What have been the possible reasons for the changes in ROEs ? •Decompose the (Return on Equity) ROE into the main components: ROA and EM •Analyse the sources of Return on Asset (ROA) : Asset Utilisation and Profit Margin ratios. (PM) •Identify the sources of the changes in AU and PM

What have been the possible reasons for the changes in ROEs ? •Decompose the (Return on Equity) ROE into the main components: ROA and EM •Analyse the sources of Return on Asset (ROA) : Asset Utilisation and Profit Margin ratios. (PM) •Identify the sources of the changes in AU and PM

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 55P

Related questions

Question

What have been the possible reasons for the changes in ROEs ?

•Decompose the (

•Analyse the sources of

•Identify the sources of the changes in AU and PM

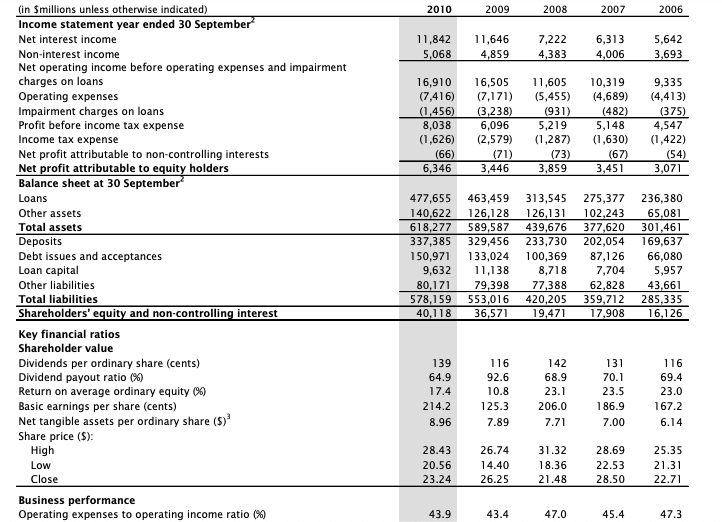

Transcribed Image Text:(in Smillions unless otherwise indicated)

Income statement year ended 30 September

2010

2009

2008

2007

2006

Net interest income

11,842

11,646

7,222

6,313

5,642

Non-interest income

5,068

4,859

4,383

4,006

3,693

Net operating income before operating expenses and impairment

charges on loans

Operating expenses

Impairment charges on loans

Profit before income tax expense

16,910

(7,416)

(1,456)

8,038

(1,626)

(66)

6,346

16,505

(7,171)

(3,238)

6,096

(2,579)

(71)

3,446

11,605

10,319

(4,689)

9,335

(5,455)

(4,413)

(375)

4,547

(1,422)

(54)

3,071

(931)

5,219

(482)

5,148

Income tax expense

(1,287)

(1,630)

Net profit attributable to non-controlling interests

Net profit attributable to equity holders

Balance sheet at 30 September

(73)

3,859

(67)

3,451

Loans

477,655

140,622

618,277

337,385

150,971

9,632

80,171

578,159

40,118

463,459

126,128

589,587

329,456

133,024

11,138

79,398

553,016

36,571

313,545

275,377

236,380

65,081

301,461

169,637

66,080

5,957

Other assets

126,131

102,243

Total assets

Deposits

Debt issues and acceptances

Loan capital

439,676

377,620

233,730

202,054

100,369

87,126

8,718

7,704

Other liabilities

77,388

62,828

Total liabilities

Shareholders' equity and non-controlling interest

420,205

19,471

43,661

285,335

16,126

359,712

17,908

Key financial ratios

Shareholder value

Dividends per ordinary share (cents)

Dividend payout ratio (%)

Return on average ordinary equity (%)

Basic earnings per share (cents)

Net tangible assets per ordinary share ($)

139

116

142

131

116

64.9

92.6

68.9

70.1

69.4

17.4

10.8

23.1

23.5

23.0

214.2

125.3

206.0

186.9

167.2

8.96

7.89

7.71

7.00

6.14

Share price ($):

High

28.43

26.74

31.32

28.69

25.35

Low

20.56

14.40

18.36

22.53

21.31

Close

23.24

26.25

21.48

28.50

22.71

Business performance

Operating expenses to operating income ratio (%)

43.9

43.4

47.0

45.4

47.3

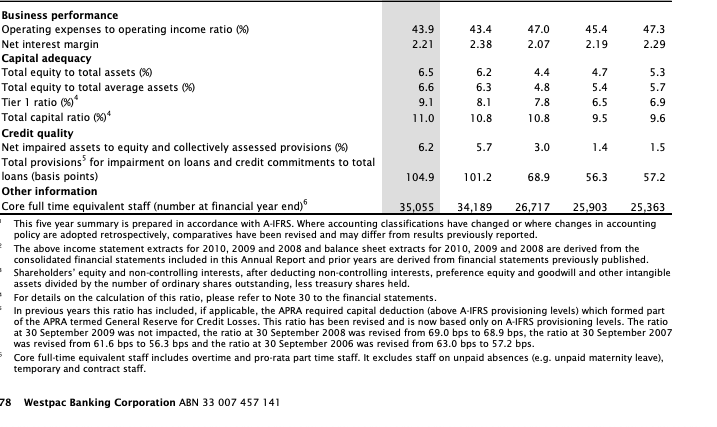

Transcribed Image Text:Business performance

Operating expenses to operating income ratio (%)

Net interest margin

Capital adequacy

Total equity to total assets (%)

Total equity to total average assets (%)

Tier I ratio 0*

Total capital ratio (%6)*

Credit quality

Net impaired assets to equity and collectively assessed provisions (%)

Total provisions for impairment on loans and credit commitments to total

loans (basis points)

43.9

43.4

47.0

45.4

47.3

2.21

2.38

2.07

2.19

2.29

6.5

6.2

4.4

4.7

5.3

6.6

6.3

4.8

5.4

5.7

9.1

8.1

7.8

6.5

6.9

11.0

10.8

10.8

9.5

9.6

6.2

5.7

3.0

1.4

1.5

104.9

101.2

68.9

56.3

57.2

Other information

Core full time equivalent staff (number at financial year end)

35,055

34,189

26,717

25,903

25,363

This five year summary is prepared in accordance with A-IFRS. Where accounting classifications have changed or where changes in accounting

policy are adopted retrospectively, comparatives have been revised and may differ from results previously reported.

The above income statement extracts for 2010, 2009 and 2008 and balance sheet extracts for 2010, 2009 and 2008 are derived from the

consolidated financial statements included in this Annual Report and prior years are derived from financial statements previously published.

Shareholders' equity and non-controlling interests, after deducting non-controlling interests, preference equity and goodwill and other intangible

assets divided by the number of ordinary shares outstanding, less treasury shares held.

For details on the calculation of this ratio, please refer to Note 30 to the financial statements.

In previous years this ratio has included, if applicable, the APRA required capital deduction (above A-IFRS provisioning levels) which formed part

of the APRA termed General Reserve for Credit Losses. This ratio has been revised and is now based only on A-IFRS provisioning levels. The ratio

at 30 September 2009 was not impacted, the ratio at 30 September 2008 was revised from 69.0 bps to 68.9 bps, the ratio at 30 September 2007

was revised from 61.6 bps to 56.3 bps and the ratio at 30 September 2006 was revised from 63.0 bps to 57.2 bps.

Core full-time equivalent staff includes overtime and pro-rata part time staff. It excludes staff on unpaid absences (e.g. unpaid maternity leave),

temporary and contract staff.

78 Westpac Banking Corporation ABN 33 007 457 141

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,