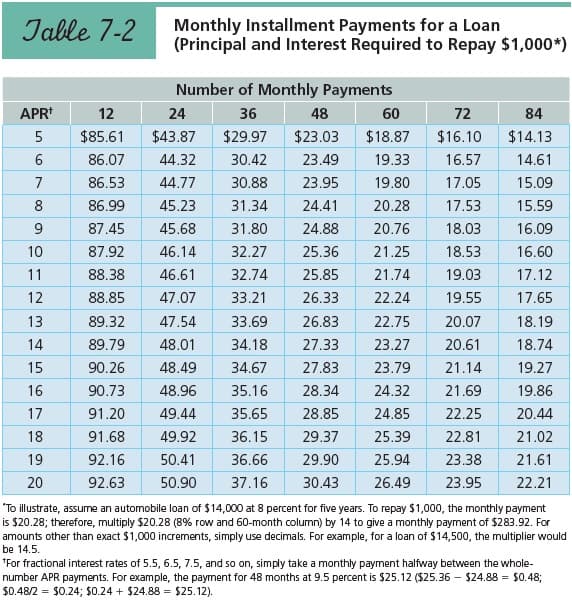

Kimberly Jensen of Storm Lake, Iowa, wants to buy some living room furniture for her new apartment. A local store offered credit at an APR of 16 percent, with a maximum term of four years. The furniture she wishes to purchase costs $3,600, with no down payment required. Using Table 7-2 or the Garman/Forgue companion website, make the following calculations (round all intermediate calculations to two decimal places): What is the amount of the monthly payment if she borrowed for four years? Round your answer to the nearest cent.

Kimberly Jensen of Storm Lake, Iowa, wants to buy some living room furniture for her new apartment. A local store offered credit at an APR of 16 percent, with a maximum term of four years. The furniture she wishes to purchase costs $3,600, with no down payment required. Using Table 7-2 or the Garman/Forgue companion website, make the following calculations (round all intermediate calculations to two decimal places): What is the amount of the monthly payment if she borrowed for four years? Round your answer to the nearest cent.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.5EX: Entries for discounted note payable A business issued a 60-day note for 75,000 to a creditor on...

Related questions

Question

100%

Kimberly Jensen of Storm Lake, Iowa, wants to buy some living room furniture for her new apartment. A local store offered credit at an APR of 16 percent, with a maximum term of four years. The furniture she wishes to purchase costs $3,600, with no down payment required. Using Table 7-2 or the Garman/Forgue companion website, make the following calculations (round all intermediate calculations to two decimal places):

-

What is the amount of the monthly payment if she borrowed for four years? Round your answer to the nearest cent.

Transcribed Image Text:Table 7-2

APR+

12

5 $85.61

6

7

8

9

10

11

12

13

14

15

16

618

17

18

19

20

Monthly Installment Payments for a Loan

(Principal and Interest Required to Repay $1,000*)

Number of Monthly Payments

24

36

48

60

72

$43.87

$29.97 $23.03 $18.87

$16.10

86.07 44.32

30.42

23.49

19.33

16.57

86.53

44.77

30.88

23.95

19.80

17.05

86.99

45.23

31.34 24.41

20.28 17.53

87.45

45.68

31.80

24.88

20.76 18.03

87.92

46.14 32.27

18.53

88.38

46.61

32.74

19.03

88.85 47.07

33.21

19.55

89.32

89.79

90.26

90.73

91.20

91.68

92.16

92.63

47.54

33.69

48.01

34.18

48.49 34.67

48.96

35.16

49.44

35.65

49.92

36.15

50.41

36.66

50.90 37.16

25.36 21.25

25.85

21.74

26.33

22.24

26.83

22.75

20.07

27.33

23.27

20.61

27.83 23.79

21.14

28.34

24.32

21.69

28.85

24.85

22.25

29.37 25.39 22.81

29.90

25.94

23.38

30.43

26.49 23.95

84

$14.13

14.61

15.09

15.59

16.09

16.60

17.12

17.65

18.19

18.74

19.27

19.86

20.44

21.02

21.61

22.21

"To illustrate, assume an automobile loan of $14,000 at 8 percent for five years. To repay $1,000, the monthly payment

is $20.28; therefore, multiply $20.28 (8% row and 60-month column) by 14 to give a monthly payment of $283.92. For

amounts other than exact $1,000 increments, simply use decimals. For example, for a loan of $14,500, the multiplier would

be 14.5.

*For fractional interest rates of 5.5, 6.5, 7.5, and so on, simply take a monthly payment halfway between the whole-

number APR payments. For example, the payment for 48 months at 9.5 percent is $25.12 ($25.36 $24.88 = $0.48;

$0.48/2 = $0.24; $0.24 + $24.88 $25.12).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What are the total finance charges over that four-year period

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,