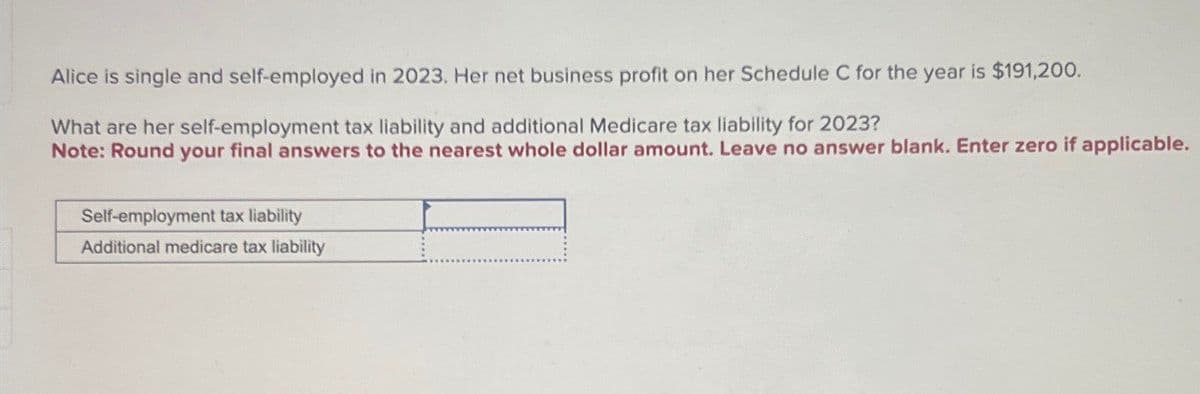

What are her self-employment tax liability and additional Medicare tax liability for 2023?

Q: 22. Rapp Corporation has invested in the stock of two other corporations, Hart Corporation and…

A: Fair ValueThe value of an asset or liability in the market is called fair value. This fair is used…

Q: Gemstone Products located in New York City, is one of the world's largest producers of beauty and…

A: "Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: On January 1, 2025, Sheffield Corporation issued $690,000 of 9% bonds, due in 10 years. The bonds…

A: When the bonds are issued by a company in excess of its normal value, then it is said that bonds are…

Q: Determine the amount of the child tax credit in each of the following cases: a. A single parent with…

A: The child tax credit is available to take the tax benefit by the respective families while filing…

Q: Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of…

A: Net Present Value: This financial term is used to assess how beneficial a project or an investment…

Q: A share of common stock just paid a dividend (DO) of $3.00. If the expected long-run growth rate for…

A: The objective of this question is to calculate the current stock price (P0) using the Gordon Growth…

Q: Giardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two…

A: Cost allocation helps a company identify the cost objects and allocate the cost to the cost objects.…

Q: Problem 8-71 (LO 8-4) (Algo) [The following information applies to the questions displayed below.]…

A: Child and dependent care credit:The child and dependent care credit is a credit that helps the…

Q: [The following information applies to the questions displayed below.] At December 31, Hawke Company…

A: Required blance in allowance account at year end = Balance in accounts receivables *%…

Q: 2. The Ombudsman Foundation is a private nonprofit organization providing dispute resolution and…

A: Closing Entries refers to the journal entry that is made at the end of an accounting period to…

Q: Chez Fred Bakery estimates the allowance for uncollectible accounts at 3% of the ending balance of…

A: Accounts receivable : Money that the business will be receiving from its clients who have utilized…

Q: (Give the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike)

A: The objective of the question is to calculate the dividend revenue of Isle Royale Inc. from Lake…

Q: Single Plantwide Factory Overread Rate Scrumptious Snacks Inc. manufactures three types of snack…

A: Plantwide Overhead Rate:— It is the rate used to allocate manufacturing overhead costs to cost…

Q: i need the answer quickly

A: Direct material cost is the cost of raw material produced or purchased to produce the final…

Q: Draw the GASB Conceptual Frame Work

A: Solution:-The conceptual framework of the European Accounting Standards Board (EASB) is a…

Q: A scientist claims that pneumonia causes weight loss in mice. The table shows the weights (in grams)…

A: b) H0:μd≤0 Ha:μ>0 (c) t > 2.015 (d) The standard deviation (σd) is approximately…

Q: On January 1, 2024, Swifty Corp. issued five-year bonds with a face value of $650,000 and a coupon…

A: The bonds are the debt instrument that a company normally issues when it wants to raise debt. The…

Q: please help me.... i need fast solution...

A: The objective of the question is to calculate the projected cash balance at the end of May for…

Q: Verle, Inc. has a cash balance of $24,000 on April 1. The company is now preparing the cash budget…

A: The objective of the question is to calculate the projected cash balance at the end of May for…

Q: A company manufactures one product (A) for which budgeted details for the forthcoming period are as…

A: Mark-up percentage = Mark-up amount / Total cost of the productWhere,Mark-up amount = Desired profit…

Q: Required information [The following information applies to the questions displayed below.)] In its…

A: LIFO is last in first out method means inventory bought last is sold first.Inventory means the…

Q: Beavis Construction Company was the low bidder on a construction project to build an earthen dam for…

A: The percentage-of-completion method recognizes revenue based on the extent of progress toward…

Q: The shareholders’ equity section of Superior Corporation’s balance sheet as of December 31, Year 3,…

A: The objective of the question is to prepare journal entries for each of the transactions that…

Q: Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and…

A: Shareholder's EquityThe amount available for the shareholders in the company is called shareholder's…

Q: Total Cost Unit Cost Total Cost Unit Cost Direct materials $8,000 $1.60 $16,000 $1.60 Direct labor…

A: Lets understand the basics.Variable costs: Variable cost is a cost that changes according to the…

Q: On December 31, 2019, Krug Company prepared adjusting entries that included the following items:…

A: As per dual concept of accounting, every transaction has dual impact on the books of accounts, the…

Q: Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat.…

A: Lets understand the basics.The income statement is prepared to record the revenue and expenses for…

Q: A company's gross profit (or gross margin) was $73,920 and its net sales were $352, 000. Its gross…

A: Gross margin ratio is the ratio between gross margin and net sales revenue. It is calculated by…

Q: Required information [The following information applies to the questions displayed below.] In its…

A: Inventory cost variations are smoothed down by the weighted average approach. Because it includes…

Q: Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Its…

A: A flexible budget performance report is prepared to make a comparison of the actual results and the…

Q: i need the answer quickly

A: A formal document that summarizes the financial actions and status of a company, group, or person is…

Q: and Alan are avid boaters and water skiers. They also enjoy parasailing. This year, they started a…

A: Tax Implication -When someone says something has or might have tax ramifications, it could have an…

Q: Factory overhead cost variances The following data relate to factory overhead cost for the…

A: Variance AmountFavorable/UnfavorableControllable variance $-9,600FavorableVolume…

Q: y of you will some day own your own business. One rapidly growing opportunity is no-frills workout…

A:

Q: Calculate Anaheim Corporation's excess net passive income tax in each of the following alternative…

A: Solution:-The inquiry pertains to computing the surplus net passive income tax for Anaheim…

Q: Crystal Charm Company makes handcrafted silver charms that attach to jewelry such as a necklace or…

A: Solution:-The inquiry involves the computation of variances in direct materials (silver and…

Q: Inventory Analysis The following data were extracted from the income statement of Brecca Systems…

A: The objective of the question is to calculate the inventory turnover and days' sales in inventory…

Q: Tableau Dashboard Activity: Calculate and Communicate 13-1 (Static) [Exercise 13-13; LO13-5] Benoit…

A: Lets understand the basics.The contribution margin is the difference between the price of a product…

Q: i need the answer quickly

A: Contribution margin = Selling price - Variable costTotal variable cost = variable manufacturing…

Q: On December 31, 2017, X Company paid $3,600,000 for 100% of the stock of Y Company when Y's…

A: To calculate the amount of goodwill reported on X Company's December 31, 2018 balance sheet, we need…

Q: Tamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in…

A: The total amount of money generated in a year from all sources, including salary, wages, tips,…

Q: Excel Online Structured Activity: Bond valuation An investor has two bonds in her portfolio, Bond C…

A: Bonds are debt instruments that are issued by entities to raise funds and meet their capital…

Q: Don't give solution in image format..

A: The objective of the question is to prepare the journal entries for the disposal of the airplanes…

Q: On July 1, Cullumber Corporation purchases 590 shares of its $5 par value common stock for the…

A: Treasury stock represent the share of a company which are bought back by it. There share can be…

Q: Required: Prepare a contribution format income statement segmented by product lines. Product Line…

A: Under the contribution margin income statement, variable expenses and fixed expenses are represented…

Q: Problem 10-71 (Static) Activity-Based Costing of Suppliers (LO 10-3, 4) Carrie Construction (CC) is…

A: Cost means different expenses incurred by the manufacturing concern to make a product available for…

Q: Exact Photo Service pur ised a new 2818 four-year useful life and a $3,200 salvage value. The…

A: The depreciation expense is a charge against an asset for wear and tear. The depreciation each year…

Q: What is the rate of return on an investment that costs $5,000, earned a $600 dividend during the…

A: The rate of return (RoR) indicates the percentage increase or decrease in the value of an investment…

Q: Periodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item…

A: Inventory valuation is based on the method of flow used by the organization. It can be the first in…

Q: Required Calculate the total monthly cost of the sales representative's salary for each of the…

A: Fixed costs are expenses that stay consistent regardless of changes in production or sales volumes.…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

- Arthur Wesson, an unmarried individual who is age 68, reports taxable income of 510,000 in 2019. He records positive AMT adjustments of 80,000 and preferences of 35,000. Arthur itemizes his deductions, and his regular tax liability in 2019 is 153,694. a. What is Arthurs AMT? b. What is the total amount of Arthurs tax liability? c. Draft a letter to Arthur explaining why he must pay more than the regular income tax liability. Arthurs address is 100 Colonels Way, Conway, SC 29526.During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for the 2019 calendar tax year. Karen is covered by a pension through her employer. What is the maximum amount that Karen may deduct for contributions to her IRA for 2019? $__________________________ If Karen is a calendar year taxpayer and files her tax return on August 15, what is the last date on which she can make her contribution to the IRA and deduct it for 2019? $__________________________

- In 2019, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and dividend income of $ 400. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a $7,000 loss. Calculate the following amounts for Lou: Adjusted gross income $ ____________________ Standard deduction $ ____________________ Taxable income $ ____________________Freda is a cash basis taxpayer. In 2019, she negotiated her salary for 2020. Her employer offered to pay her 21,000 per month in 2020 for a total of 252,000. Freda countered that she would accept 10,000 each month for the 12 months in 2020 and the remaining 132,000 in January 2021. The employer accepted Fredas terms for 2020 and 2021. a. Did Freda actually or constructively receive 252,000 in 2020? b. What could explain Fredas willingness to spread her salary over a longer period of time? c. In December 2020, after Freda had earned the right to collect the 132,000 in 2020, the employer offered 133,000 to Freda at that time, rather than 132,000 in January 2021. The employer wanted to make the early payment so as to deduct the expense in 2020. Freda rejected the employers offer. Was Freda in constructive receipt of the income in 2020? Explain.Arlen is required by his 2019 divorce agreement to pay alimony of $2,000 a month and child support of $ 2,000 a month to his ex-wife Jane. What is the tax treatment of these two payments for Arlen? What is the tax treatment of these two payments for Jane? Arlen_______________________________________________________________________________________________________________________________________________ Jane_______________________________________________________________________________________________________________________________________________