,700 hours and the depre...

A: The declining balance method refers to the concept which evaluates the depreciation on assets on the...

Q: into 30 ordinary shares. The interest expense on the liability component of convertible bonds for th...

A: The share dividend is declared and dividends are paid in the form of shares of the company. A 2 for ...

Q: Exercise: Determine if Variable, Fixed or Mtxed 2000 units 5000 units 1. Depreciation 2. Materials 3...

A: The costs can be classified as variable, fixed and mixed costs. The variable cost per unit remains ...

Q: Problem 9 Miracle Company provides you with the following information January 1 January 31 Inventori...

A: Cost of goods manufacturing: Cost of goods manufactured refers to the cost incurred to produce the g...

Q: On October 1, 2019, Ball Company issued 9% bonds dated October 1, 2019, with a face amount of $200,0...

A: Journal is the book of original entry in which all the transactions relating to the business are rec...

Q: A firm sold goods worth ₹ 5,00,000 and it's gross profit is 20 percent of sales value. The inventory...

A: Inventory Turnover Ratio = Cost of goods sold / Average stock Inventory Holding Period = 365 d...

Q: internal controls over cash receipts and cash payments. Identify and discuss the similarities and di...

A: lnternal control are methods that are ensure the proper safeguarding of assets are necessary to en...

Q: Problem 8-1A (Algo) Part 4 4. Compared to straight-line depreciation, does accelerated depreciation ...

A: Accelerated depreciation is any method of depreciation used for income tax purposes that allow for s...

Q: Boss Sporting Goods, a retail sportswear company, purchased merchandise of $500 on account from Awes...

A: The freight charges are the part of material cost and should be included in the cost of the material...

Q: Prepare the necessary journals for the given transactions 1. Cash paid to Sara BD 600 2. Sold Furnit...

A: The first step in accounting is a journal entry, which is used to record a business transaction in a...

Q: Given the following list of accounts with normal balances, what are the trial balance totals of the ...

A: Introduction: Trial balance: All final ledger accounts balances are posted in Trial balance to check...

Q: The account "Warranty Liability": Multiple Choice a)has a year-end credit balance equal to the co...

A: A warranty liability is a liability account in which a company notes the amount of the repair or rep...

Q: Monona Company reported net income of $29,975 for 2019. During all of 2019, Monona had 1,000 shares ...

A: Earnings per share refer to the amount that is earned by the stockholders on every share held by the...

Q: Isla Esme, Inc., sells tea products to various customers. In recent years, profits have been declini...

A: Total cost is determined astThe sum total of all the amount spent on the production of any product.

Q: Assuming that Sheffield Paints has $20,000 in excess cash budgeted for April, how much principal wil...

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. % ar...

Q: Electro Corporation bought a new machine and agreed to pay for it in equal annual installments of $5...

A: The fixed assets such as machinery are recorded in the books of account are recorded in the books at...

Q: Depreciation for Partial Periods Cheers Delivery Company purchased a new delivery truck for $38,000 ...

A: Depreciation- Depreciation is thus the diminish in the price of assets and the process used to restr...

Q: The Cash account of Silver Maple Art Gallery shows the following at April 30, 2014 Cash Date Item Jr...

A: 1) Silver Maple Art Gallery’s bank reconciliation as on April 30, 2014 :- Particulars Amount Par...

Q: Which statement is not correct? a. Related-party income is taxable b. Related-party losses are non-...

A: The correct answer is given in the following steps for your reference.

Q: Entries for Issuing and Calling Bonds; Gain Emil Corp. produces and sells wind-energy-driven engine...

A: Bonds were issued for $ 771000 Duration = 25 years Rate of interest = 13% Gain on redemption of bond...

Q: (d) Explain and justify the accounting treatment for share dividends and share splits.

A: Share dividend is the form of dividend in which company issue shares as dividend rather than cash. G...

Q: Helsinki Inc. produces premium bottled water. Helsinki purchases artesian water, stores the water in...

A: The question asks to compute the ending WIP on December 31 : where , ending WIP = Ending work in pro...

Q: Match the following in the correct order.

A: Check- reminder of what the check was payment for Numerical amount- written number in box Written ...

Q: Identify a correct statement. a. Deductions may be claimed against a gross income subject to final ...

A: Solution Deduction is an expense that can be substracted from a taxpayer's gross income in order to ...

Q: Can someone please help? Every time I do the Fair Value Allocation things don't seem to turn out rig...

A: Fair Value- Fair value is a word with several meanings in the fiscal world. In investing, it refers ...

Q: In a job order cost system, indirect labor incurred is debited to which account?A. work in process i...

A: Job order costing system is generally used by the entities who are involved in the production of cus...

Q: Mr. John started a T-shirts business to be known as "John T-shirts". He has provided you with the fo...

A: Expense refers to the cost that is incurred in return of acquiring goods or services.

Q: restment for each all projects is eg

A: A) 4 & 5: Profitability index is a calculation that divides the current value of expected antici...

Q: When a destroyed business asset is replaced, which of the following is true?

A: When the asset of business is destroyed then the destroyed assets's car...

Q: Project L requires an initial outlay at t = 0 of $35,000, its expected cash inflows are $8,000 per y...

A: Answer:

Q: The capital structure of Red Ribbon Corporation on December 31, 2020 follows: Preference 12% Share C...

A: Solution Outstanding shares are the stock that is held by a company's shareholders on the open marke...

Q: 2013 income statement, what amount should Cordelli report as income tax expense?

A: As per our protocol we provide solution to the one question only but as you have asked two multiple ...

Q: The following items were derived from Woodbine Circle Corporation’s adjusted trial balance on Decemb...

A: An income statement is a financial statement that shows a company's revenue and costs. It also revea...

Q: Helsinki Inc. produces premium bottled water. Helsinki purchases artesian water, stores the water in...

A: Process Costing: Process Costing is one of the technique of costing where a product is manufactured ...

Q: The following trial balance was taken from the books of Dumbo Trading at 31 December 2021. Dumbo Tra...

A: Comprehensive Income statement is a income statement which contains income and expenses that have no...

Q: Condensed financial data of Crane Inc. follow. CRANE INC. Comparative Balance Sheets December 31 A...

A: A cash flow statement indicates cash inflow and cash outflow information of a particular time period...

Q: A corporation purchased 1,000 shares of its own $5 par common stock at $10 and subsequently sold 500...

A: Formula: Total purchases = Number of shares x Each share Purchase price

Q: ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC cha...

A: Following information was available from the given question: Total materials purchased (including di...

Q: Why is the power to tax is sometimes called sometimes the power to destroy?

A: Note: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered o...

Q: A company just starting business had the following transactions in February: Purchase Sale Purchase ...

A: The inventory can be valued using various methods as LIFO, FIFO and weighted average method.

Q: t on the account is 10% compounded semi-annually, for how long does Laura have to deposit the money?...

A: The answer has been mentioned below.

Q: Which of the following is a conversion cost?A. raw materialsB. direct laborC. sales commissionsD. di...

A: Conversion costs seem to be the expenses of converting raw resources into finished goods. In cost ac...

Q: Use the following information to calculate total ending cash and equivalents: Beginning Cash and Equ...

A: Introduction: Statement of cash flows: All cash in and out flows are shown in cash flow statements. ...

Step by step

Solved in 2 steps

- Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000On July 2, 2018, McGraw Corporation issued 500,000 of convertible bonds. Each 1,000 bond could be converted into 20 shares of the companys 5 par value stock. On July 3, 2020, when the bonds had an unamortized discount of 7,400 and the market value of the McGraw shares was 52 per share, all the bonds were converted into common stock. Required: 1. Prepare the journal entry to record the conversion of the bonds under (a) the book value method and (b) the market value method. 2. Compute the companys debt-to-equity ratio (total liabilities divided by total shareholders equity, as described in Chapter 6) under each alternative. Assume the companys other liabilities are 2 million and shareholders equity before the conversion is 3 million. 3. Assume the company uses IFRS and issued the bonds for 487,500 on July 2, 2018. On this date, it determined that the fair value of each bond was 930 and the fair value of the conversion option was 45 per bond. Prepare the journal entry to record the issuance of the bonds.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.

- Calculating the Number of Shares Issued Castalia Inc. issued shares of its $0.80 par value common stock on September 4, 2019, for $8 per share. The Additional Paid-In Capital-Common Stock account was credited for 5612,000 in the journal entry to record this transaction. Required: How many shares were issued on September 4, 2019?Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.